New York Receipt Template for Small Business

Description

How to fill out Receipt Template For Small Business?

You might invest time online looking for the legal document template that fulfills both state and federal requirements you have.

US Legal Forms provides countless legal forms that have been evaluated by experts.

You can easily download or print the New York Receipt Template for Small Business from their service.

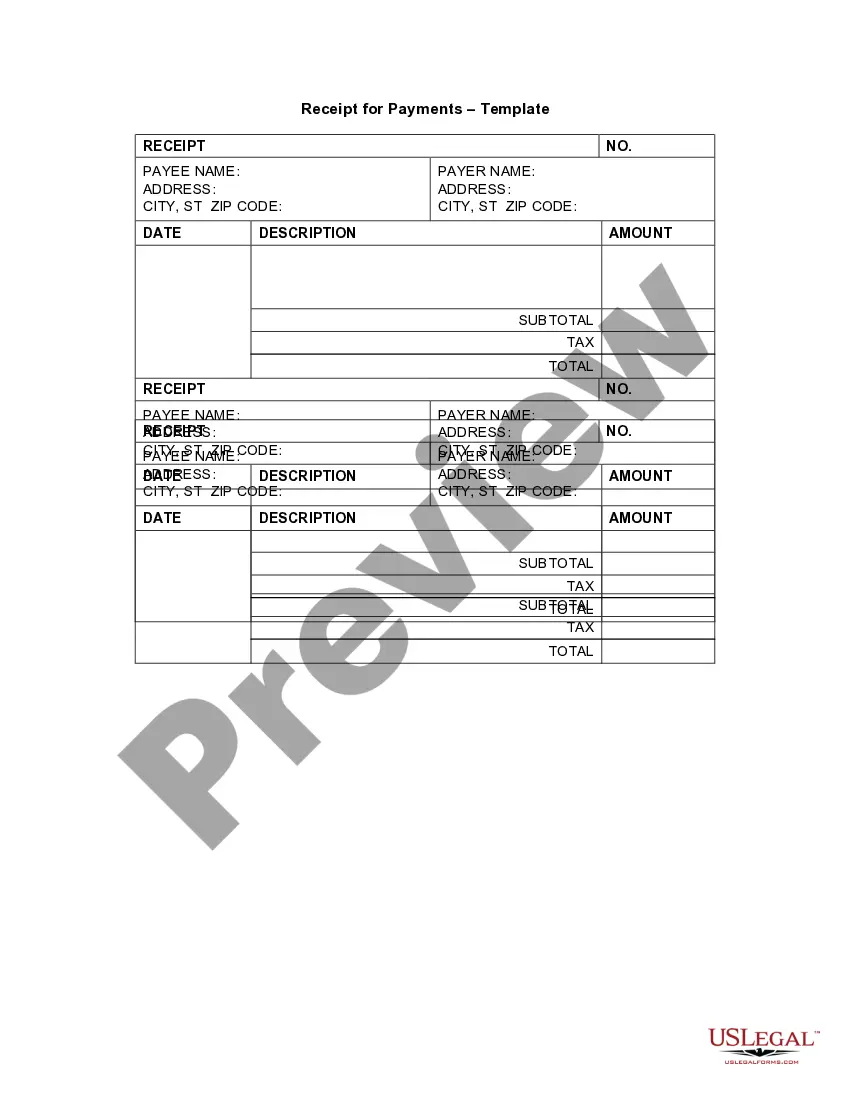

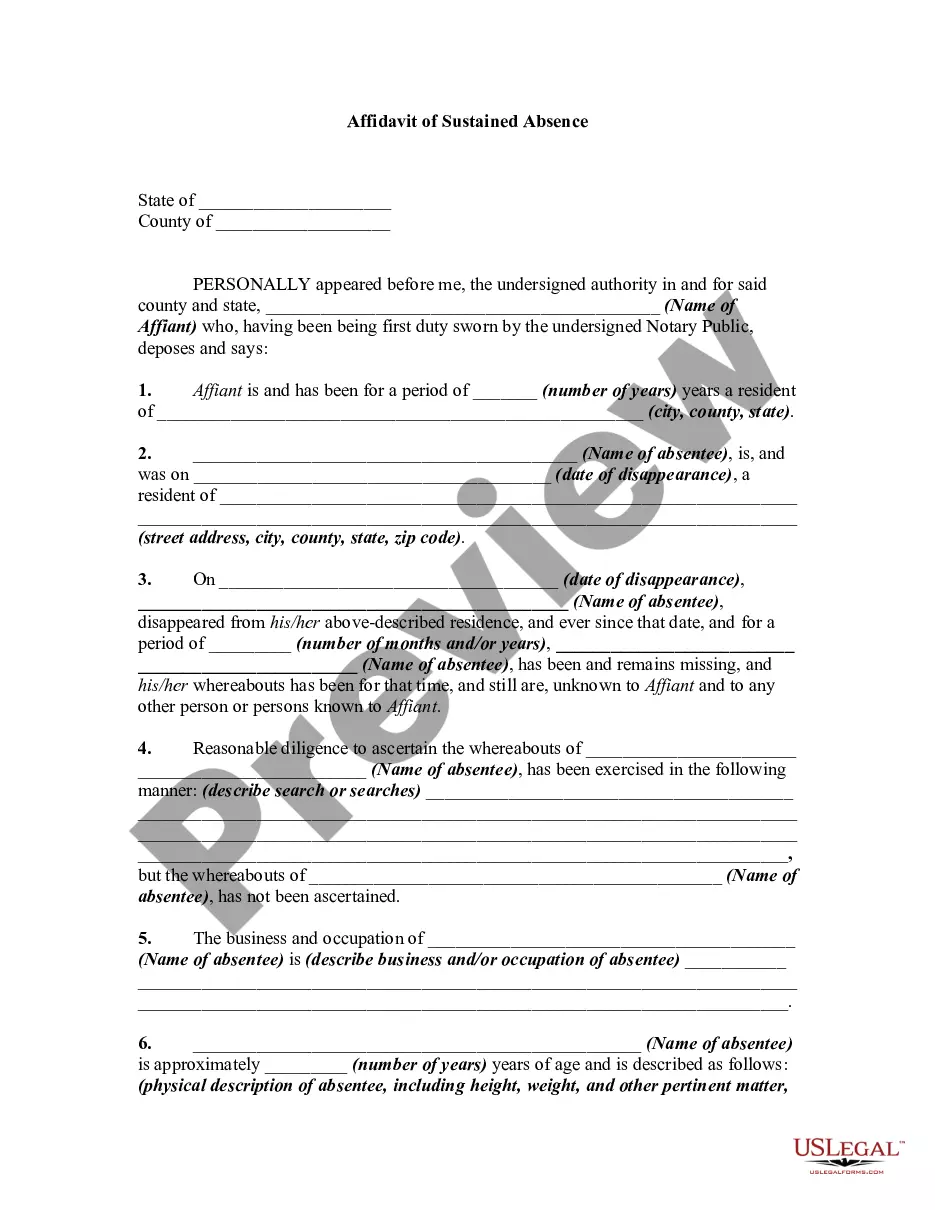

If available, use the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the New York Receipt Template for Small Business.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the straightforward instructions below.

- First, make sure you have selected the correct document template for the area/city of your choice.

- Check the form outline to ensure you have chosen the accurate form.

Form popularity

FAQ

Generally, yes. A corporation must file a tax return each year, even if it does not generate much income. Understanding your obligations is crucial, and a New York Receipt Template for Small Business helps you keep clear records, making tax season smoother.

All corporations that conduct business, own property, or derive income from New York City or State must file a corporate tax return. Even small entities can fall under this requirement depending on their activities. A New York Receipt Template for Small Business can assist in maintaining proper records and ensuring compliance with these filing obligations.

To file receipts for a small business, gather all necessary documents and categorize them by date and type of expenditure. Ensure that they match your financial records for accuracy. Adopting a New York Receipt Template for Small Business simplifies this process, allowing for easy tracking and efficient filing.

Any corporation doing business within New York City must file a tax return. This requirement extends to corporations based on their net income or other specific qualifications. If you maintain organized records using a New York Receipt Template for Small Business, navigating your tax filings can become a less daunting task.

