Nevada Certificate of Limited Partnership of New Private Equity Fund

Description

How to fill out Certificate Of Limited Partnership Of New Private Equity Fund?

US Legal Forms - one of several most significant libraries of authorized varieties in the USA - provides an array of authorized document layouts you are able to obtain or print. Using the web site, you can find a huge number of varieties for business and personal uses, categorized by types, states, or keywords and phrases.You will find the newest variations of varieties like the Nevada Certificate of Limited Partnership of New Private Equity Fund within minutes.

If you have a subscription, log in and obtain Nevada Certificate of Limited Partnership of New Private Equity Fund from your US Legal Forms collection. The Acquire option can look on each type you view. You have accessibility to all formerly acquired varieties from the My Forms tab of your own bank account.

If you want to use US Legal Forms the very first time, here are simple directions to obtain started out:

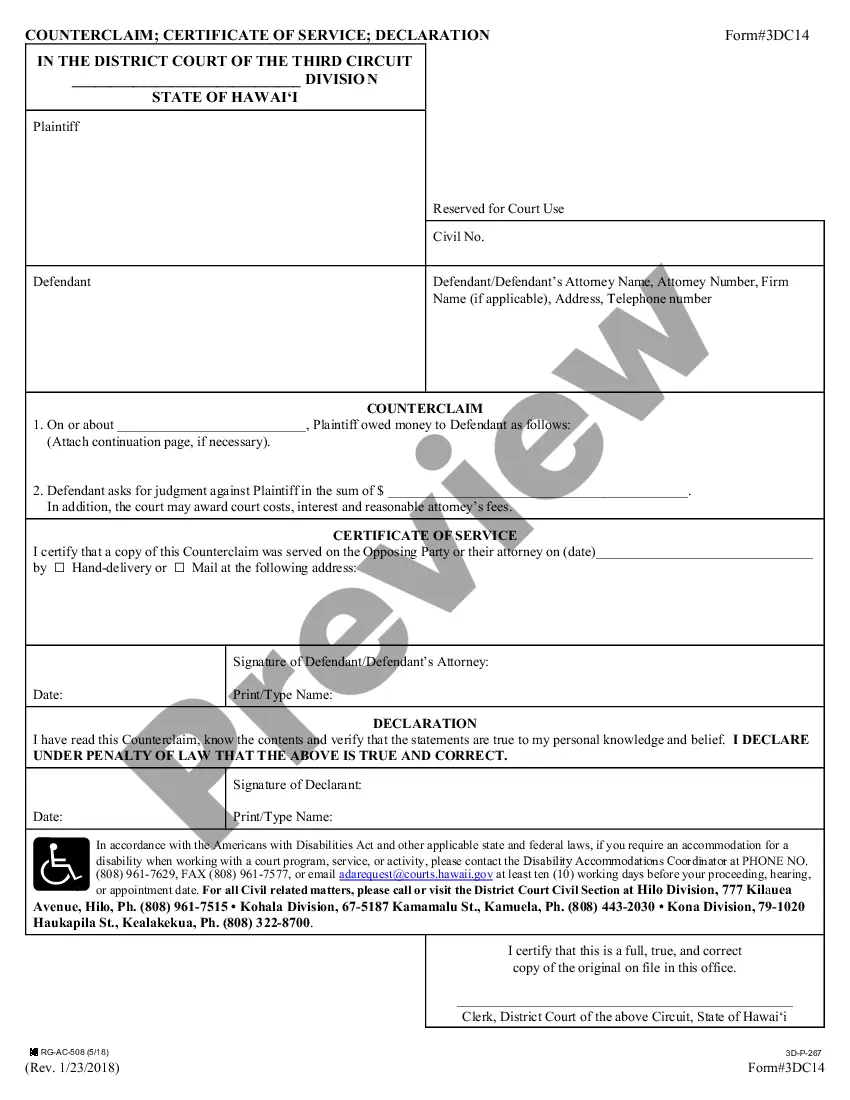

- Be sure you have selected the correct type for your personal area/area. Select the Review option to review the form`s information. Browse the type information to actually have selected the proper type.

- When the type doesn`t match your needs, make use of the Research field on top of the monitor to obtain the one which does.

- In case you are satisfied with the shape, verify your decision by clicking on the Buy now option. Then, pick the prices program you favor and supply your qualifications to register for an bank account.

- Method the deal. Make use of your bank card or PayPal bank account to accomplish the deal.

- Select the file format and obtain the shape in your product.

- Make adjustments. Fill out, change and print and signal the acquired Nevada Certificate of Limited Partnership of New Private Equity Fund.

Each format you put into your money does not have an expiration time and it is your own property for a long time. So, if you wish to obtain or print an additional copy, just proceed to the My Forms area and click about the type you need.

Gain access to the Nevada Certificate of Limited Partnership of New Private Equity Fund with US Legal Forms, one of the most comprehensive collection of authorized document layouts. Use a huge number of professional and express-distinct layouts that satisfy your small business or personal needs and needs.

Form popularity

FAQ

The firm name of your limited liability partnership must contain the words ?limited liability partnership? or ?societe a responsabilite limitee? or the abbreviations ?LLP?, ?L.L.P.? or ?s.r.l.? as the last words or letters of the firm name.

Another difference between the two Chapters would be that Chapter 88 requires a dissolution date for your LP, while 87A allows for your limited partnership to exist forever. Regardless of the type of limited partnership, the partnership must register as such with the Nevada Secretary of State.

Some states only require that the certificate contains the name of the limited partnership, the name and address of the registered agent and registered office, and the names and addresses of all of the general partners.

A key difference in forming an LLC vs. LLP is that you can form a single-member LLC but not a single-partner LLP. This is because LLPs are a type of partnership ? so there must be at least two people to form one.

The certificate must state: (1) the name of the limited partnership, which must comply with Section 15901.08; (2) the address of the initial designated office; and (3) the name and address of the initial agent for service of process in ance with paragraph (1) of subdivision (d) of Section 15901.16.

A limited partnership has two types of partners: general partners and limited partners. It must have one or more of each type. All partner, limited and general, share the profits of the business. Each general partner has unlimited liability for the obligations of the business.

Limited liability partnership (LLP) is a type of general partnership where every partner has a limited personal liability for the debts of the partnership. Partners will not be liable for the tortious damages of other partners but potentially for the contractual debts depending on the state.

We'll walk you through each of these steps below. Step 1 ? Business Planning Stage. ... Step 2: Create a Partnership Agreement. ... Step 3 ? Name your Partnership and Obtain a DBA. ... Step 4 ? Get an EIN from the IRS. ... Step 5 ? Get a Nevada State Business License, and Research other license requirements.