The Fair Credit Reporting Act also provides that a consumer reporting agency that furnishes a consumer report for employment purposes and which, for that purpose, compiles and reports items of information on consumers that are matters of public record and are likely to have an adverse effect on a consumer's ability to obtain employment must: (1) at the time the public record information is reported to the user of the consumer report, notify the consumer of the fact that public record information is being reported by the consumer reporting agency, together with the name and address of the person to whom the information is being reported; or (2) maintain strict procedures designed to insure that whenever public record information likely to have an adverse effect on a consumer's ability to obtain employment is reported, it is complete and up to date.

Nevada Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect

Description

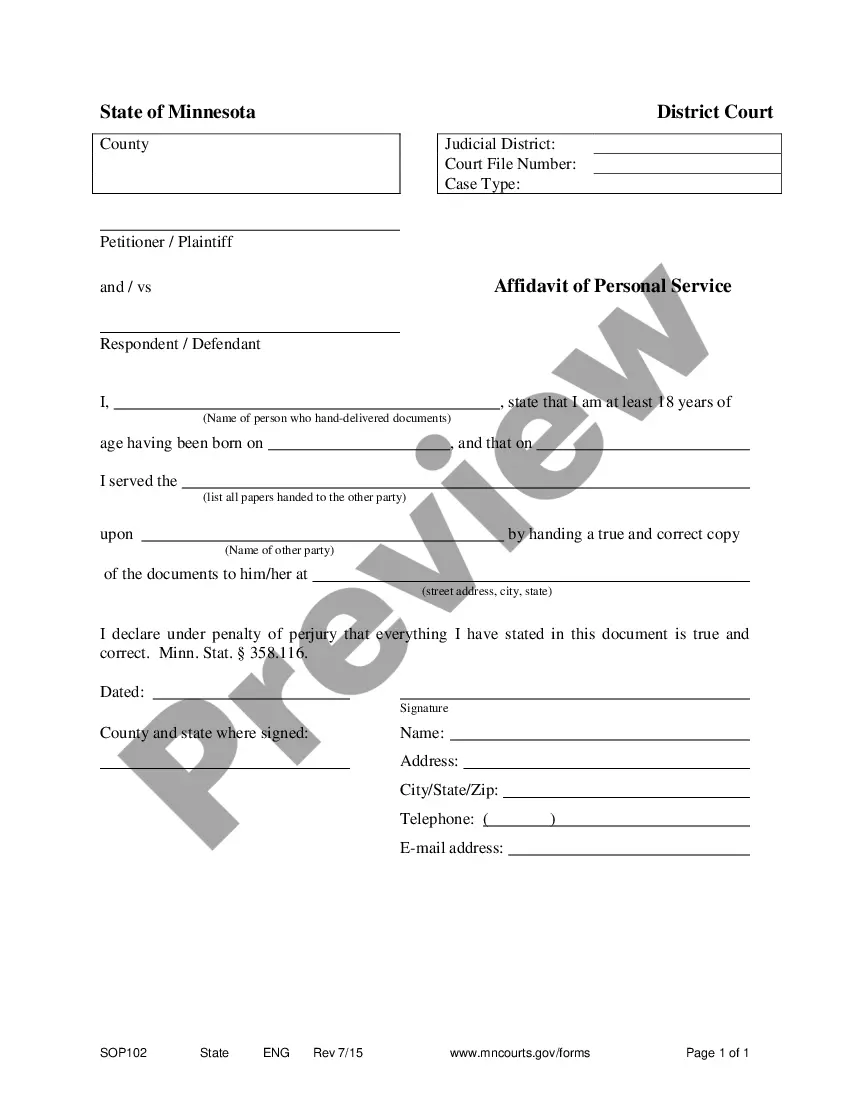

How to fill out Notice To Consumer Of Report Of Public Record Information Likely To Have Adverse Effect?

If you need to complete, obtain, or produce authorized document layouts, use US Legal Forms, the most important assortment of authorized kinds, which can be found on the Internet. Take advantage of the site`s easy and handy search to discover the documents you need. Various layouts for business and personal uses are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to discover the Nevada Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect in just a few click throughs.

In case you are previously a US Legal Forms consumer, log in for your bank account and then click the Down load option to obtain the Nevada Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect. You can even entry kinds you in the past saved within the My Forms tab of your respective bank account.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for your appropriate area/region.

- Step 2. Make use of the Review choice to examine the form`s information. Don`t forget about to learn the information.

- Step 3. In case you are not happy using the kind, use the Lookup industry at the top of the monitor to discover other types of your authorized kind format.

- Step 4. Once you have identified the shape you need, select the Buy now option. Select the pricing program you prefer and add your accreditations to sign up on an bank account.

- Step 5. Approach the deal. You may use your bank card or PayPal bank account to finish the deal.

- Step 6. Select the format of your authorized kind and obtain it on your own system.

- Step 7. Comprehensive, change and produce or signal the Nevada Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect.

Each authorized document format you buy is your own permanently. You have acces to each kind you saved in your acccount. Click on the My Forms segment and pick a kind to produce or obtain once again.

Compete and obtain, and produce the Nevada Notice to Consumer of Report of Public Record Information Likely to Have Adverse Effect with US Legal Forms. There are thousands of skilled and state-distinct kinds you may use for the business or personal needs.

Form popularity

FAQ

How long can Consumer Reporting Agencies report unfavorable information on my credit report? Generally, seven years. Adverse information cannot be reported after that, with certain exceptions: Bankruptcy information can be reported for ten years.

If you deny a consumer credit based on information in a consumer report, you must provide an ?adverse action? notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a ?risk-based pricing? notice.

Under the provisions of the Fair Credit Reporting Act, adverse information?for example, collection actions, charge-offs, suits, and judgments?may remain on your credit report for seven years.

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can stay on your report for up to ten years.

Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies more than 10 years old.