Nevada Sample Letter for Dissolution and Liquidation

Description

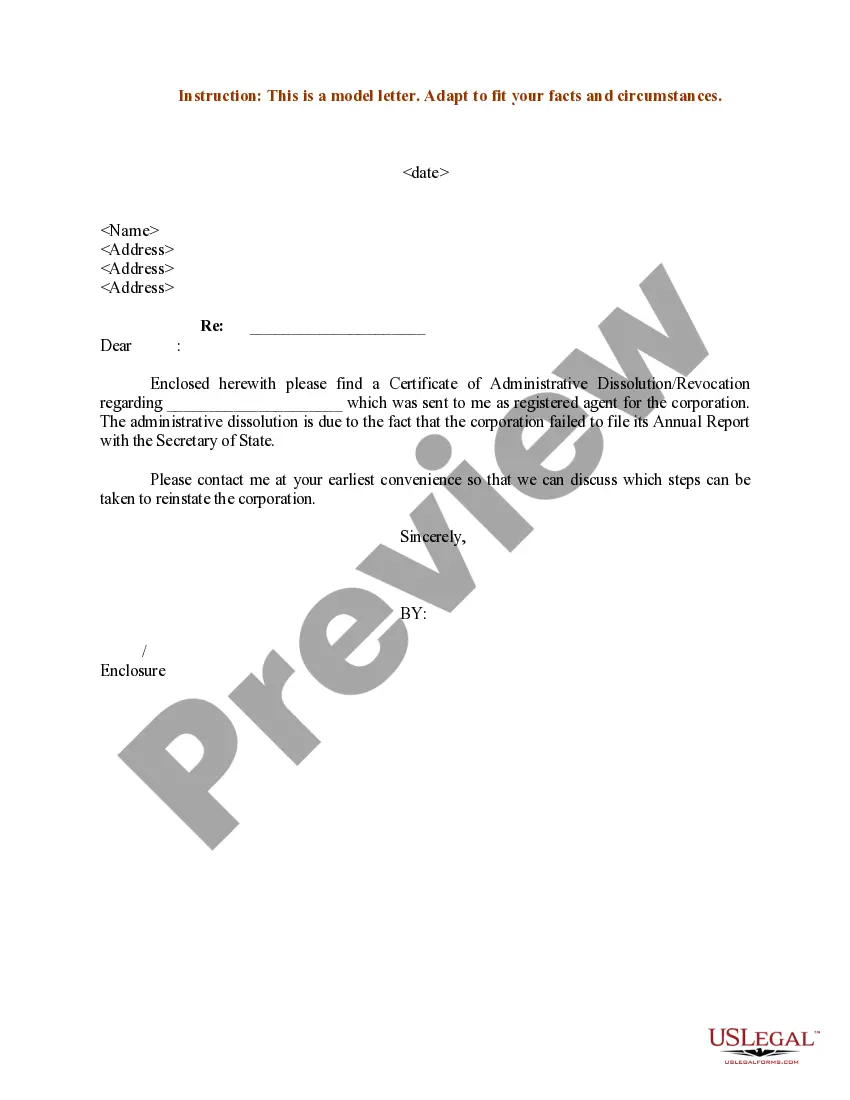

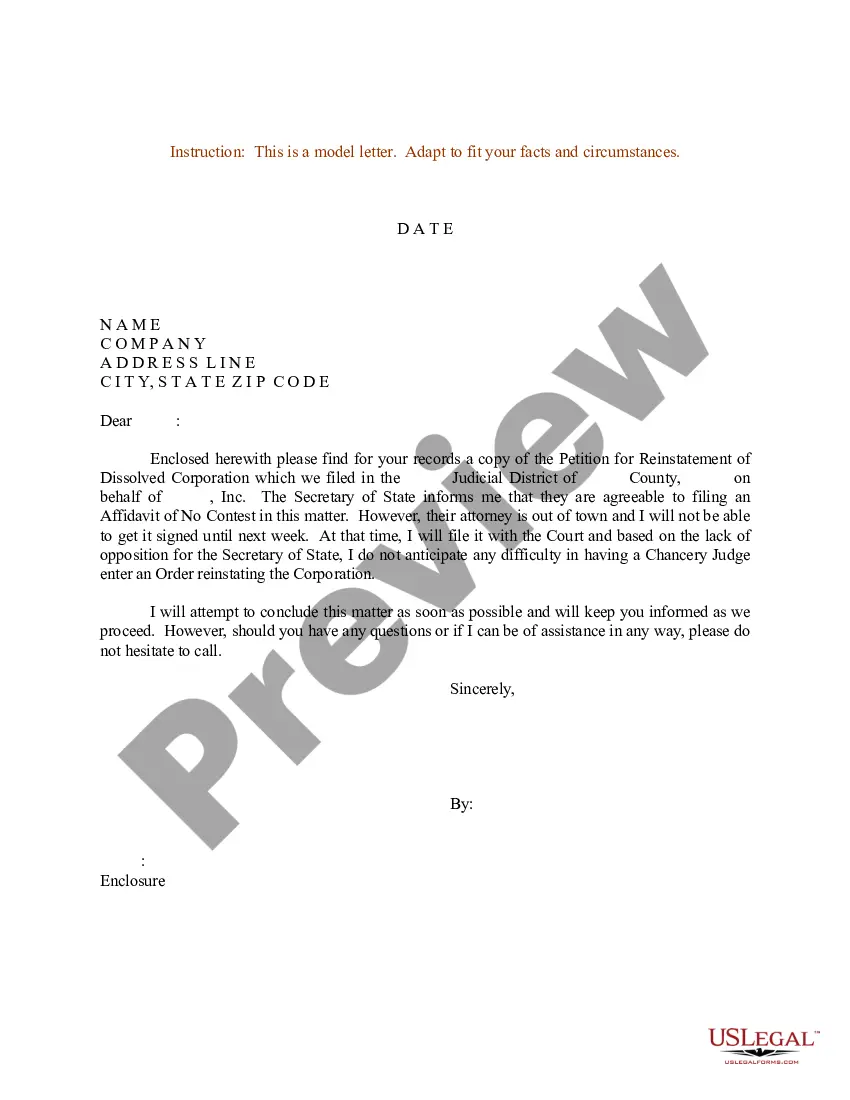

How to fill out Sample Letter For Dissolution And Liquidation?

Discovering the right legal record web template could be a have difficulties. Needless to say, there are a lot of layouts available on the net, but how can you get the legal type you will need? Make use of the US Legal Forms site. The assistance delivers a huge number of layouts, including the Nevada Sample Letter for Dissolution and Liquidation, that can be used for company and personal requirements. All of the types are checked out by experts and fulfill federal and state needs.

When you are currently listed, log in for your accounts and click on the Down load key to have the Nevada Sample Letter for Dissolution and Liquidation. Use your accounts to appear throughout the legal types you may have ordered in the past. Proceed to the My Forms tab of the accounts and have an additional duplicate of the record you will need.

When you are a new user of US Legal Forms, listed here are easy directions that you should comply with:

- Initially, make certain you have chosen the right type for the metropolis/region. You can examine the shape making use of the Preview key and read the shape description to make sure this is the best for you.

- In case the type does not fulfill your requirements, use the Seach industry to obtain the right type.

- Once you are certain the shape would work, click on the Acquire now key to have the type.

- Select the prices prepare you need and enter the necessary information and facts. Build your accounts and buy the transaction making use of your PayPal accounts or Visa or Mastercard.

- Pick the submit structure and download the legal record web template for your system.

- Complete, edit and print out and signal the obtained Nevada Sample Letter for Dissolution and Liquidation.

US Legal Forms may be the largest catalogue of legal types that you will find numerous record layouts. Make use of the company to download professionally-made paperwork that comply with state needs.

Form popularity

FAQ

