Nevada Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

Choosing the best lawful papers format might be a battle. Naturally, there are plenty of themes available online, but how would you get the lawful kind you want? Use the US Legal Forms internet site. The service gives thousands of themes, including the Nevada Request for Copy of Tax Form or Individual Income Tax Account Information, that you can use for organization and private requirements. Every one of the varieties are checked by specialists and fulfill federal and state demands.

Should you be currently signed up, log in in your accounts and click on the Acquire button to find the Nevada Request for Copy of Tax Form or Individual Income Tax Account Information. Make use of accounts to check from the lawful varieties you have acquired earlier. Go to the My Forms tab of the accounts and have yet another backup from the papers you want.

Should you be a brand new user of US Legal Forms, listed here are simple guidelines that you should stick to:

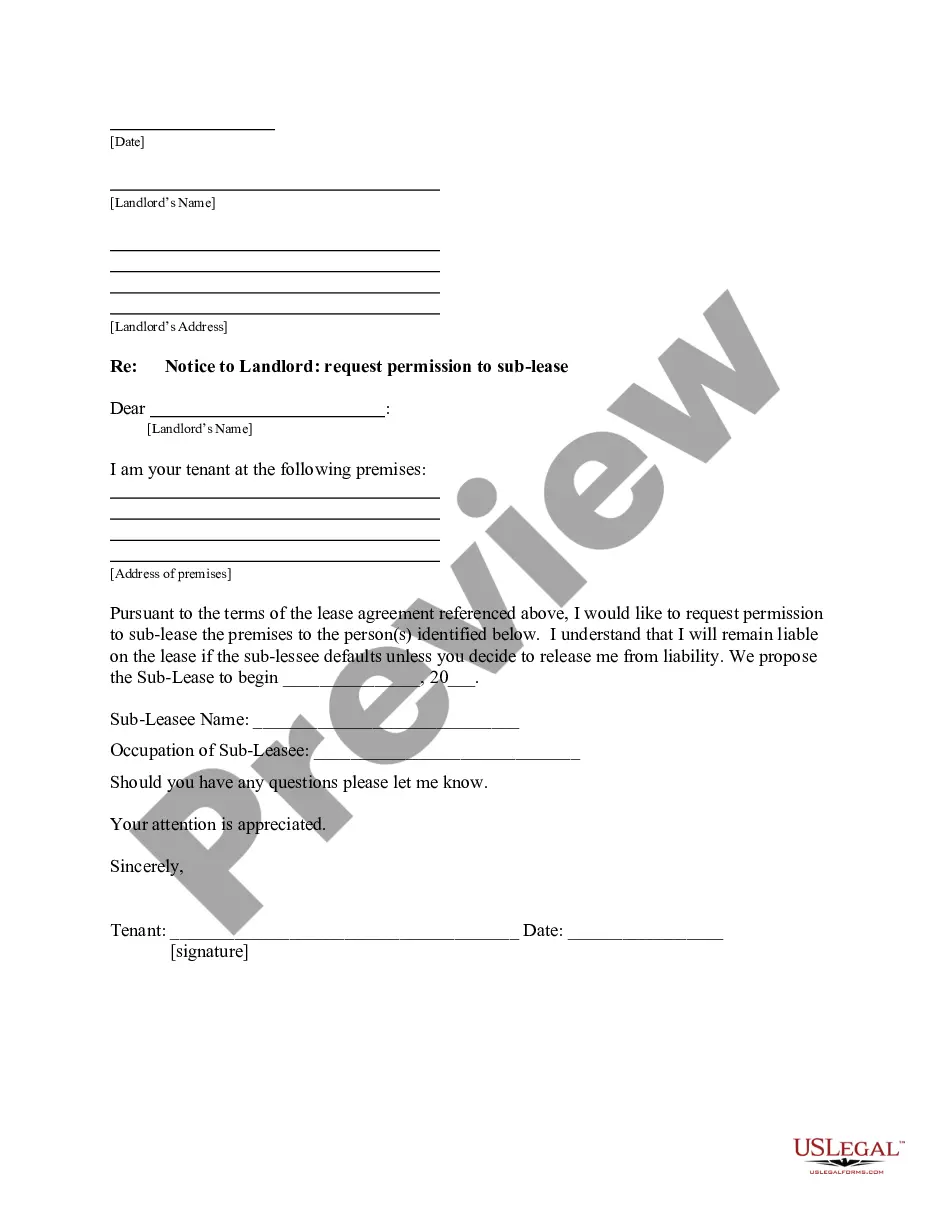

- Initial, be sure you have chosen the proper kind to your area/county. You are able to examine the form utilizing the Review button and read the form information to ensure it will be the best for you.

- When the kind fails to fulfill your requirements, make use of the Seach discipline to obtain the proper kind.

- Once you are certain that the form is suitable, select the Buy now button to find the kind.

- Pick the rates strategy you would like and enter in the essential info. Create your accounts and pay money for the transaction utilizing your PayPal accounts or charge card.

- Choose the submit formatting and download the lawful papers format in your system.

- Complete, edit and print and indicator the acquired Nevada Request for Copy of Tax Form or Individual Income Tax Account Information.

US Legal Forms is the largest catalogue of lawful varieties in which you can discover numerous papers themes. Use the service to download appropriately-produced paperwork that stick to condition demands.

Form popularity

FAQ

Portable Document Format (PDF) Right click on the link, which is usually the item number (if your mouse is configured for left-handed operation use the left mouse button). Select "Save Target As" or "Save Link As" when presented with a menu. Use Adobe Acrobat Reader to open the file after downloading.

Nevada does not have an individual income tax. Nevada does not have a corporate income tax but does levy a gross receipts tax. Nevada has a 6.85 percent state sales tax rate, a max local sales tax rate of 1.53 percent, and an average combined state and local sales tax rate of 8.23 percent.

Click the Your Federal or Your State Return. Right click the document and click "Save as" or "Save target As" (depending on your browser). If this option is not available, open the PDF and choose to "Save As" directly from the PDF viewer. The filename will be filled in with the default form name.

Step 1: Go to the income tax India website at .incometax.gov.in and log in. Step 2: Select the 'e-File'>'Income Tax Returns'>'View Filed Returns' option to see e-filed tax returns. Step 3: To download ITR-V click on the 'Download Form' button of the relevant assessment year.

You can now file Income Tax Return forms conveniently online. Check out the easy steps to download ITR forms in PDF from the official website of the Income Tax department: Log in to the official website of .incometaxindia.gov.in.

Tip: Get faster service: Online at .irs.gov, Get Your Tax Record (Get Transcript) or by calling 1-800-908-9946 for specialized assistance.

Get the current filing year's forms, instructions, and publications for free from the IRS. Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

Order a free tax return transcript over the phone by calling the automated Internal Revenue Service Transcript Order Line at 1-800-908-9946. Description:Here's an overview of how to obtain a tax return copy. Complete Form 4506 now and download, print, and mail it to the address on the form.