Nevada Demand for Indemnity from a Limited Liability Company LLC by Member

Description

How to fill out Demand For Indemnity From A Limited Liability Company LLC By Member?

Are you presently in the placement that you require files for sometimes organization or individual purposes just about every working day? There are a lot of lawful papers themes available on the Internet, but finding types you can depend on isn`t simple. US Legal Forms gives a huge number of form themes, much like the Nevada Demand for Indemnity from a Limited Liability Company LLC by Member, that are published to satisfy federal and state specifications.

Should you be currently familiar with US Legal Forms website and possess an account, basically log in. Next, you may acquire the Nevada Demand for Indemnity from a Limited Liability Company LLC by Member web template.

Should you not have an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the form you need and make sure it is to the proper town/county.

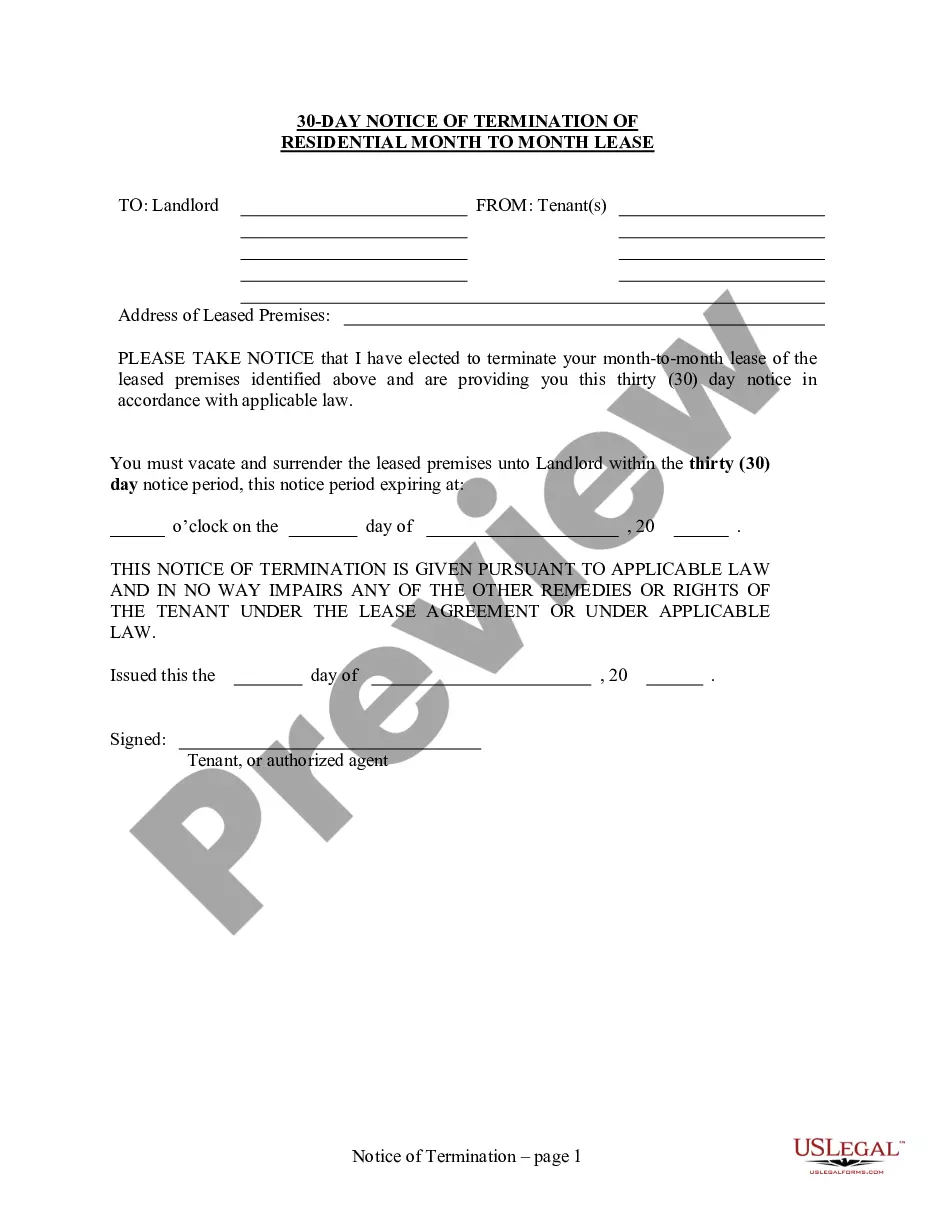

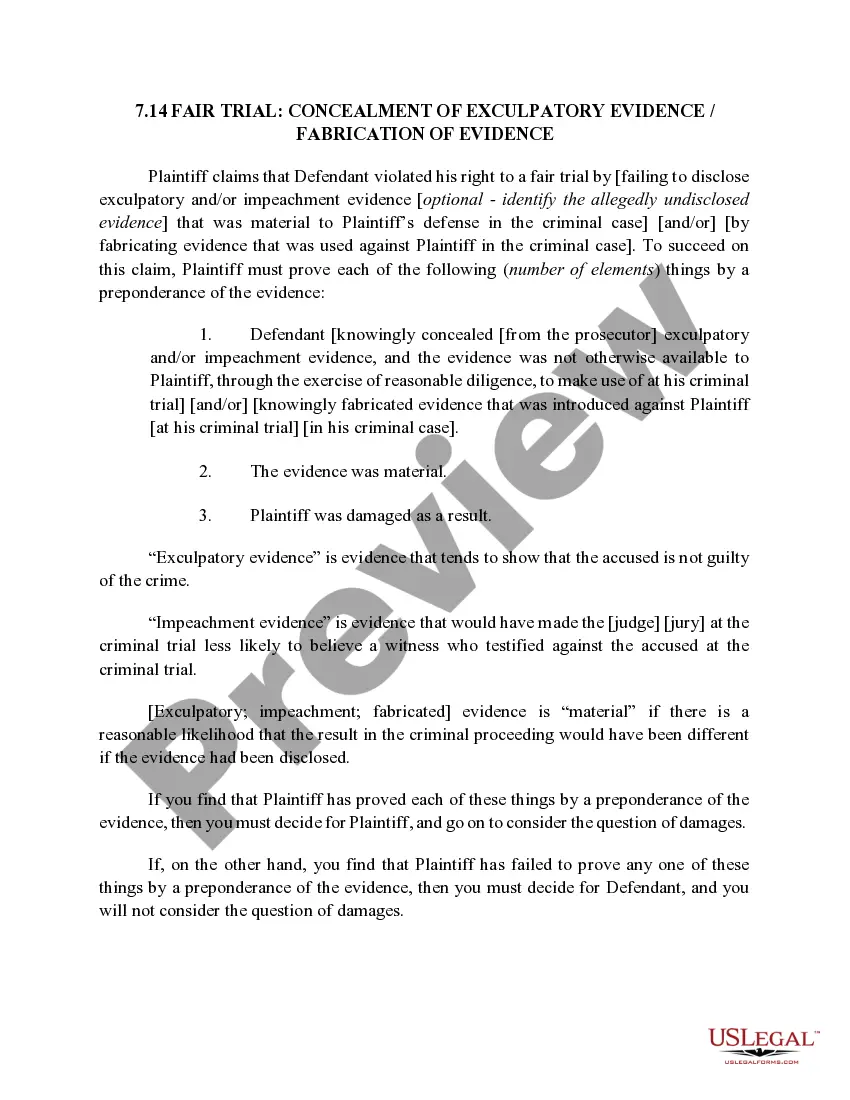

- Make use of the Preview key to check the form.

- Read the description to ensure that you have chosen the appropriate form.

- If the form isn`t what you`re trying to find, take advantage of the Search discipline to find the form that fits your needs and specifications.

- Once you find the proper form, simply click Buy now.

- Opt for the prices prepare you would like, complete the necessary info to generate your money, and pay for the order using your PayPal or bank card.

- Choose a convenient document formatting and acquire your copy.

Discover each of the papers themes you might have bought in the My Forms menus. You can aquire a more copy of Nevada Demand for Indemnity from a Limited Liability Company LLC by Member whenever, if necessary. Just click the necessary form to acquire or print out the papers web template.

Use US Legal Forms, probably the most extensive variety of lawful varieties, to save efforts and stay away from errors. The support gives appropriately made lawful papers themes that can be used for a selection of purposes. Create an account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

