Nevada Mortgage Note

Description

How to fill out Mortgage Note?

Are you presently within a position in which you need to have papers for sometimes business or personal reasons just about every day time? There are plenty of authorized papers themes accessible on the Internet, but finding types you can rely on isn`t easy. US Legal Forms provides a large number of kind themes, much like the Nevada Mortgage Note, which are written to fulfill federal and state requirements.

When you are previously knowledgeable about US Legal Forms site and have a free account, merely log in. Following that, you are able to acquire the Nevada Mortgage Note template.

Should you not provide an bank account and want to start using US Legal Forms, abide by these steps:

- Get the kind you will need and ensure it is to the appropriate city/area.

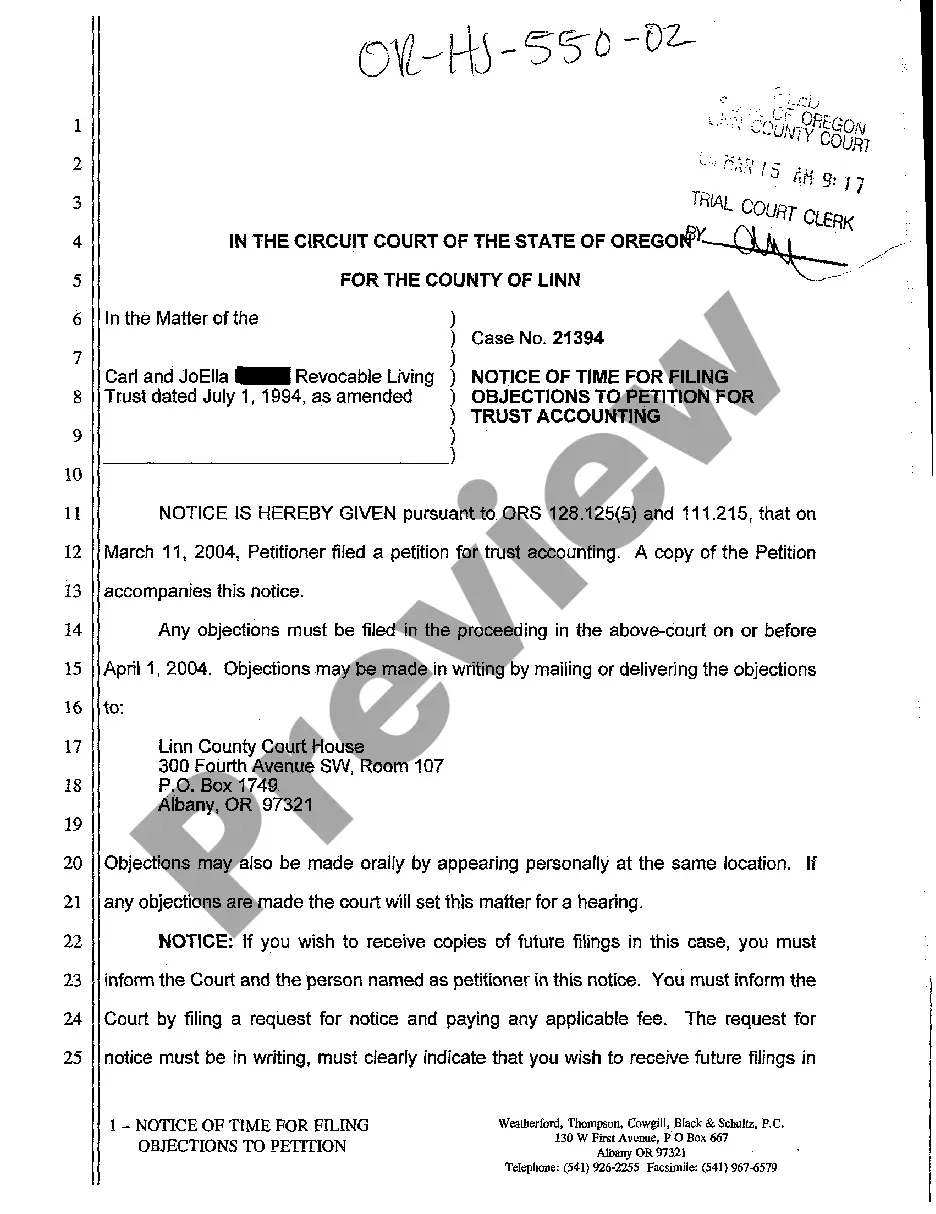

- Utilize the Review key to analyze the form.

- Look at the outline to actually have chosen the right kind.

- When the kind isn`t what you are looking for, use the Look for industry to obtain the kind that fits your needs and requirements.

- If you get the appropriate kind, click on Get now.

- Select the prices prepare you need, submit the desired info to make your bank account, and buy your order with your PayPal or bank card.

- Select a handy file formatting and acquire your version.

Discover all the papers themes you may have bought in the My Forms food selection. You may get a further version of Nevada Mortgage Note anytime, if possible. Just go through the necessary kind to acquire or print out the papers template.

Use US Legal Forms, probably the most extensive assortment of authorized types, to save time as well as prevent mistakes. The support provides expertly produced authorized papers themes that can be used for an array of reasons. Make a free account on US Legal Forms and commence making your way of life a little easier.

Form popularity

FAQ

A promissory note is a written agreement containing the details of the mortgage loan, whereas a mortgage is a loan that is secured by real property. A promissory note is often referred to as a mortgage, but they are separate contracts.

Because there are secured and unsecured loans, you can have a promissory note without a mortgage ? which is considered an unsecured loan. However, you typically can't have a mortgage without a promissory note, ing to Chase Bank. The promissory note is a crucial legal document to protect the lender.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

The Deed is a recorded document memorializing the transfer of property from the Grantor to the Grantee. The Note is an unrecorded paper that binds an individual who has assumed debt through a promise-to-pay instrument.

Your lender will typically provide you with a copy of the promissory note, along with several other documents, when you close on your home purchase. The lender will keep the original promissory note until the loan is paid off.

A mortgage note is the document that you sign at the end of your home closing. It should accurately reflect all the terms of the agreement between the borrower and the lender or be corrected immediately if it doesn't.

So, as a rule of thumb, if someone is on the Deed, they must be on the Mortgage. But just because they are on the Mortgage, doesn't mean they are on the Note.

Promissory Note Vs. Mortgage. A promissory note is a document between the lender and the borrower in which the borrower promises to pay back the lender, it is a separate contract from the mortgage. The mortgage is a legal document that ties or "secures" a piece of real estate to an obligation to repay money.