Nevada Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software

Description

How to fill out Revenue Sharing Agreement To Income From The Licensing And Custom Modification Of The Software?

Choosing the best legal file template can be quite a have difficulties. Obviously, there are plenty of templates available on the net, but how can you find the legal type you need? Make use of the US Legal Forms web site. The service gives a large number of templates, for example the Nevada Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software, which you can use for company and private requirements. Every one of the forms are checked out by professionals and satisfy state and federal specifications.

If you are presently registered, log in to the account and click on the Acquire button to obtain the Nevada Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software. Make use of account to check throughout the legal forms you have ordered in the past. Visit the My Forms tab of your respective account and acquire an additional duplicate from the file you need.

If you are a fresh consumer of US Legal Forms, listed below are straightforward instructions so that you can stick to:

- Initial, make certain you have selected the right type for your area/state. You may look over the form using the Preview button and browse the form description to make certain it will be the best for you.

- In the event the type is not going to satisfy your needs, take advantage of the Seach industry to obtain the right type.

- Once you are certain the form is acceptable, select the Acquire now button to obtain the type.

- Pick the rates prepare you would like and type in the necessary details. Create your account and pay money for the order using your PayPal account or bank card.

- Select the document formatting and acquire the legal file template to the product.

- Total, change and print out and sign the attained Nevada Revenue Sharing Agreement to Income from the Licensing and Custom Modification of the Software.

US Legal Forms is the greatest library of legal forms where you will find numerous file templates. Make use of the service to acquire professionally-manufactured documents that stick to status specifications.

Form popularity

FAQ

The primary benefit of a revenue sharing investment is that its structure allows participants to focus on shared success. The goal between management and shareholders are fully aligned towards generating sustainable revenue.

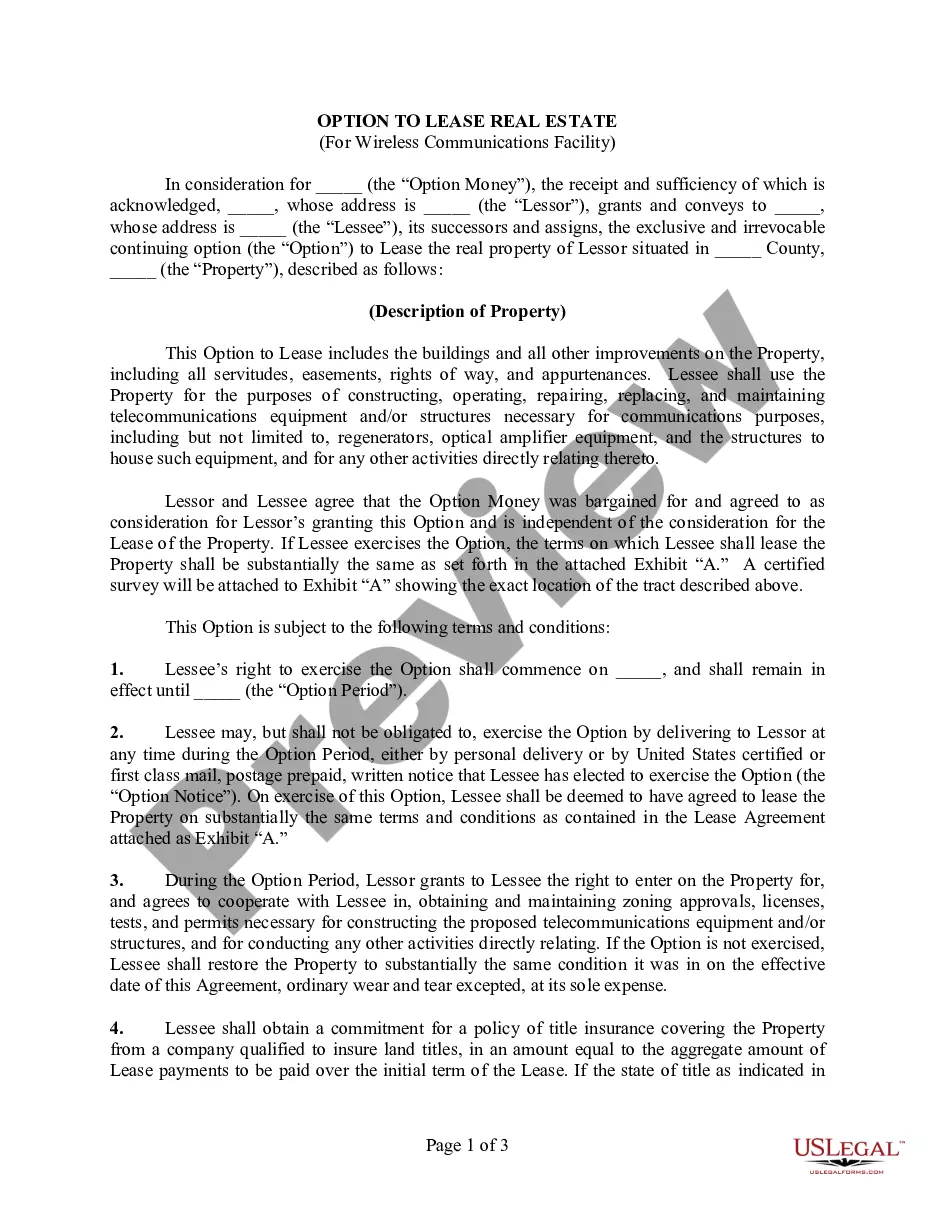

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Sales of custom software - delivered on tangible media are exempt from the sales tax in California. Sales of custom software - downloaded are exempt from the sales tax in California.

