Nevada Revocable Trust for Married Couple

Description

How to fill out Revocable Trust For Married Couple?

Are you in a predicament where you require documents for both professional and personal purposes nearly every day.

There are many legal document templates available on the internet, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of template forms, similar to the Nevada Revocable Trust for Married Couples, that are designed to comply with state and federal regulations.

Once you locate the appropriate form, click Download now.

Choose a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can acquire an additional copy of the Nevada Revocable Trust for Married Couples at any time, if desired. Click the needed form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can obtain the Nevada Revocable Trust for Married Couples template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for your specific city/region.

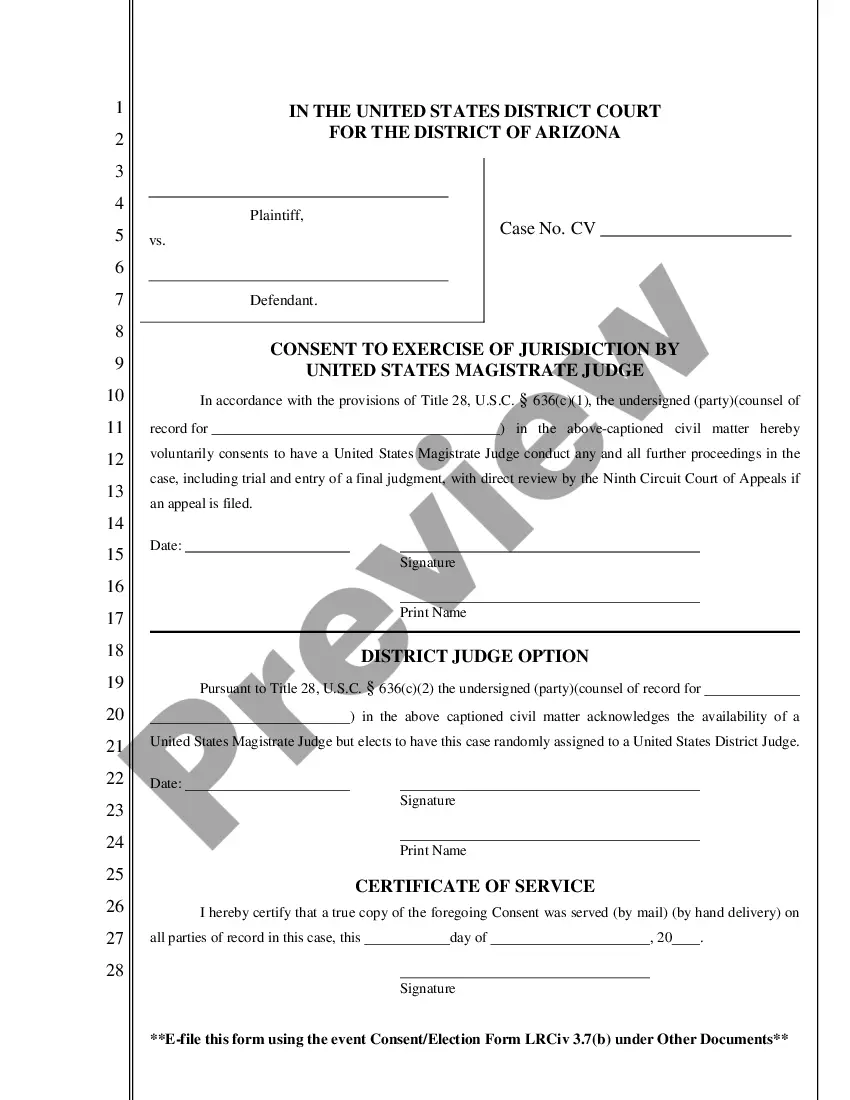

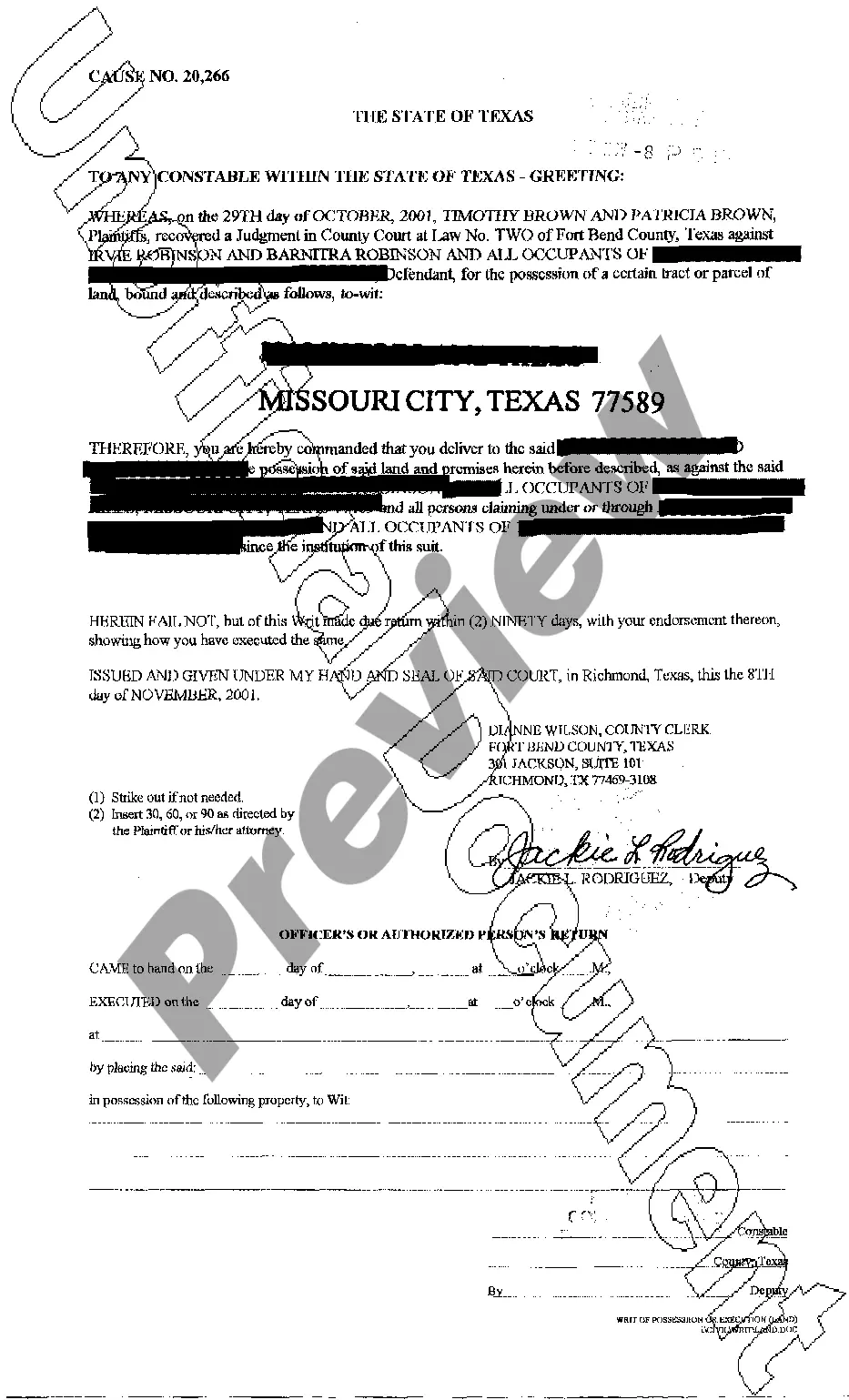

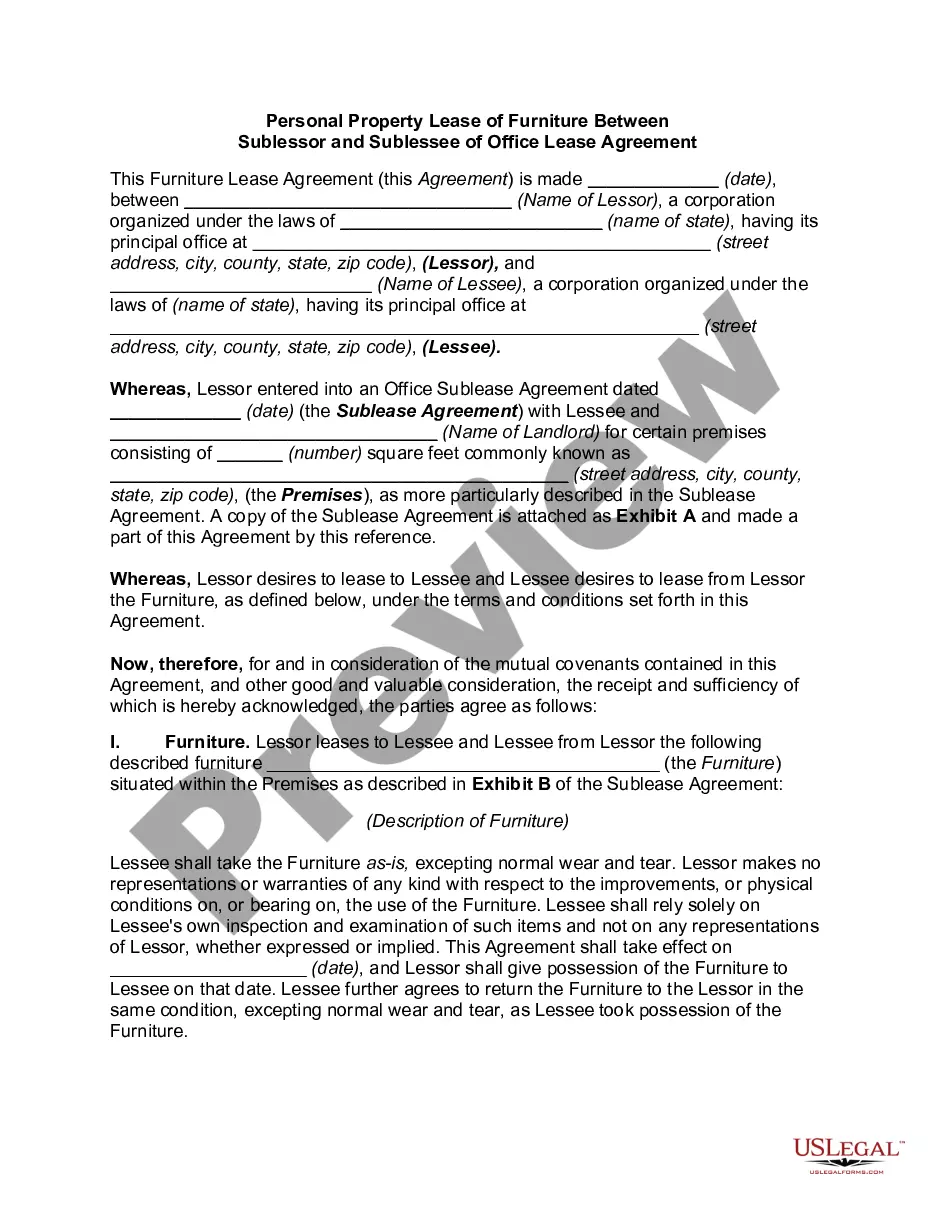

- Utilize the Preview feature to review the form.

- Examine the description to confirm that you have selected the correct form.

- If the form is not what you need, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

The best type of trust for a married couple often depends on their specific circumstances, but a Nevada Revocable Trust for Married Couple is frequently recommended. This trust allows both partners to manage and adjust their assets while alive, supporting their financial decisions together. It ensures smoother transitions and can effectively address each spouse's wishes.

