New York Dividend Policy - Resolution Form - Corporate Resolutions

Description

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

It is feasible to invest time online trying to locate the authorized document template that fulfills the federal and state requirements you need.

US Legal Forms offers a vast array of legal forms that are verified by experts.

You can download or print the New York Dividend Policy - Resolution Form - Corporate Resolutions from the service.

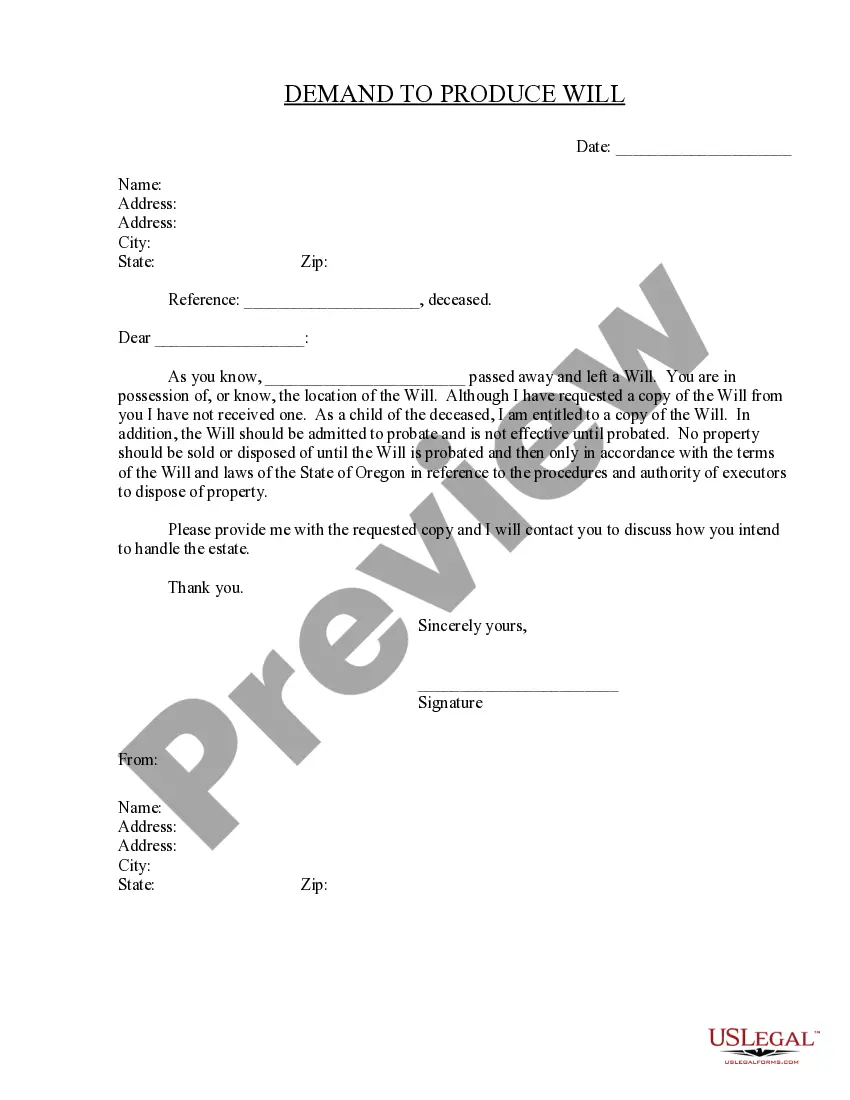

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Afterward, you can complete, edit, print, or sign the New York Dividend Policy - Resolution Form - Corporate Resolutions.

- Every legal document template you buy is yours permanently.

- To retrieve another copy of a purchased form, navigate to the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have chosen the correct document template for your area/city of choice. Check the form description to confirm you have selected the correct version.

Form popularity

FAQ

To write a written resolution, begin with identifying the specific decision being made, then draft a clear and concise statement reflecting that decision. It is important to include the names of all individuals involved in the signing process, along with the date. Incorporating best practices from the New York Dividend Policy - Resolution Form - Corporate Resolutions will additionally assist in creating a document that meets all regulatory requirements.

The format of writing a resolution typically includes several key sections: a title, a body delineating the resolution's purpose, the resolution statement itself, and a signature section for the board members. Clarity and specificity are crucial, and leveraging resources like the New York Dividend Policy - Resolution Form - Corporate Resolutions can simplify this process. Following a structured format enhances the document's effectiveness and legal standing.

An example of a resolution can be seen in a corporate meeting where the board decides to declare a dividend of $1 per share. This resolution would detail the exact amount, the payment date, and any conditions associated with the distribution. Using the New York Dividend Policy - Resolution Form - Corporate Resolutions can help in drafting such documents, ensuring that all essential details are included and recorded properly.

Writing a corporate resolution involves several straightforward steps, beginning with choosing a clear title like 'Corporate Resolution for Dividend Distribution.' Next, include a preamble explaining the resolution's purpose, followed by the resolution statement itself. Finally, provide spaces for signatures and dates, ensuring to consider the requirements outlined in the New York Dividend Policy - Resolution Form - Corporate Resolutions for compliance.

The corporate resolution of signing authority is a legal document that delegates the power to sign contracts and other obligations on behalf of the corporation. This resolution outlines which officers or individuals have that authority, helping to prevent unauthorized transactions. By maintaining clear documentation through the New York Dividend Policy - Resolution Form - Corporate Resolutions, businesses can operate more smoothly and avoid potential legal issues.

The board of resolution format is a standardized template that outlines the various components needed to draft a corporate resolution effectively. This format typically includes the title, a recital clause, the resolution statement, and the signature section. Many organizations find it beneficial to utilize the New York Dividend Policy - Resolution Form - Corporate Resolutions to streamline this process, ensuring that all resolutions are composed in a legally compliant manner.

The resolution of distribution of dividends refers to the formal decision made by a corporation's board of directors to specify the amount and timing of dividend payments to shareholders. This resolution is essential to comply with the New York Dividend Policy - Resolution Form - Corporate Resolutions, as it ensures that all necessary legal requirements are met. Essentially, it provides clarity on how profits will be shared among stakeholders, enhancing trust and transparency with shareholders.

A board resolution in the United States is an official document reflecting the board of directors' decisions on specific issues, such as financial matters or significant corporate actions. This resolution serves as proof that a decision was made and provides legal backing to the actions taken. To ensure your board resolutions meet legal requirements, the New York Dividend Policy - Resolution Form - Corporate Resolutions is an excellent resource.

A resolution should have a clear structure that includes a title, a preamble stating the reasons for the resolution, and the resolved clause detailing the actual decision. This format helps present the information logically and understandably. For optimal results, consider the New York Dividend Policy - Resolution Form - Corporate Resolutions, which guides you through structuring your document effectively.

To write a corporate resolution example, begin with a heading that identifies the document as a resolution. Clearly state the decision being made, provide context, and include a date. Using the New York Dividend Policy - Resolution Form - Corporate Resolutions can streamline this process, ensuring your resolution adheres to required formats and guidelines.