Nevada Department Time Report for Payroll

Description

How to fill out Department Time Report For Payroll?

You have the capability to spend hours online searching for the legal document template that meets the federal and state requirements you seek.

US Legal Forms provides thousands of legal templates that are assessed by professionals.

You can download or print the Nevada Department Time Report for Payroll from your support.

If needed, use the Preview button to view the document template at the same time.

- If you already possess a US Legal Forms account, you can sign in and then click the Acquire button.

- Subsequently, you can complete, edit, print, or sign the Nevada Department Time Report for Payroll.

- Each legal document template you obtain is yours permanently.

- To get another copy of the acquired template, navigate to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, adhere to the simple steps outlined below.

- Firstly, ensure that you have selected the correct document template for the region/area of your choice.

- Review the template description to confirm that you have chosen the correct template.

Form popularity

FAQ

To prepare a payroll report using the Nevada Department Time Report for Payroll, begin by gathering all necessary employee time records, including hours worked and any applicable overtime. Next, ensure you have the appropriate tax information and deductions ready. Utilize a reliable software or platform, such as USLegalForms, which simplifies the process and ensures compliance with state regulations. Following these steps allows you to create an accurate payroll report that reflects your employees' earnings in a timely manner.

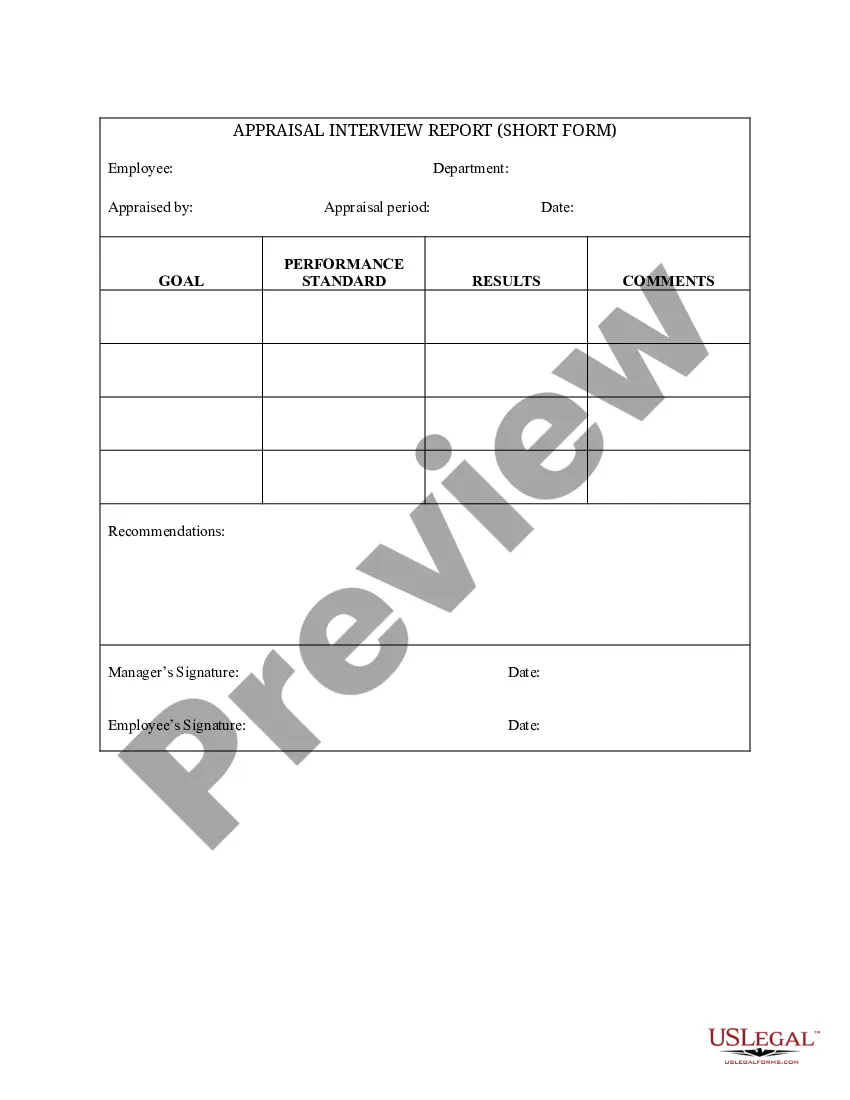

The payroll time sheet report primarily displays the hours worked by employees, along with relevant details like overtime, leave hours, and job classifications. This report is crucial for employers to verify that the hours align with the Nevada Department Time Report for Payroll requirements. Moreover, accurate reporting helps prevent errors in payment, fostering trust between employees and management. Utilizing US Legal Forms can simplify the generation of these reports, making the payroll process more efficient and reliable.

The payroll schedule for employees under the Nevada Department Time Report for Payroll typically follows a biweekly cycle. This means that employees receive their paychecks every two weeks, ensuring they have a consistent and predictable income. It's essential for both employers and employees to understand this schedule for accurate financial planning. For those managing payroll, using tools like US Legal Forms can streamline this process and help ensure compliance with state regulations.

Reg. 285/01, which is being retained for transitional purposes. Subsection 21.2(1) provides that, under certain circumstances, employees must be paid at least three hours' pay at the employee's regular rate of pay, even though the employee has worked less than three hours.

A. Yes, you are entitled to one hour of reporting time pay. Under the law, if an employee is required to report to work a second time in any one workday and is furnished less than two hours of work on the second reporting, he or she must be paid for two hours at his or her regular rate of pay.

FeffThe Fair Labor Standards Act (FLSA), governs the process that Compensation Analysts use to determine whether a position is either eligible for over-time pay for hours worked in excess of 40 per week (non-exempt) or is paid a flat sum for hours worked, even if they exceed 40 hours within a workweek (exempt).

An employer must give employees at least seven (7) days' notice before any change is made to any payday or place of payment.

Currently, there is one state, Oregon, with full state predictive scheduling regulations that apply to every city. Additionally, Vermont and New Hampshire have specific regulations in place around flexible working hours for employees.

Nevada's Overtime Minimum WageNevada overtime law requires all employees working more then 40 hours a week or 8 hours a day to be paid time-and-a-half wages for any additional hours worked. Daily overtime applies for workers earning less then $12.38 per hour (or $10.89 per hour with health benefits).

A.) If the employee quits employment, they must receive their final wages within 7 days or by the next regular pay day, whichever is earlier. If the employee is discharged, they must receive their final wages within 3 days (Nevada Revised Statutes 680.020-NRS 608.040).