Typically, a joint trust does not automatically become irrevocable upon the death of one spouse. The trust generally continues as a revocable trust, maintained by the surviving spouse, allowing for adjustments as needed. Knowing these details is crucial when establishing a Nevada Revocable Trust for Married Couple.

One disadvantage of a joint revocable trust is that both spouses must agree on changes or withdrawals, which can complicate decision-making. Additionally, a joint trust may not provide as much privacy as separate trusts, as the assets and changes apply to both parties. Understanding these factors is essential when considering a Nevada Revocable Trust for Married Couple.

The biggest mistake parents often make is failing to clearly define the terms and beneficiaries of the trust fund. Parents must ensure that their intentions are documented and understood by all parties involved. In this context, a Nevada Revocable Trust for Married Couple can provide clarity and avoid potential family disputes in the future.

When a spouse dies, the first step is to locate any estate planning documents, like a will or any trusts. Next, notify financial institutions and take steps to manage shared accounts and assets. Using a Nevada Revocable Trust for Married Couple can simplify this process and ensure that both partners’ wishes are honored.

In Nevada, marital property law attributes most assets acquired during marriage as joint property. This includes income, real estate, and investments, regardless of whose name is on the title. A Nevada Revocable Trust for Married Couple can help clarify asset distribution and ensure that both partners' interests are fully protected.

When one spouse dies, a joint revocable trust typically remains intact, but it usually becomes a single trust for the surviving spouse. The surviving spouse retains control over the assets without the need for probate, simplifying the transition. This ease of management is one of the key benefits of a Nevada Revocable Trust for Married Couple.

For remarried couples, a Nevada Revocable Trust for Married Couple often provides flexibility and security. This trust allows both partners to retain control over their assets during their lifetime. Additionally, it can help ensure that property distribution aligns with each spouse's wishes upon death.

To file a trust in Nevada, you first need to create a trust document, such as a Nevada Revocable Trust for Married Couple. This document outlines how you want your assets managed and distributed. After drafting the document, you will need to fund the trust by transferring ownership of your assets. Utilizing services like USLegalForms can simplify the process and ensure your trust complies with state laws.

Nevada has specific laws governing trusts, including the Nevada Revocable Trust for Married Couple. This type of trust allows couples to maintain control over their assets during their lifetime while streamlining the transfer process after death. Nevada's laws are favorable, offering privacy and minimal taxes. To stay compliant, it's wise to consult legal resources or platforms like USLegalForms.