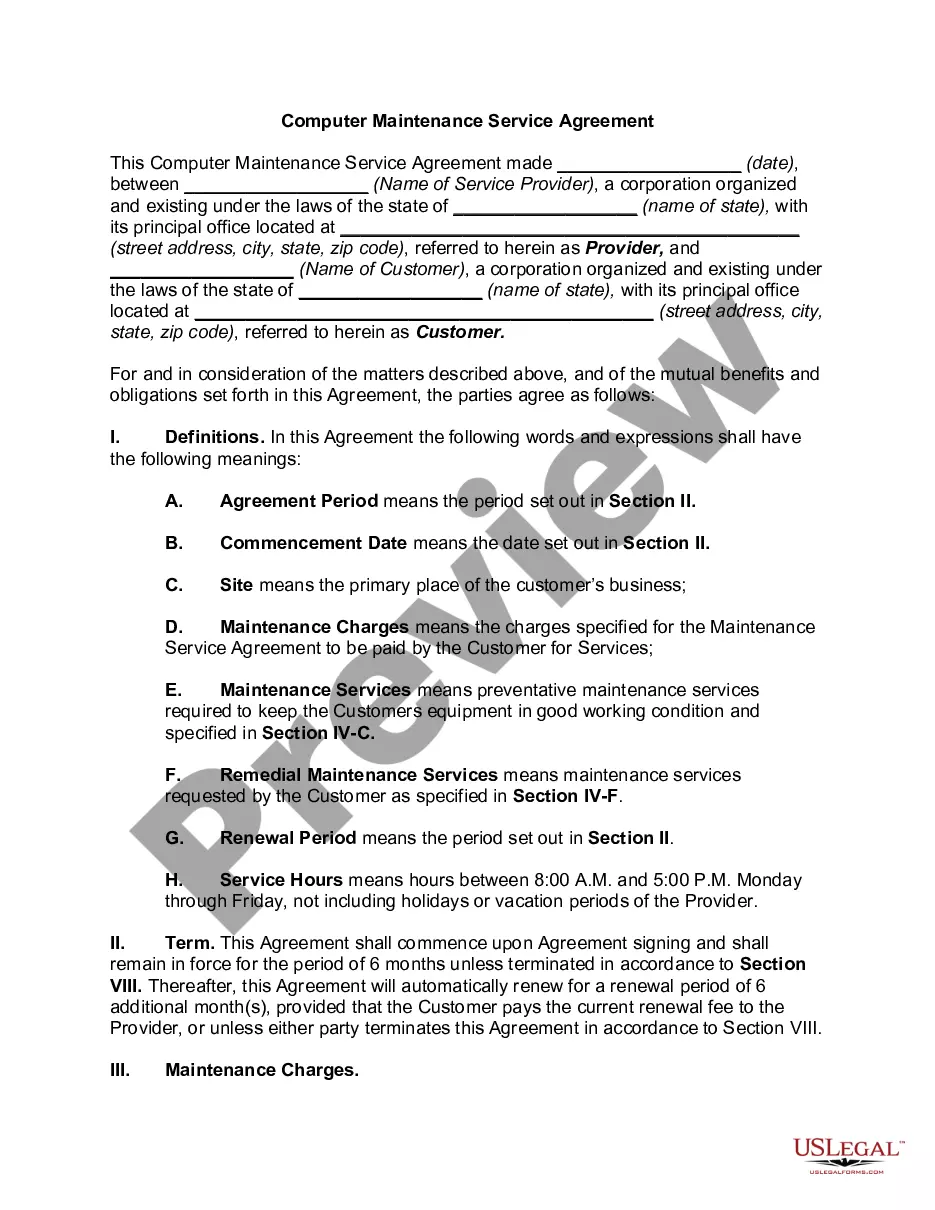

A revenue sharing agreement is a legal document between two parties where one party has to pay a percentage of profits or revenues received to the other for the rights to use something.

Revenue sharing is a somewhat flexible concept that involves sharing operating profits or losses among associated financial actors. Revenue sharing can exist as a profit-sharing system that ensures each entity is compensated for its efforts.

Prewritten computer software is taxable as tangible personal property, whether it is sold as part of a package or as a separate component, regardless of how the software is conveyed to the purchaser.

Second, revenue sharing contract has an adverse impact on the sales effort. If the retailer is getting only a small fraction of the revenue he's generating, his incentive to improve sales goes down whereas the supplier wants the retailer to buy the right quantity, and also want them to sell at a higher rate.

Is software, electronic magazines, clipart, program code, or other downloaded material taxable to Nevada residents? No. Products delivered electronically or by load and leave are not subject to Nevada Sales or Use Tax.

Under a revenue-sharing contract, a retailer pays a supplier a wholesale price for each unit purchased plus a percentage of the revenue the retailer generates. Such contracts have become more prevalent in the video cassette rental industry relative to the more conventional wholesale price contract.

Ideally, all software purchases should be taxable to final users and exempt for business users. Instead, states tax some kinds of software and exempt others, based on whether it is customized or off-the-shelf and whether it is on CD or downloaded, all silly distinctions for tax purposes.