Nevada Domestic Partnership Dependent Certification Form

Description

How to fill out Domestic Partnership Dependent Certification Form?

If you seek to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the finest variety of legal forms available online.

Leverage the site's straightforward and effective search to locate the documents you require.

An assortment of templates for business and personal applications are categorized by type and state or keywords.

Each legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Navigate to the My documents section and select a form to print or download again.

Compete and download, then print the Nevada Domestic Partnership Dependent Certification Form with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Utilize US Legal Forms to locate the Nevada Domestic Partnership Dependent Certification Form within just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and then click the Obtain button to find the Nevada Domestic Partnership Dependent Certification Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/region.

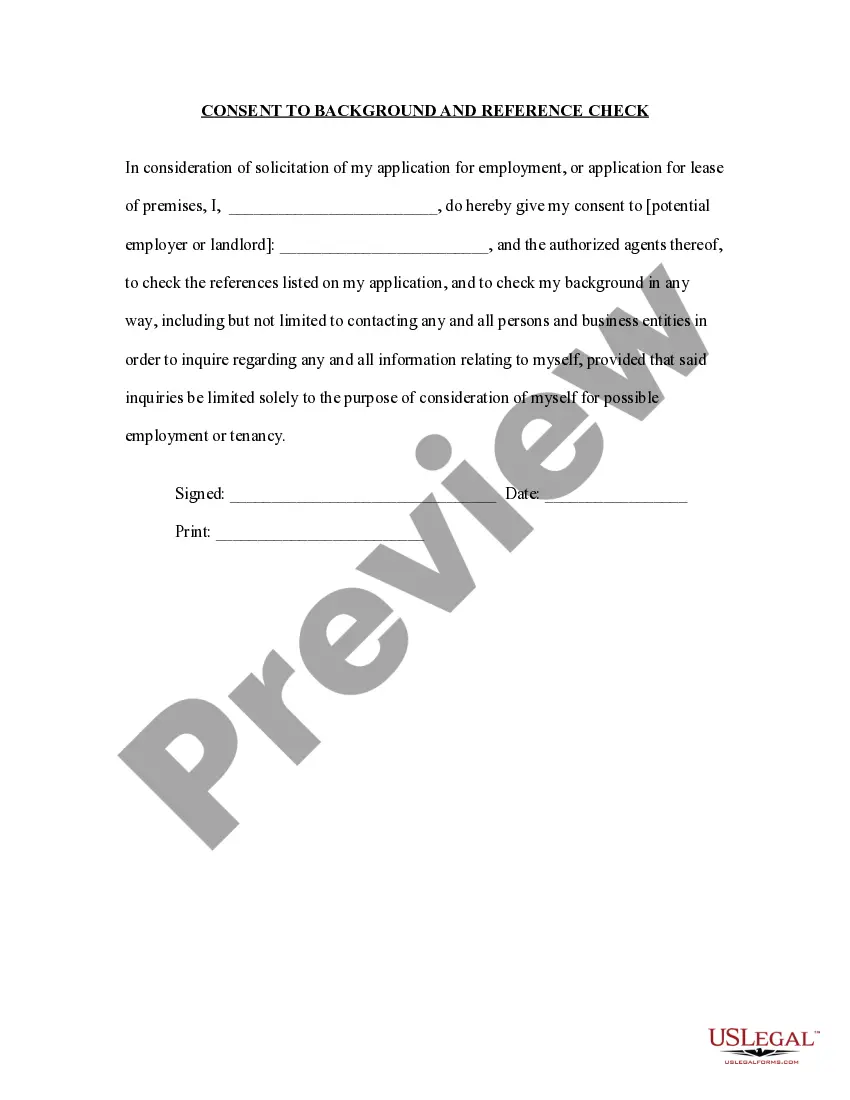

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your information to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Retrieve the template of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Nevada Domestic Partnership Dependent Certification Form.

Form popularity

FAQ

Can my domestic partner claim me as a dependent? Yes, your domestic partner can claim you as a dependent on their tax return under qualifying relative rules for determining dependency status. Dependents don't necessarily need to be related to be claimed on tax returns.

Individuals wishing to register as domestic partners under Nevada's law must file a Declaration of Domestic Partnership form. This one-page form must be signed in the presence of a notary public; electronic notarization is acceptable. The $50 registration fee includes a black and white certificate.

Individuals wishing to register as domestic partners under Nevada's law must file a Declaration of Domestic Partnership form. This one-page form must be signed in the presence of a notary public; electronic notarization is acceptable. The $50 registration fee includes a black and white certificate.

Community Property and Nevada Cohabitation Since 1984, the Nevada courts have permitted couples, by agreement, to apply community property law to their acquired property by analogy, allowing community property laws to apply to the property acquired by unmarried (usually cohabiting) couples.

Two individuals seeking to become domestic partners must complete and file a declaration of domestic partnership in person with the City Clerk Department. Each applicant must provide a valid photo ID issued by a United States government agency that provides name, date of birth, height, weight, and hair and eye color.

"Declaration of Domestic Partnership." A "Declaration of Domestic Partnership" is a statement signed under penalty of perjury. By signing it, the two people swear that they meet the requirements of the definition of domestic partnership when they sign the statement. Each must provide a mailing address.

A domestic partner can be broadly defined as an unrelated and unmarried person who shares common living quarters with an employee and lives in a committed, intimate relationship that is not legally defined as marriage by the state in which the partners reside.

Under Nevada law, a domestic partnership is a legally recognized relationship between two people that confers nearly all the same rights and responsibilities under state law as marriage. A domestic partnership is created by registering with the Nevada Secretary of State.

Under Nevada law, a domestic partnership is a legally recognized relationship between two people that confers nearly all the same rights and responsibilities under state law as marriage. A domestic partnership is created by registering with the Nevada Secretary of State.

Marriage in Nevada is a civil contract requiring the consent of each party and a formal ceremony before witnesses known as solemnization. Nevada does not recognize common-law marriages begun after March 29, 1943. Persons who are at least 18 years of age may marry.