The minimum corporate tax in New York is $25, applicable to most corporations doing business in the state. This figure may vary based on other tax calculations and the specific nature of your business. Using a New York Receipt Template for Small Business can help you track income and expenses, making it easier to navigate these tax regulations.

Yes, if your business operates as a corporation in New York, you typically need to file a corporate tax return annually. This obligation ensures that you meet both state and local tax requirements. Utilizing a New York Receipt Template for Small Business can help organize your financial data for easier tax preparation.

A New York state filing receipt is a document that serves as proof of a business's compliance with state registration and tax filing requirements. It includes essential details such as filing dates and types of documents submitted. If you are using a New York Receipt Template for Small Business, you can ensure accurate record-keeping and streamline your business operations.

Creating your own receipt is simple. First, you can start by deciding the format you prefer, whether it's digital or paper. Then, fill in crucial details such as your business name, address, and the date of the transaction. If you're looking for a structured approach, the New York Receipt Template for Small Business can help you create professional and detailed receipts quickly.

Writing a proof of payment receipt requires similar information as a regular receipt. Begin with your business information, then include the customer's name, payment amount, date, and a description of the service or product. Using a New York Receipt Template for Small Business can further enhance your document's credibility by providing a standardized format. This ensures both you and your customer have a clear record of the transaction.

To write a simple receipt of payment, start by stating the name of your business, followed by the buyer's information, transaction date, and the payment amount. Ensure you clearly list the products or services provided to maintain transparency. A New York Receipt Template for Small Business can be an excellent resource for constructing this document, providing a clear format to follow. This makes your receipts look organized and official.