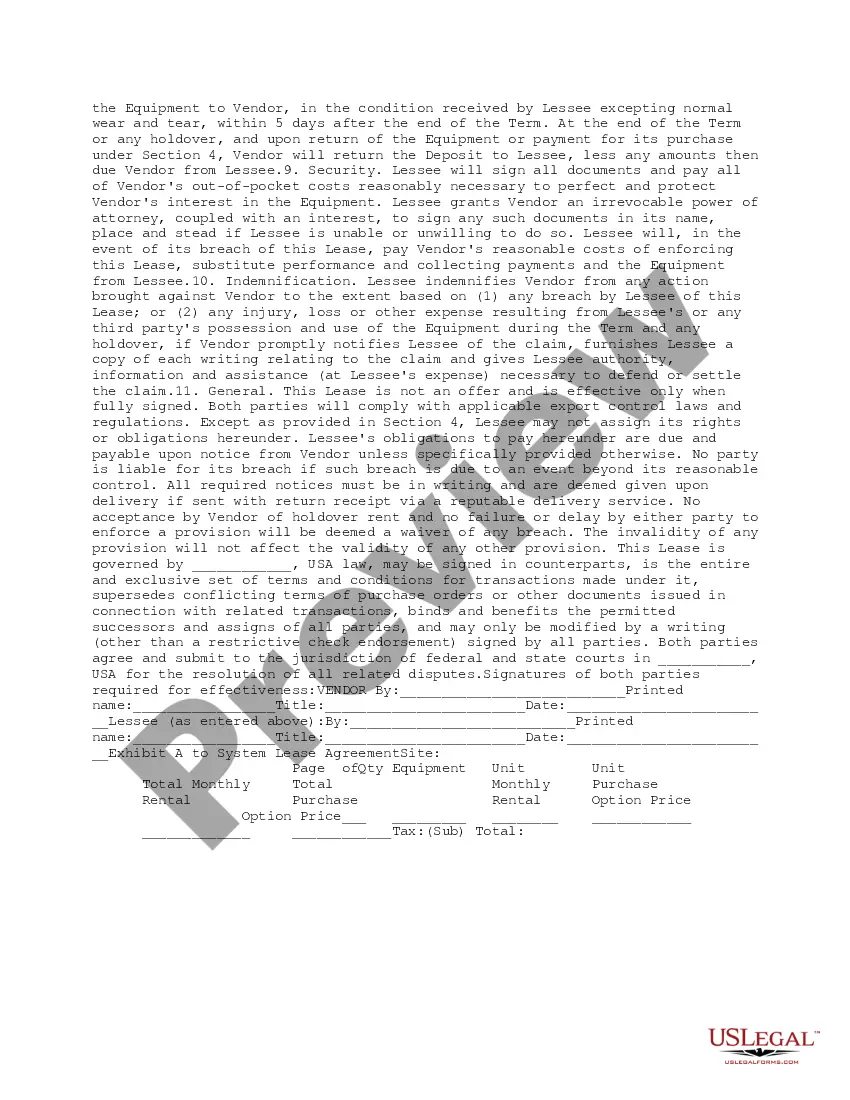

This is an equipment/technology lease. The vendor leases the equipment/technology to the lessee, and is responsible for delivery. The document contains clauses on rent, term of the lease, purchase option, substitution, and all other terms common to such an agreement.

Nevada Equipment Technology Lease

Description

How to fill out Equipment Technology Lease?

US Legal Forms - one of the most significant libraries of authorized forms in the United States - offers a wide range of authorized papers themes it is possible to down load or print out. Making use of the web site, you can get a large number of forms for organization and specific functions, categorized by classes, says, or search phrases.You can get the most recent models of forms much like the Nevada Equipment Technology Lease in seconds.

If you have a monthly subscription, log in and down load Nevada Equipment Technology Lease from the US Legal Forms catalogue. The Obtain key can look on each form you view. You have accessibility to all in the past acquired forms inside the My Forms tab of your respective profile.

If you want to use US Legal Forms the first time, here are straightforward guidelines to help you get started off:

- Ensure you have picked the right form for your personal city/state. Click on the Review key to check the form`s content material. Look at the form description to actually have chosen the proper form.

- In the event the form does not satisfy your specifications, take advantage of the Look for area at the top of the display screen to find the one that does.

- If you are satisfied with the shape, affirm your decision by clicking the Buy now key. Then, select the prices prepare you prefer and offer your references to register on an profile.

- Process the deal. Make use of your bank card or PayPal profile to complete the deal.

- Find the structure and down load the shape on your gadget.

- Make changes. Fill up, revise and print out and signal the acquired Nevada Equipment Technology Lease.

Each and every web template you put into your money lacks an expiry particular date and is also yours for a long time. So, if you wish to down load or print out an additional version, just check out the My Forms segment and click on about the form you will need.

Gain access to the Nevada Equipment Technology Lease with US Legal Forms, probably the most extensive catalogue of authorized papers themes. Use a large number of skilled and state-distinct themes that satisfy your business or specific needs and specifications.

Form popularity

FAQ

Equipment Lease Types Operating Leases. An operating lease is a contract that permits one company to use another company's equipment in exchange for fixed monthly payments over a specific period of time. ... Finance Leases (or Capital Leases) ... $1 Buyout Lease. ... Purchase Option Lease. ... Sale-Leaseback (or Leaseback) ... TRAC Lease.

If the transaction is treated as a lease, the lessor shall be eligible for depreciation on the asset. The entire lease rentals will be taxed as income of the lessor. The lessee, correspondingly, will not claim any depreciation and will be entitled to expense off the rentals.

Disadvantages of Equipment Leasing The equipment is not owned by the business. Interest is being paid by the business. Accessibility of equipment leasing is restricted for new businesses. Limited range of products to lease. Penalties.

At the end of the lease agreement, you may continue leasing the equipment and continue making payments, upgrade the equipment and get new technology into your business or return the equipment, depending upon the type of agreement in place.

A lease will be recorded on the balance sheet as a right-of-use (ROU) asset and lease liability. The lease liability is the payment obligation over the term of the lease contract, while the ROU asset represents the control of the asset under the lease contract.

You are the lessee and the owner of the equipment, or the lender, is the lessor in a lease agreement. Once the lease period ends, the equipment is returned to the owner. In some cases, you may have the option to buy the equipment.

Depreciation generally may be claimed by the owner of a capital asset. If you lease your equipment instead of purchasing it, you can't depreciate the equipment.