Although the content will vary, certain elements should be included in every letter of dissolution. These include: The name of the recipient and the name of the person sending the letter. The purpose of the letter, including the relationship to be terminated and the date of termination, stated in the first paragraph.

After dissolution, a corporation is generally expected to pay all its existing debts and then liquidate its remaining assets to its shareholders. This sometimes becomes difficult, however, where there are unknown claims that may exist against the corporation.

Liquidation generally refers to the process of selling off a company's inventory, typically at a big discount, to generate cash. In most cases, a liquidation sale is a precursor to a business closing. Once all the assets have been sold, the business is shut down.

Liquidate means a formal closing down by a liquidator when there are still assets and liabilities to be dealt with. Dissolving a company is where the business is struck off the register at Companies House because it is now inactive. The two are very different processes.

To comply with corporation formalities, the board of directors should draft and approve the resolution to dissolve. Shareholders then vote on the director-approved resolution. Both actions should be documented and placed in the corporate record book.

A partnership can be dissolved or liquidated to legally terminate. A dissolution occurs when partners change, but the partnership continues operations. A liquidation occurs when the business ceases to exist.

What are the differences between liquidation and dissolution? Dissolving a company through the process of dissolution often takes place when a company is solvent, but is no longer trading. Liquidation however, occurs due to a company having financial difficulties and therefore being unable to keep up with their debts.

Once a company is dissolved, it no longer exists as a legal entity and cannot conduct business or enter into contracts. Dissolution may also trigger a number of certain legal obligations, such as the distribution of remaining assets to creditors or shareholders. It also might involve the filing of final tax returns.