A limited liability company (LLC) managing member is both an LLC owner and someone who keeps the business running on a day-to-day basis. The managerial aspect generally includes having the authority to make decisions and enter into contracts on behalf of the business.

LLCs do not have shareholders. They have members who share in the profits of the business. The members' share of the profits is taxable as income. The company itself has no tax liability.

What are the owners of an LLC called? The owners of an LLC are called its members. Depending upon the size of the organization, an LLC member can assume a position resembling a partner, passive investor, or a sole proprietor.

A restricted LLC is a type of LLC used as a vehicle for transferring assets (like properties, businesses, or land) and is only available in Nevada. Restricted LLCs have restrictions on when profits from the LLC can be paid out.

The Nevada Limited Liability Company Act outlines the filing requirements for forming an LLC in the state of Nevada. Under this act, an LLC must file articles of organization with the Nevada Secretary of State to conduct business as an independent legal entity.

In an LLC, the units of ownership are not known as shares of 'stock'. The majority of the LLC's agreement delegates a particular number of ?membership interests? or ?membership units?. These LLC shares or units may also be further broken down into two types: the voting units and the non-voting units.

To remove a member from your LLC, a withdrawal notice, a unanimous vote, or a procedure depicted in the articles of organization may entail. The member in question of removal may need to get compensated for his share of membership interests.

The term member refers to the individual(s) or entity(ies) holding a membership interest in a limited liability company. The members are the owners of an LLC, like shareholders are the owners of a corporation. Members do not own the LLC's property.