New York Seller's Real Estate Disclosure Statement

Description

How to fill out Seller's Real Estate Disclosure Statement?

If you need to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms, that are available online.

Employ the website's user-friendly and efficient search to obtain the paperwork you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Choose the pricing plan you prefer and enter your information to sign up for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to process the payment.

- Use US Legal Forms to obtain the New York Seller's Real Estate Disclosure Statement with a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and then click the Download option to retrieve the New York Seller's Real Estate Disclosure Statement.

- You can also access forms you previously purchased from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to review the form's content. Don't forget to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other types of your legal form template.

Form popularity

FAQ

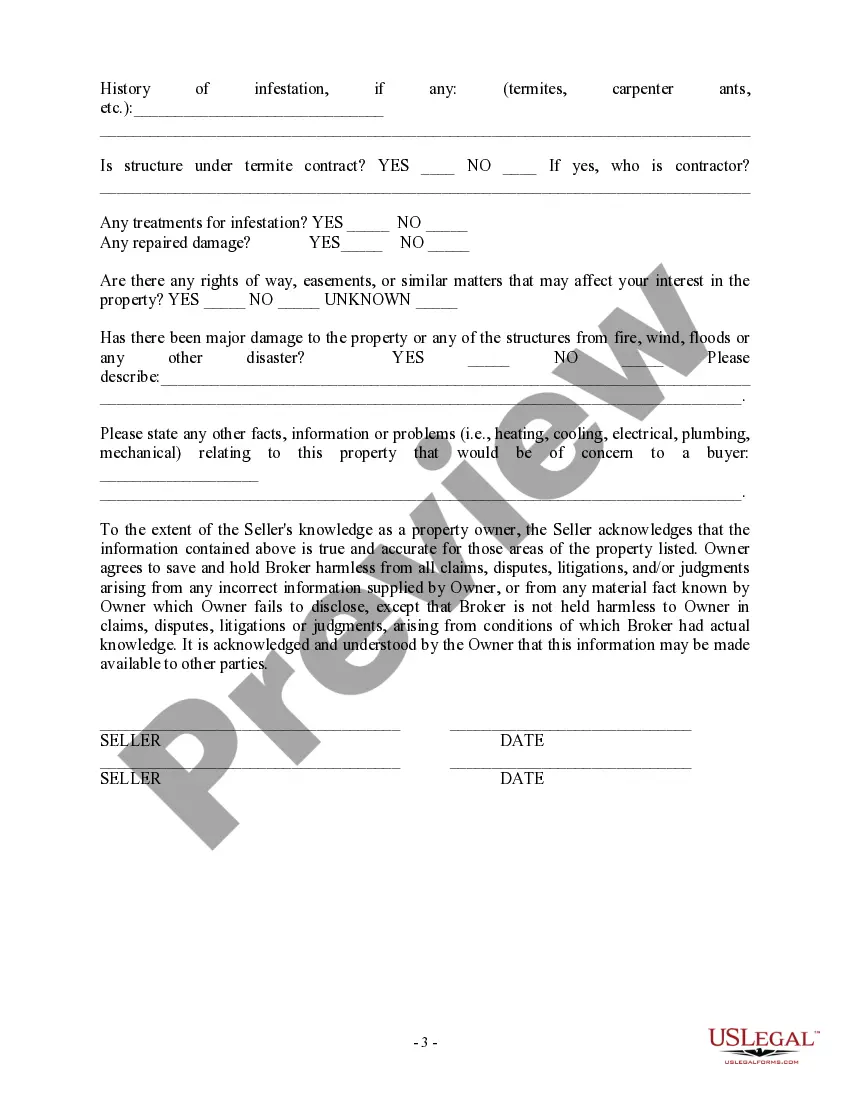

New York law requires you to disclose known home defects to the buyer. Under today's law, youas a New York home sellercould be found liable to a buyer for having failed to disclose certain property conditions, or defects, in the course of the sale.

