New York Promissory Note Assignment and Notice of Assignment

Description

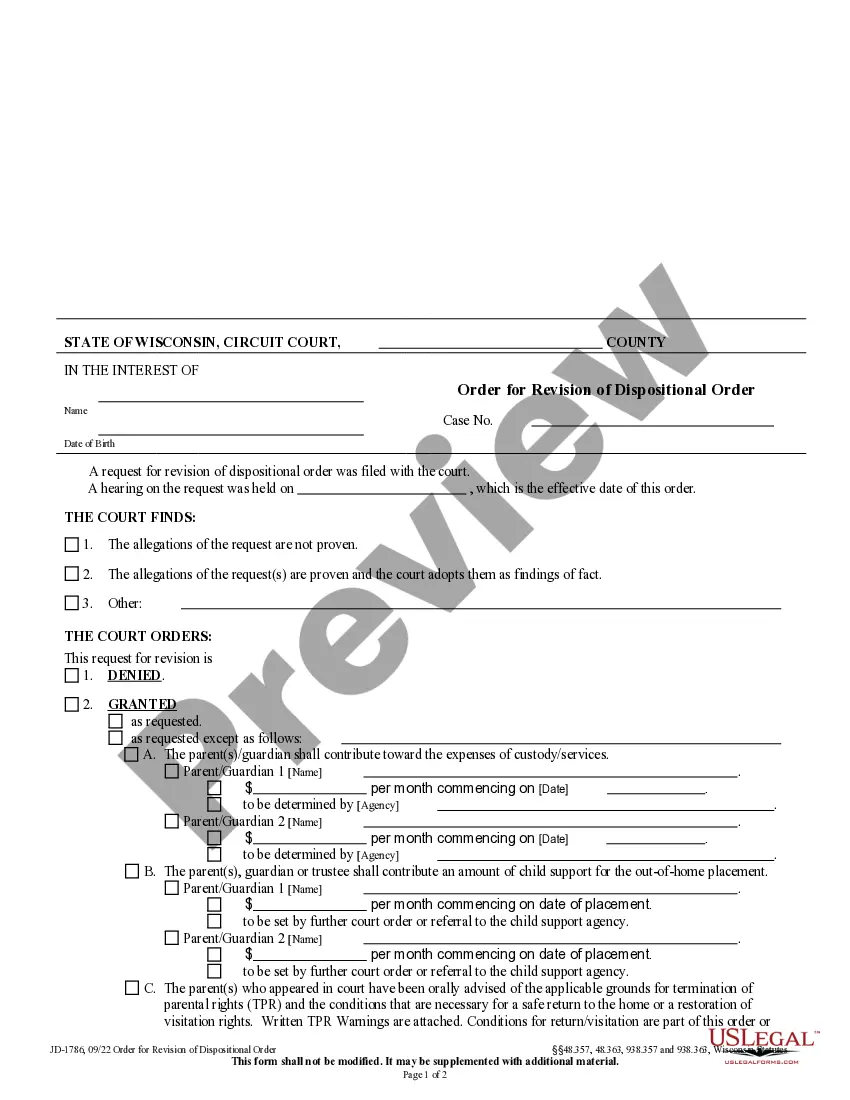

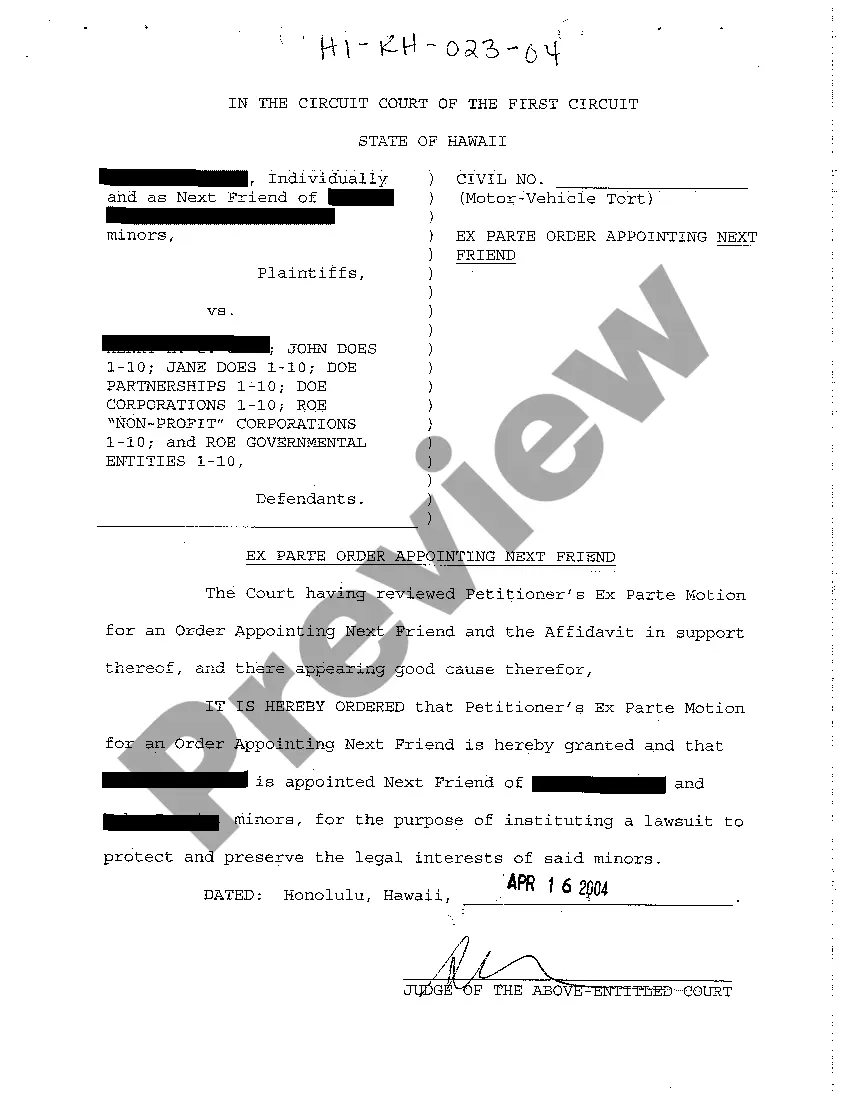

How to fill out Promissory Note Assignment And Notice Of Assignment?

It is feasible to spend hours online searching for the appropriate legal document format that meets the state and federal requirements you desire.

US Legal Forms offers a vast array of legal templates that are vetted by experts.

You can easily download or print the New York Promissory Note Assignment and Notice of Assignment from my service.

If available, use the Preview button to look through the format as well.

- If you possess a US Legal Forms account, you can Log In and press the Acquire button.

- After that, you can complete, modify, print, or sign the New York Promissory Note Assignment and Notice of Assignment.

- Every legal document you acquire is yours indefinitely.

- To obtain an additional copy of any purchased form, visit the My documents tab and press the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the state/city of your preference.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

Obtaining a promissory note can be straightforward. You can create your own using templates or professional legal services available online. US Legal Forms offers various tools to help you draft a proper promissory note tailored to your needs. Make sure to include all essential details to ensure the note's validity during the New York Promissory Note Assignment and Notice of Assignment.

In New York, the duration a promissory note remains valid typically depends on the statute of limitations, which is generally six years for written agreements. After this period, the lender may lose the ability to legally enforce repayment. It's important during a New York Promissory Note Assignment and Notice of Assignment to be aware of this timeframe. Keep records and monitor expiration to safeguard your interests.

A promissory note must clearly outline the amount owed, the interest rate, the payment schedule, and any other relevant terms. This document serves as a promise to repay a specific sum under agreed conditions. When engaging in a New York Promissory Note Assignment and Notice of Assignment, it's crucial that all details are explicitly stated to avoid confusion. Consider using templates available from US Legal Forms to create a compliant promissory note.

