Nevada Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status, take Investor statements regarding information, and waiver of claims."

How to fill out Accredited Investor Qualification And Verification Requirements For Reg D, Rule 506(c) Offerings?

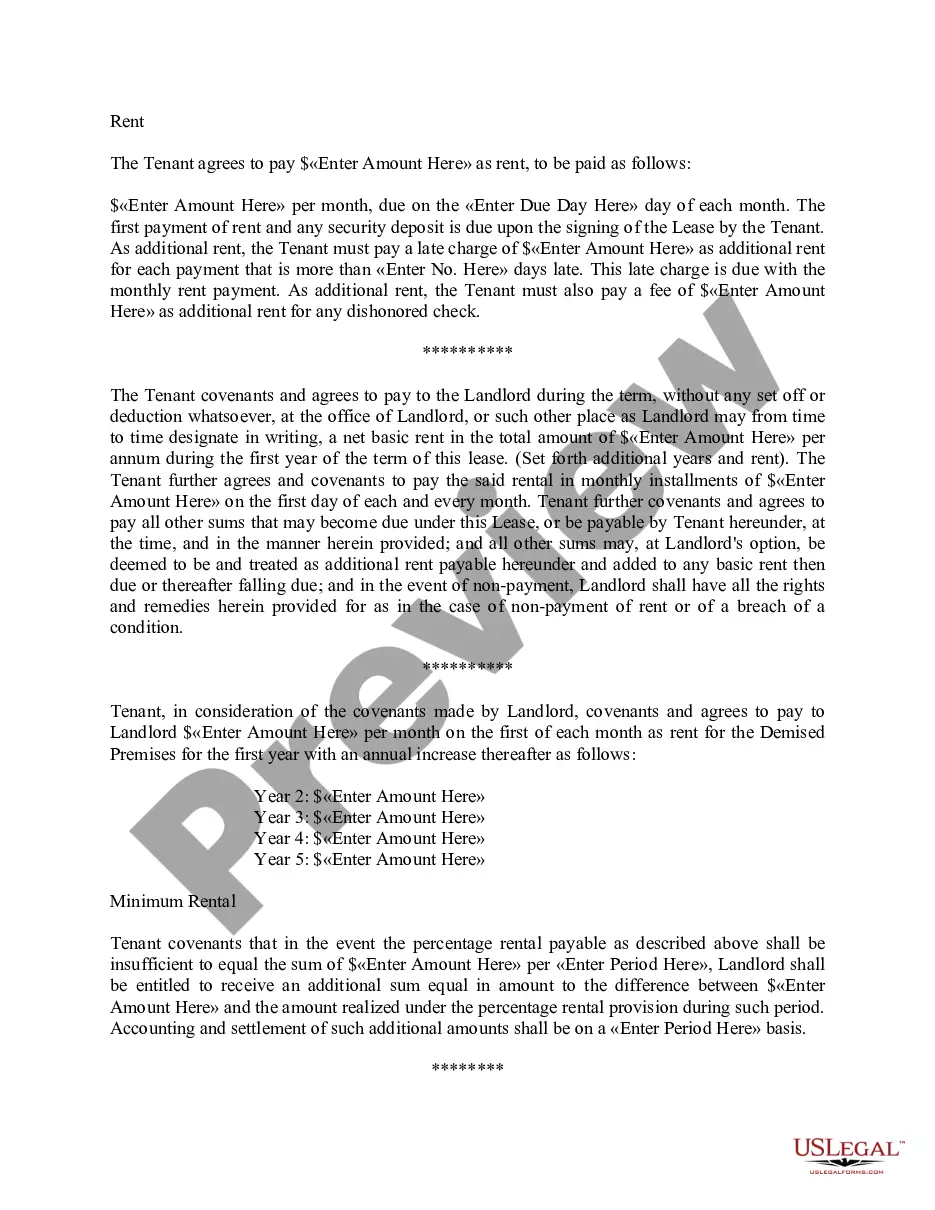

You are able to devote time online trying to find the authorized record web template that suits the state and federal requirements you need. US Legal Forms offers 1000s of authorized types that happen to be evaluated by specialists. It is simple to acquire or print the Nevada Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings from our assistance.

If you already have a US Legal Forms account, you can log in and then click the Download button. Next, you can total, revise, print, or sign the Nevada Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings. Every single authorized record web template you acquire is the one you have eternally. To acquire one more duplicate associated with a purchased develop, proceed to the My Forms tab and then click the related button.

If you work with the US Legal Forms website for the first time, adhere to the basic directions listed below:

- Initial, ensure that you have selected the proper record web template for that region/metropolis of your choosing. Read the develop outline to make sure you have picked out the right develop. If readily available, use the Preview button to look through the record web template too.

- If you would like get one more model of your develop, use the Look for discipline to obtain the web template that fits your needs and requirements.

- After you have discovered the web template you need, click on Buy now to continue.

- Select the pricing prepare you need, enter your accreditations, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You can use your bank card or PayPal account to pay for the authorized develop.

- Select the format of your record and acquire it to your system.

- Make alterations to your record if required. You are able to total, revise and sign and print Nevada Accredited Investor Qualification and Verification Requirements for Reg D, Rule 506(c) Offerings.

