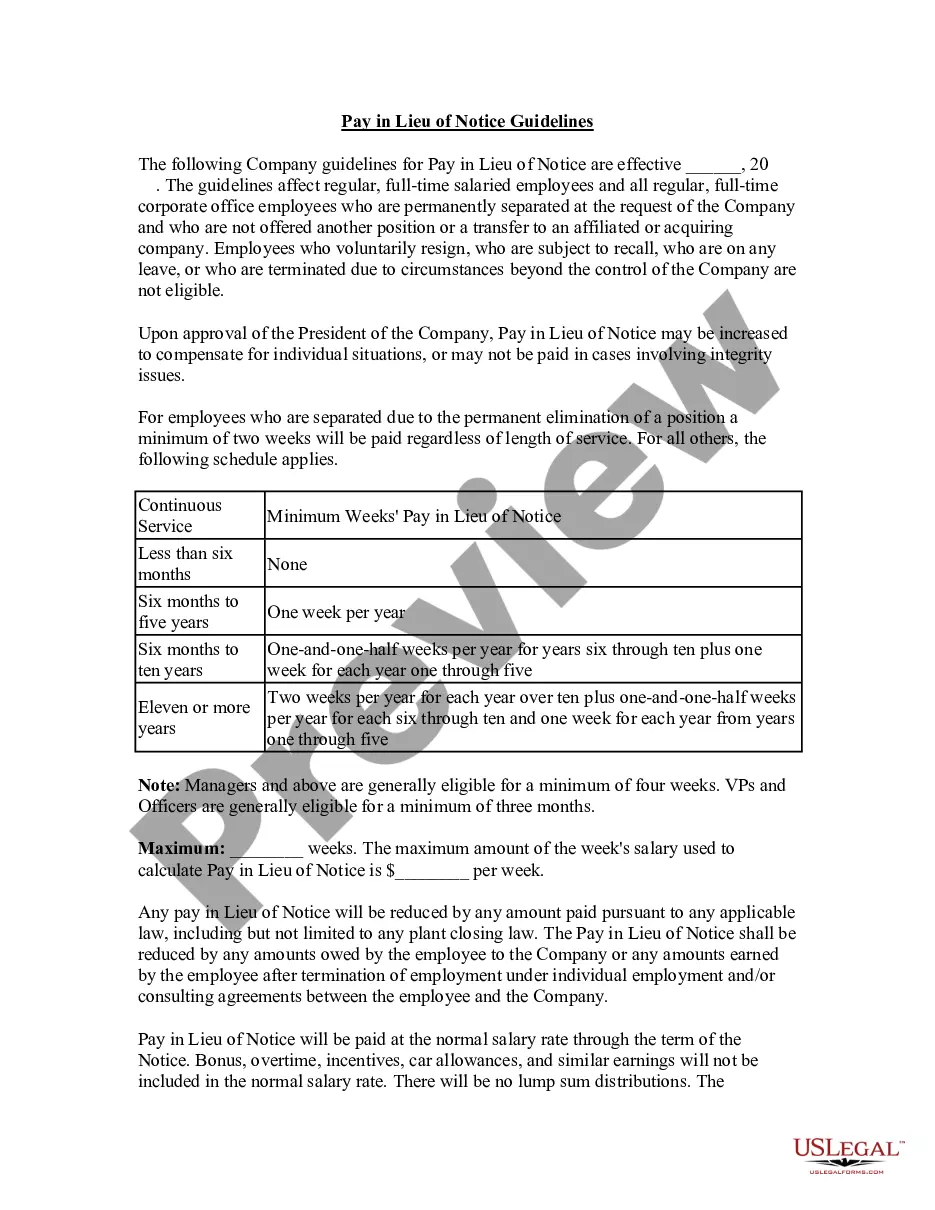

Nevada Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

If you seek extensive, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's user-friendly and efficient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

