Nevada Notice of Operating Agreement

Description

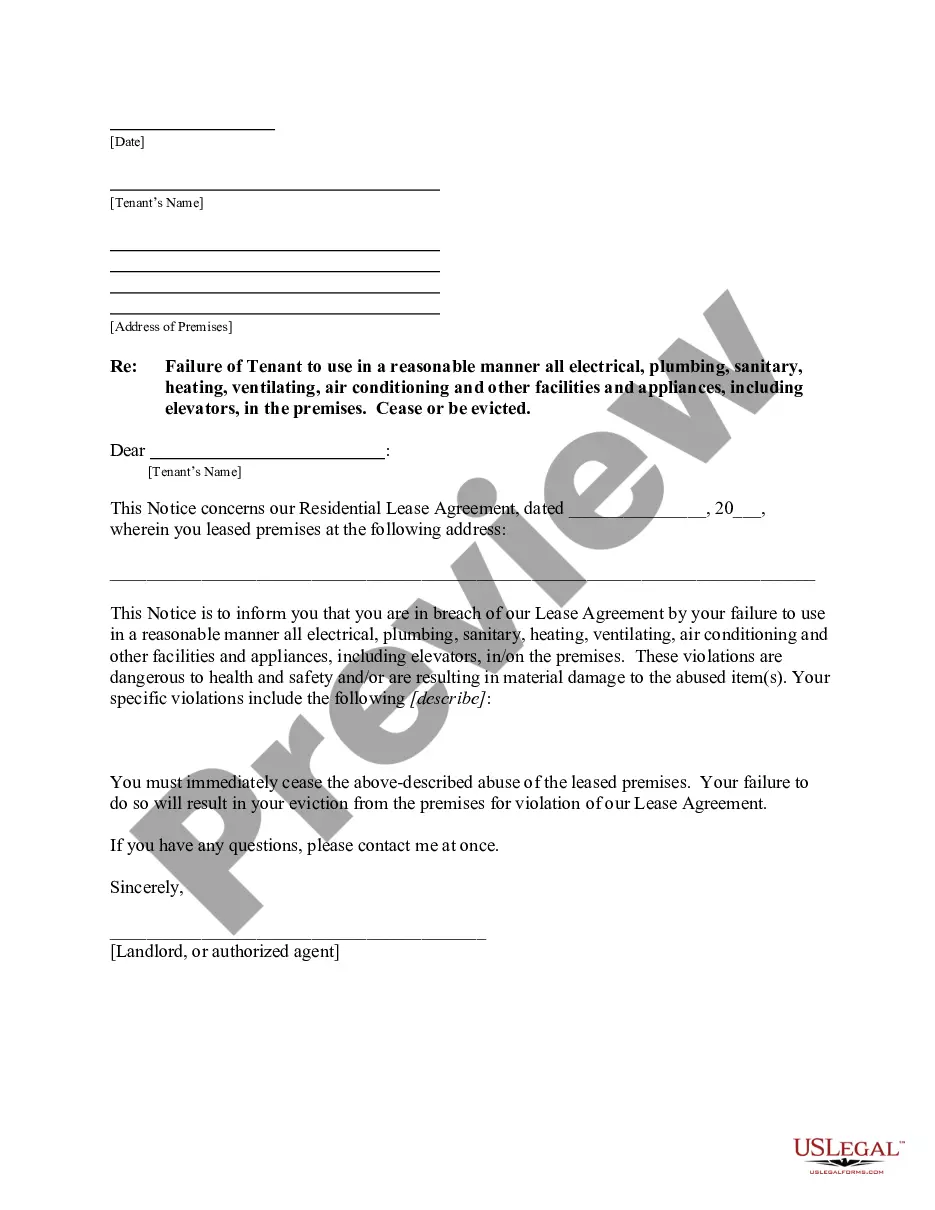

How to fill out Notice Of Operating Agreement?

US Legal Forms - one of the greatest libraries of legal types in the States - offers a wide array of legal file web templates it is possible to obtain or print out. Making use of the website, you can get thousands of types for enterprise and specific uses, sorted by classes, claims, or key phrases.You will find the newest types of types just like the Nevada Notice of Operating Agreement within minutes.

If you already have a registration, log in and obtain Nevada Notice of Operating Agreement through the US Legal Forms local library. The Down load option will show up on every type you look at. You gain access to all formerly delivered electronically types from the My Forms tab of the bank account.

If you wish to use US Legal Forms the very first time, allow me to share easy recommendations to help you get started out:

- Make sure you have chosen the right type for the metropolis/county. Click on the Preview option to examine the form`s articles. Browse the type outline to ensure that you have chosen the correct type.

- When the type doesn`t suit your specifications, take advantage of the Research industry on top of the display screen to discover the one who does.

- If you are pleased with the shape, affirm your choice by clicking on the Acquire now option. Then, select the prices plan you want and give your credentials to sign up on an bank account.

- Process the transaction. Utilize your credit card or PayPal bank account to perform the transaction.

- Select the formatting and obtain the shape on your gadget.

- Make changes. Fill up, edit and print out and indication the delivered electronically Nevada Notice of Operating Agreement.

Every single template you added to your account does not have an expiry day which is your own property permanently. So, if you wish to obtain or print out an additional copy, just check out the My Forms portion and click about the type you need.

Get access to the Nevada Notice of Operating Agreement with US Legal Forms, the most considerable local library of legal file web templates. Use thousands of specialist and express-certain web templates that meet your business or specific requires and specifications.

Form popularity

FAQ

To start an LLC in Nevada, you'll need to choose a Nevada registered agent, file business formation paperwork with the Nevada Secretary of State, and pay a $425 state filing fee. If you file online, you'll pay a 2.5% credit card fee, which works out to $436.

No, Operating Agreements are not legally required in Nevada. ing to the Nevada Revised Statutes (NRS) 86.286 Operating Agreement clause, ?A limited-liability company may, but is not required to, adopt an operating agreement.?

The cheapest way to get an LLC in Nevada is to follow the steps above and file yourself. There is an LLC filing fee of $75, but this is required whether you file on your own or use an LLC filing service.

Starting an LLC in Nevada will include the following steps: #1: Name Your Nevada LLC. #2: Register an Agent. #3: File the Required Forms for Your Nevada LLC. #4: Create an Operating Agreement. #5: Get an EIN for Your Nevada LLC.

You can form an LLC in Nevada even if your business will not be located in Nevada and/or no LLC members will live there. But you will probably still need to qualify your LLC to do business in your home state?and this means you'll have to file additional paperwork and pay additional fees.

An LLC operating agreement should contain provisions to cover: Basic information about the LLC. ... A profit and loss allocation plan. ... The LLC's purpose. The management structure. ... Ownership percentages of each member. ... Voting rights and procedures. ... Meeting frequency. Procedures for bringing in new members.

Nevada LLC Formation Filing Fee: $425 If you file online and pay by credit card, you'll have to pay a 2.5% credit card fee, which works out to $436. Nevada also offers expedited service: 24-hour expedited state processing: $75-$125. 2-hour expedited state processing: $500.

Nevada LLC Fees The annual manager list filing fee is $150 and provides the Nevada Secretary of State with an up-to-date list of the LLC's managers. The annual business license fee is $200 and must be filed so an LLC can maintain its good standing with the Nevada Secretary of State. The total cost is $350.