Download and print 1000s of record templates while using US Legal Forms site, which offers the biggest selection of authorized types. Use specialist and express-particular templates to tackle your small business or personal demands.

Form popularity

FAQ

The company cannot use general solicitation or advertising to market the securities. The company may sell its securities to an unlimited number of "accredited investors" and up to 35 other purchasers.

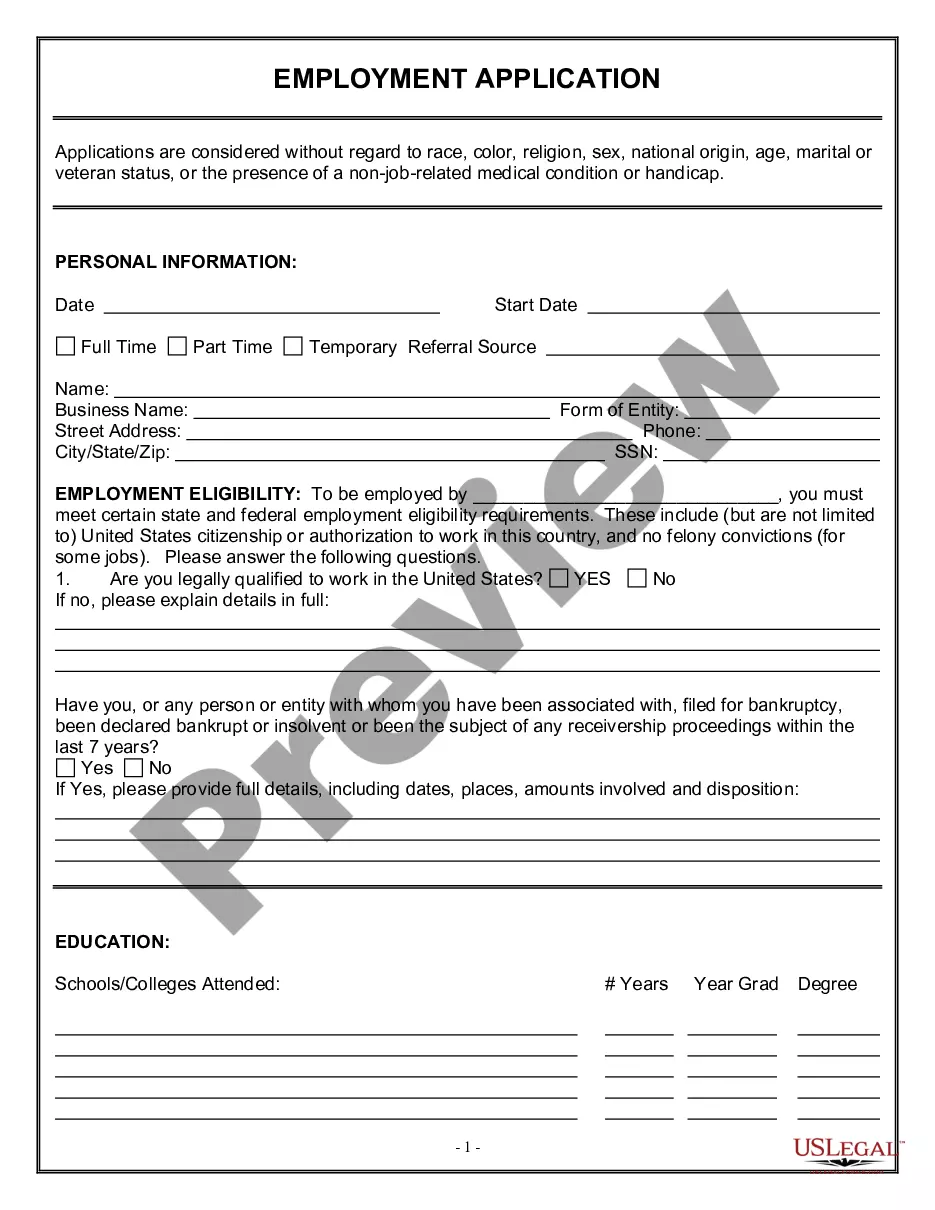

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

In the U.S., the term accredited investor is used by the Securities and Exchange Commission (SEC) under Regulation D to refer to investors who are financially sophisticated and have a reduced need for the protection provided by regulatory disclosure filings.

Rule 506(d) states that any Bad Actor who has engaged in a disqualifying event cannot be a part of any offer made under Regulation D. These disqualifying events don't just affect the individual in question. If you make any offering with a Bad Actor as part of your issuing team, the SEC disqualifies the offering.

Rule 504 is not a common method of privately placing securities because the $5,000,000 cap is unattractive to many large issuers. Rule 506, which restricts who can purchase securities in a private placement but does not cap the offering amount, is the more common method of private placement under Regulation D.

Reviewing bank statements, brokerage statements, and other similar reports to determine net worth. Obtaining written confirmation of the investor's accredited investor status from one of the following persons: a registered broker-dealer, an investment adviser registered with the SEC, a licensed attorney, or a CPA.

Accredited investors are generally large financial institutions, such as investment banks, or high net-worth individuals. Rule 506 bans general solicitation of the securities. That is, issuers may not advertise their offering to a broad audience.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.