This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Have you ever been in a situation where you require documents for both business or personal purposes nearly every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers a vast array of form templates, including the Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, designed to meet state and federal regulations.

Select a convenient file format and download your copy.

Find all of the document templates you have purchased in the My documents section. You can obtain an additional copy of the Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually at any time, if needed. Click on the specific form to download or print the document template.

- If you're already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/state.

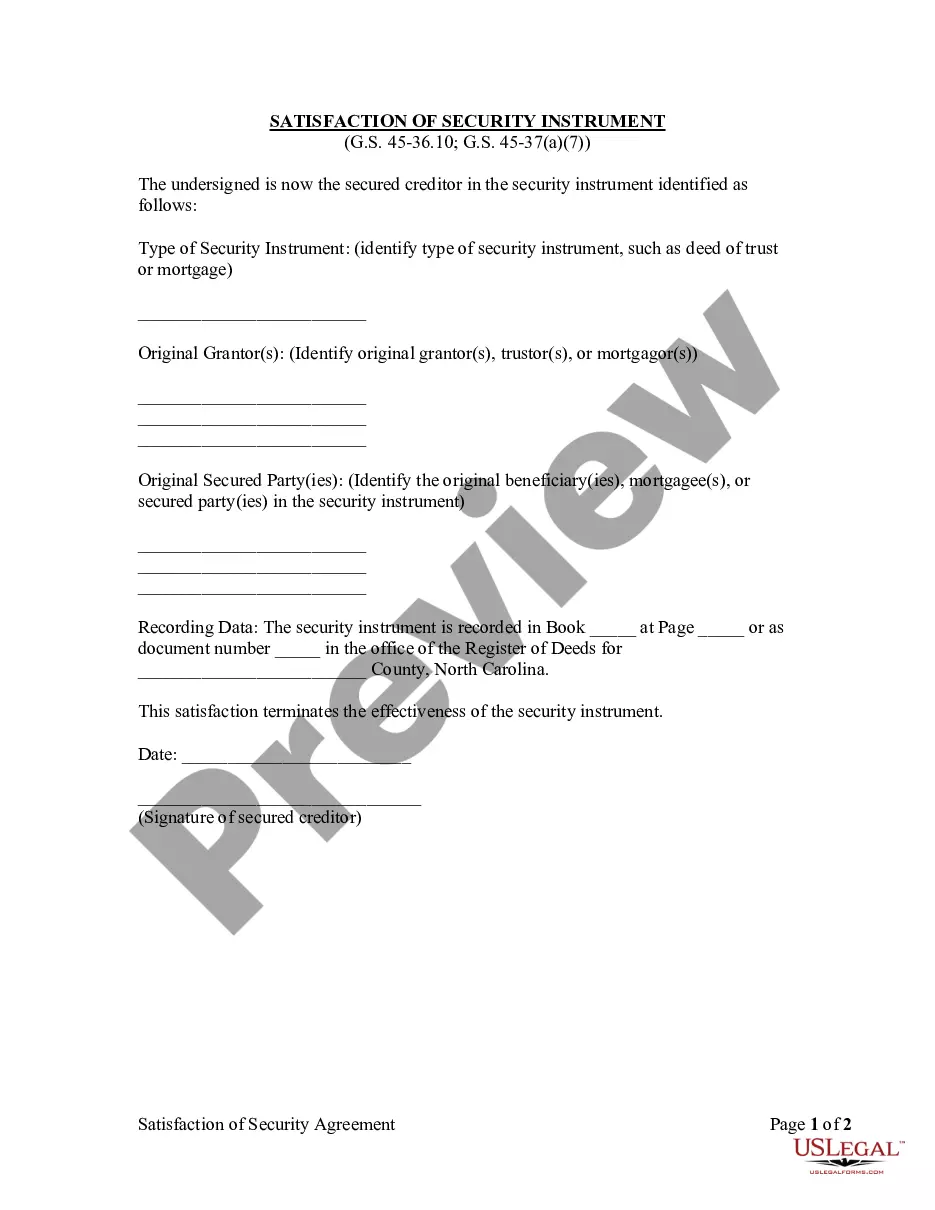

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the correct document.

- If the form isn't what you're looking for, use the Search field to locate the form that meets your needs and criteria.

- Once you have acquired the correct form, click Get now.

- Choose the pricing plan you want, fill in the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Form popularity

FAQ

The maturity value of a promissory note is the total amount payable to the lender when the note reaches its maturity date. In the case of a Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, this value includes the original principal plus all accrued interest. Knowing the maturity value can aid you in planning your finances effectively. You don’t want any surprises when it’s time to settle the note.

Interest on a promissory note, such as a Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, accumulates over time based on the principal amount and the agreed rate. This means the borrower does not make any payments until maturity, and interest compounds annually. This structure can effectively increase the total amount owed by the time the note matures. Understanding this aspect helps you make informed decisions when entering into a promissory note agreement.

While a note does not have to have a maturity date, including one is beneficial for all parties involved. A maturity date clarifies when payment is due, thus reducing potential conflicts. When creating a Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, consider adding terms or conditions that define the timeline for repayment to promote understanding.

The statute of limitations for enforcing a promissory note in Nevada is generally six years. This timeframe begins from the moment a payment is missed. It’s important to act within this period, especially when the note is structured as a Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually; delayed action could jeopardize your rights.

For a promissory note to be valid in Nevada, it generally must include essential elements like the principal amount, interest rate, and terms of repayment. Additionally, it requires signatures from both parties involved. When crafting a Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, ensure these key components are present to avoid disputes down the line.

In Nevada, a promissory note does not strictly need a maturity date, but having one is usually advisable. A maturity date provides a clear understanding of when repayment is expected. For a Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, a lack of a defined maturity date could introduce confusion. It’s best to consult legal resources or professionals to navigate this aspect.

Yes, a promissory note can technically lack a maturity date. However, if a note does not specify when the payment is due, it could lead to complications. In the case of a Nevada Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, clarity is key. Without a maturity date, both parties might face uncertainties regarding when repayment should occur.

Yes, promissory notes do accrue interest as specified in their terms. In the case of a Nevada promissory note with no payment due until maturity and interest to compound annually, the interest accumulates over the life of the note. This arrangement benefits lenders, as the total amount due grows over time, reflecting both the principal and all accrued interest.

Interest on a promissory note is calculated based on the agreed-upon interest rate and the time period specified within the note. For a Nevada promissory note with no payment due until maturity and interest to compound annually, you will multiply the principal balance by the interest rate, and then apply compounding based on the time the note is outstanding. Utilizing reliable resources like US Legal Forms can help you draft or understand these calculations.

Yes, interest can compound on a promissory note. For example, a Nevada promissory note with no payment due until maturity and interest to compound annually will accumulate interest on the original principal, as well as on the previously earned interest. This feature enhances the overall return over time, making it a beneficial choice for lenders.