Yes, a promissory note can be assigned to another party. The original lender often transfers the rights to receive payment through a legal process known as assignment. During a New York Promissory Note Assignment and Notice of Assignment, the assignee takes over the rights associated with the note. Ensure that both parties understand the terms to facilitate a smooth transition.

In New York, a promissory note does not legally require notarization to be valid. However, having it notarized can provide an additional layer of security and authenticity. Many lenders prefer notarized documents during New York Promissory Note Assignment and Notice of Assignment to avoid disputes. It is wise to consult with legal counsel to ensure all requirements are met.

The structure of a promissory note generally includes the title, date, borrower's details, lender's details, the principal amount, interest rate, payment schedule, and signatures of both parties. This organization helps to ensure that all necessary information is present and clear. Using a well-structured note is beneficial for any New York Promissory Note Assignment and Notice of Assignment to avoid confusion or disputes.

Filling out a promissory demand note is similar to a regular promissory note, but it specifies that the lender can demand payment at any time. Include details such as the borrower's name, the amount due, and any interest rates applicable. Make sure you clarify the repayment terms, as this is essential for enforceability, especially in the context of a New York Promissory Note Assignment and Notice of Assignment.

A promissory note typically includes the title, date, written amount, borrower's and lender's information, payment terms, and signature lines. It is advisable to structure the note clearly, highlighting the obligations and rights of both parties. Utilizing a structured format can aid in clarity and serve well in any New York Promissory Note Assignment and Notice of Assignment.

In New York, a promissory note does not necessarily need to be notarized to be enforceable. However, notarization may provide additional protection for both parties involved by offering a verified signature. To ensure security in your New York Promissory Note Assignment and Notice of Assignment, consider using notary services when finalizing your documents.

To assign a promissory note, you must first check if the note includes terms that allow assignment. Next, create a written document called an 'Assignment of Promissory Note.' This document should detail the name of the assignor, the assignee, the amount being assigned, and any relevant terms. It is crucial to additionally consider the New York Promissory Note Assignment and Notice of Assignment to ensure compliance with state regulations.