New York Release of Oil and Gas Lease by a Limited Liability Company

Description

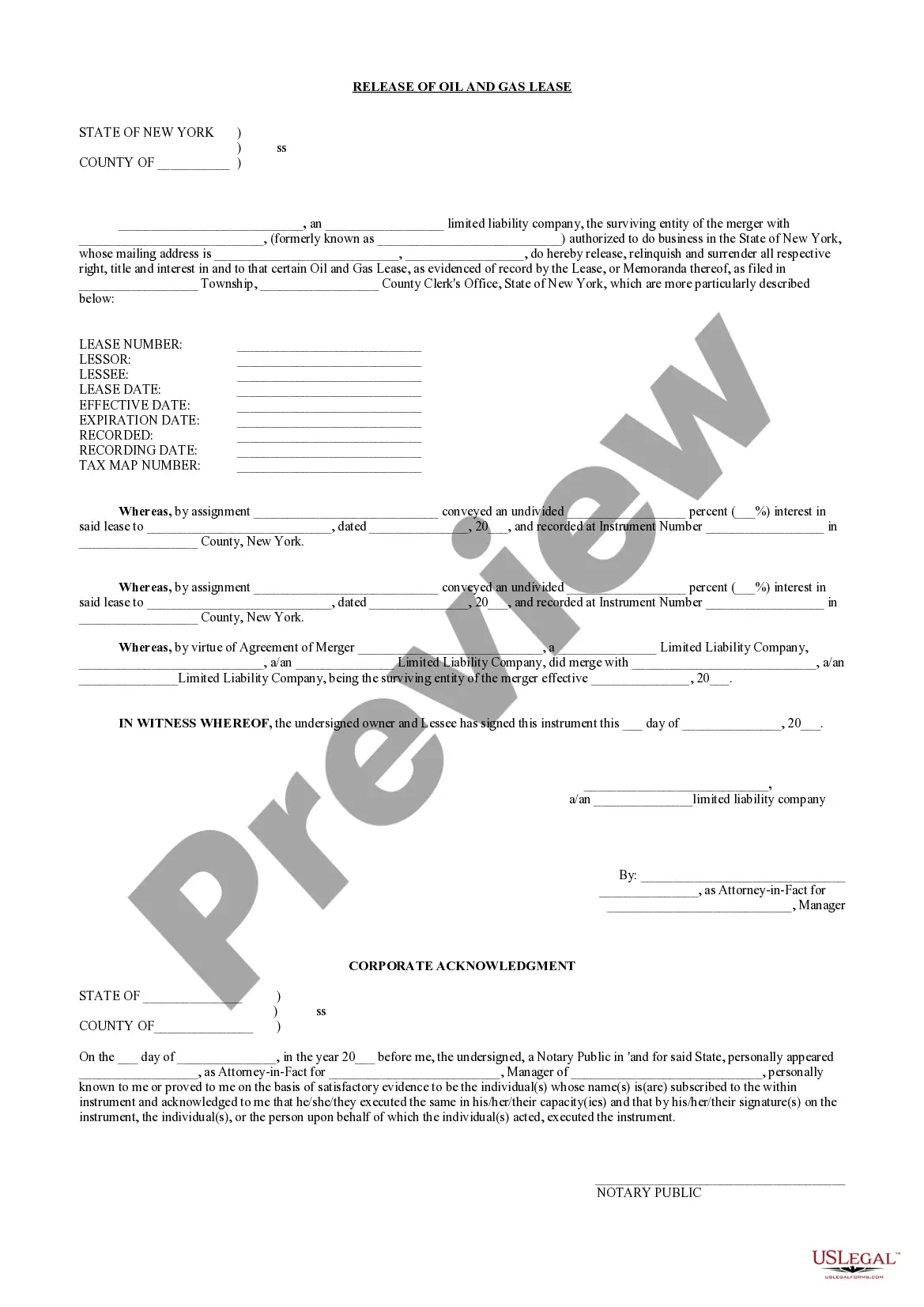

How to fill out New York Release Of Oil And Gas Lease By A Limited Liability Company?

In terms of filling out New York Release of Oil and Gas Lease by a Limited Liability Company, you almost certainly visualize an extensive procedure that involves getting a ideal form among hundreds of very similar ones and then being forced to pay out legal counsel to fill it out for you. In general, that’s a slow and expensive option. Use US Legal Forms and select the state-specific document within just clicks.

In case you have a subscription, just log in and click on Download button to find the New York Release of Oil and Gas Lease by a Limited Liability Company form.

In the event you don’t have an account yet but need one, follow the step-by-step manual listed below:

- Make sure the file you’re getting is valid in your state (or the state it’s required in).

- Do this by looking at the form’s description and also by visiting the Preview function (if offered) to see the form’s information.

- Click Buy Now.

- Pick the appropriate plan for your financial budget.

- Join an account and choose how you would like to pay: by PayPal or by card.

- Download the file in .pdf or .docx format.

- Get the document on the device or in your My Forms folder.

Professional lawyers draw up our samples to ensure after downloading, you don't need to worry about modifying content outside of your personal information or your business’s information. Be a part of US Legal Forms and receive your New York Release of Oil and Gas Lease by a Limited Liability Company document now.

Form popularity

FAQ

The specific provisions of the laws vary from state to state, but drillers are generally allowed to extract minerals from a large area or "pool"--in most states a minimum of 640 acres--if leases have been negotiated for a certain percentage of that land. The company can then harvest gas from the entire area.

Choose a name for your LLC. Find a NY registered agent. File articles of organization with NY state. Obtain NY business permits. Publish notice of LLC formation and submit certification of publication to the state. Create an LLC operating agreement. Keep your LLC active by paying necessary NY taxes.

Filing the Articles of Organization By mail, send the completed Articles of Organization with the filing fee of $200 to the New York State Department of State, Division of Corporations, State Records and Uniform Commercial Code, One Commerce Plaza, 99 Washington Avenue, Albany, New York 12231.

The cost to start a New York limited liability company (LLC) is $200. This fee is paid to the New York Department of State when filing the LLC's Articles of Organization. There are two options for forming your LLC: You can hire a professional LLC formation service to set up your LLC (for an additional small fee).

For many years, almost all oil and gas leases reserved a 1/8th royalty. Today, the royalty fraction is negotiable, and is usually between 1/8th and 1/4th. Bonus. The bonus is the amount paid to the Lessor as consideration for his/her execution of the lease.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.

Further, annual rental fees for onshore oil and gas leases $1.50 per acre during the first five years and $2 per acre each year thereafter allow drilling companies to hold and explore mineral leases for the price of a cup of coffee.

Nationally, mineral rights owners can expect anywhere from $100 to $5,000 per acre for their mineral rights lease. The most valuable mineral rights leases are on producing parcels of land that are still expected to hold many more precious minerals.