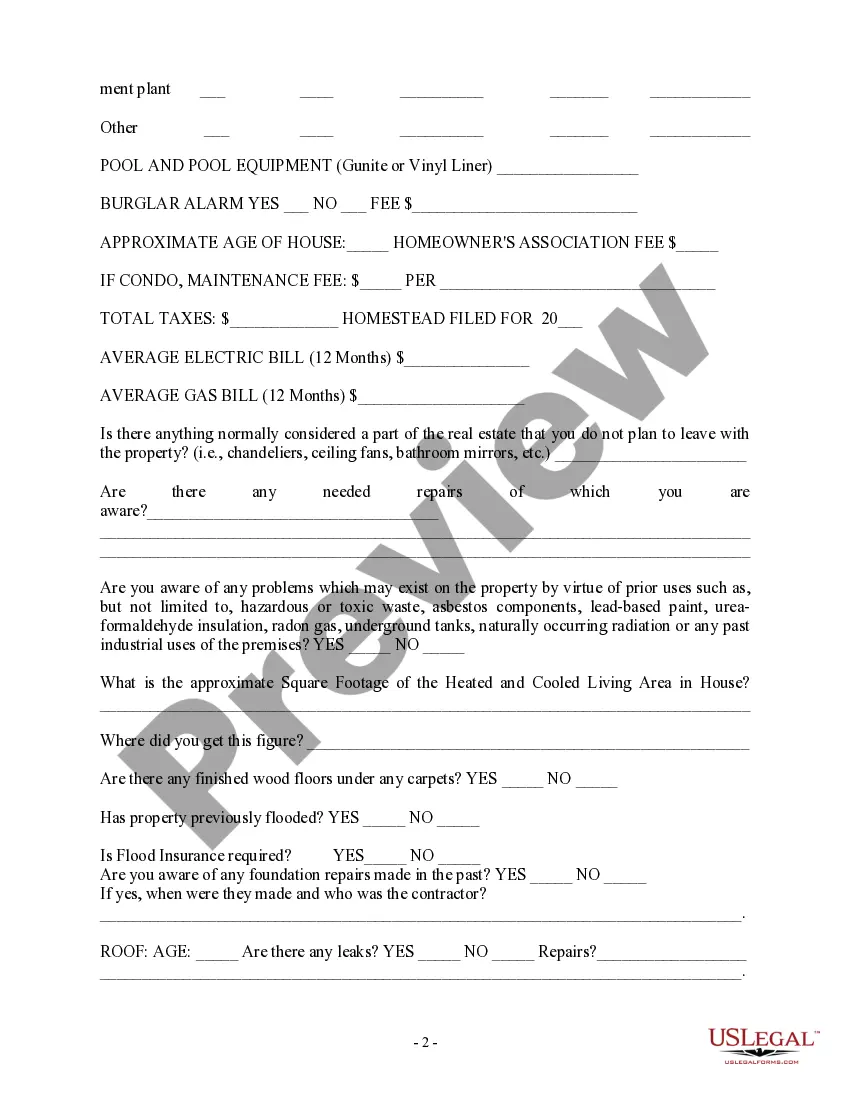

A Seller's Disclosure is a legal document that requires sellers to provide previously undisclosed details about the property's condition that prospective buyers may find unfavorable. This document is also known as a property disclosure, and it's important for both those buying a house and for those selling a house.

Other exemptions from of the TDS include transfers from one co-owner to another, transfers made to a spouse or child, grandchild, parent, grandparent or other direct ancestor or descendent; transfers between spouses in connection with dissolution of marriage, and various transfers to the state for failure to pay

The Information Act 2002 allows organisations to refuse access to information if its disclosure would be contrary to the public interest. Access can only be refused if the information qualifies under one of a series of exemptions set out in sections 44-58 of the Act.

In general, a disclosure document is supposed to provide details about a property's condition that might negatively affect its value. Sellers who willfully conceal information can be sued and potentially convicted of a crime. Selling a property "As Is" will usually not exempt a seller from disclosures.

Which seller is exempt from completing a transfer disclosure statement? A lender selling a property which they previously foreclosed upon.

Most sellers of residential real property are required to complete a real estate transfer disclosure statement (TDS). Exemptions from the TDS requirement include court ordered sales, fiduciaries in the administration of estates and trusts, and REO sales. One of the most confusing exemptions has been for trustees.

Here are eight common real estate seller disclosures to be aware of, whether you're on the buyer's side or the seller's side.Death in the Home.Neighborhood Nuisances.Hazards.Homeowners' Association Information.Repairs.Water Damage.Missing Items.Other Possible Disclosures.

This secrecy is not permitted by law under any circumstances. Sellers are obliged to declare all the positive and negative details. With 100% complete information about a property, the buyer must be able to make the right decision.

By a fiduciary in the course of the administration of a decedent's estate, guardianship, conservatorship, or trust. From one co-owner to one or more other co-owners. Made to a spouse or to a person or persons in the lineal line of consanguinity of one or more of the transferors.