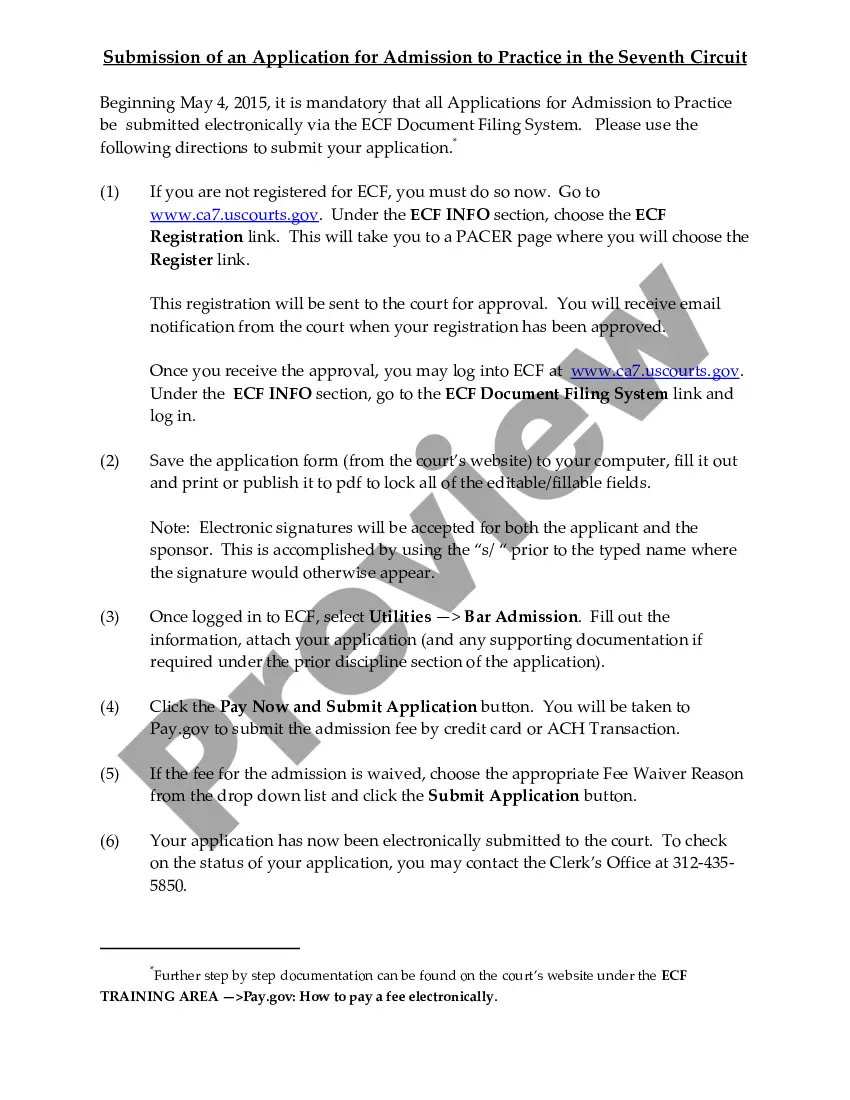

Step 3. If you are dissatisfied with the form, use the Search bar at the top of the screen to find alternative versions of the legal form template.

Step 4. After identifying the form you need, click the Get now button. Choose the subscription plan you prefer and enter your details to register for an account.

- Use US Legal Forms to swiftly locate the Nevada Pay in Lieu of Notice Guidelines.

- If you are already a US Legal Forms customer, Log In to your profile and click on the Acquire button to obtain the Nevada Pay in Lieu of Notice Guidelines.

- You can also access forms you previously downloaded via the My documents section of your profile.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Preview feature to view the form's content. Don't forget to read the description.

Form popularity

FAQ

The 24-hour rule in Nevada stipulates that certain employers must provide notice to employees when their work schedules change. According to the Nevada Pay in Lieu of Notice Guidelines, employees must be informed of schedule changes at least 24 hours in advance. This requirement creates a more transparent workplace, allowing employees to plan their personal lives accordingly. Familiarizing yourself with this rule will help you understand your rights and obligations as an employee.

The 4/10 rule in Nevada allows employees to work four 10-hour days instead of the traditional five 8-hour days. This schedule provides employees with a three-day weekend every week, promoting work-life balance. Under the Nevada Pay in Lieu of Notice Guidelines, employers must adhere to specific labor laws when implementing this work schedule. This rule benefits both employees and employers by increasing productivity and job satisfaction.

The Leave of Absence (LOA) law in Nevada outlines the rights and obligations of employees and employers regarding unpaid time off. Under the Nevada Pay in Lieu of Notice Guidelines, employees may seek leave for various reasons, including personal health or family matters. This law ensures that employees have the necessary protections while balancing their job responsibilities. Understanding this law can help employees make informed decisions about their time away from work.

To calculate payment in lieu of notice, follow the Nevada Pay in Lieu of Notice Guidelines by determining the employee's usual pay rate. Multiply the daily pay rate by the number of notice days not provided. Additionally, consider any applicable deductions or benefits entitlement before arriving at the final payout amount.

Payment in lieu of leave refers to compensation provided to employees for unused leave days instead of taking the leave itself. In the context of Nevada Pay in Lieu of Notice Guidelines, this concept can apply when an employee separates from a company and has accrued leave days. Employers must follow legal requirements to ensure fair payout according to company policies.

Yes, under the Nevada Pay in Lieu of Notice Guidelines, payment in lieu of notice is subject to superannuation contributions. Employers are required to contribute a percentage of the payment in lieu towards the employee's superannuation fund. This ensures that employees receive their entitled benefits, even when notice is not served.

To obtain payment in lieu of notice, employees should submit a formal request to their employer, citing the applicable Nevada Pay in Lieu of Notice Guidelines. This request should include details about the employment duration and the circumstances leading to the request. Employers will then evaluate the request based on company policy and legal obligations.

To process payment in lieu of notice in accordance with Nevada Pay in Lieu of Notice Guidelines, you first need to determine the employee's regular pay rate and the notice period required. Then, calculate the total amount owed by multiplying the daily pay rate by the number of days of notice not given. Ensure all calculations are documented for transparency and compliance.