Nevada Promissory Note - Satisfaction and Release

Description

How to fill out Promissory Note - Satisfaction And Release?

Are you in a position where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of template documents, such as the Nevada Promissory Note - Satisfaction and Release, which can be tailored to meet state and federal regulations.

Select a convenient document format and download your copy.

Find all the document templates you have purchased in the My documents section. You can obtain an extra copy of the Nevada Promissory Note - Satisfaction and Release at any time if needed. Just click on the required template to download or print the document format.

- If you are already aware of the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Nevada Promissory Note - Satisfaction and Release template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

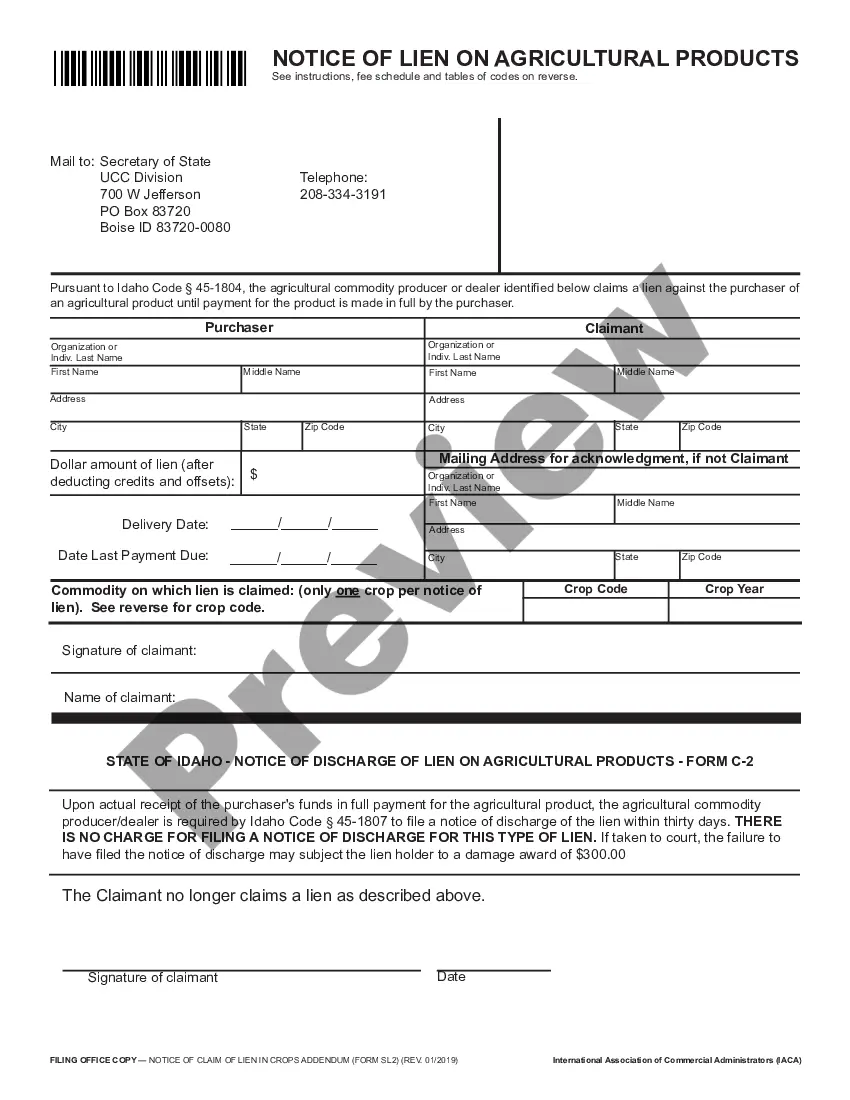

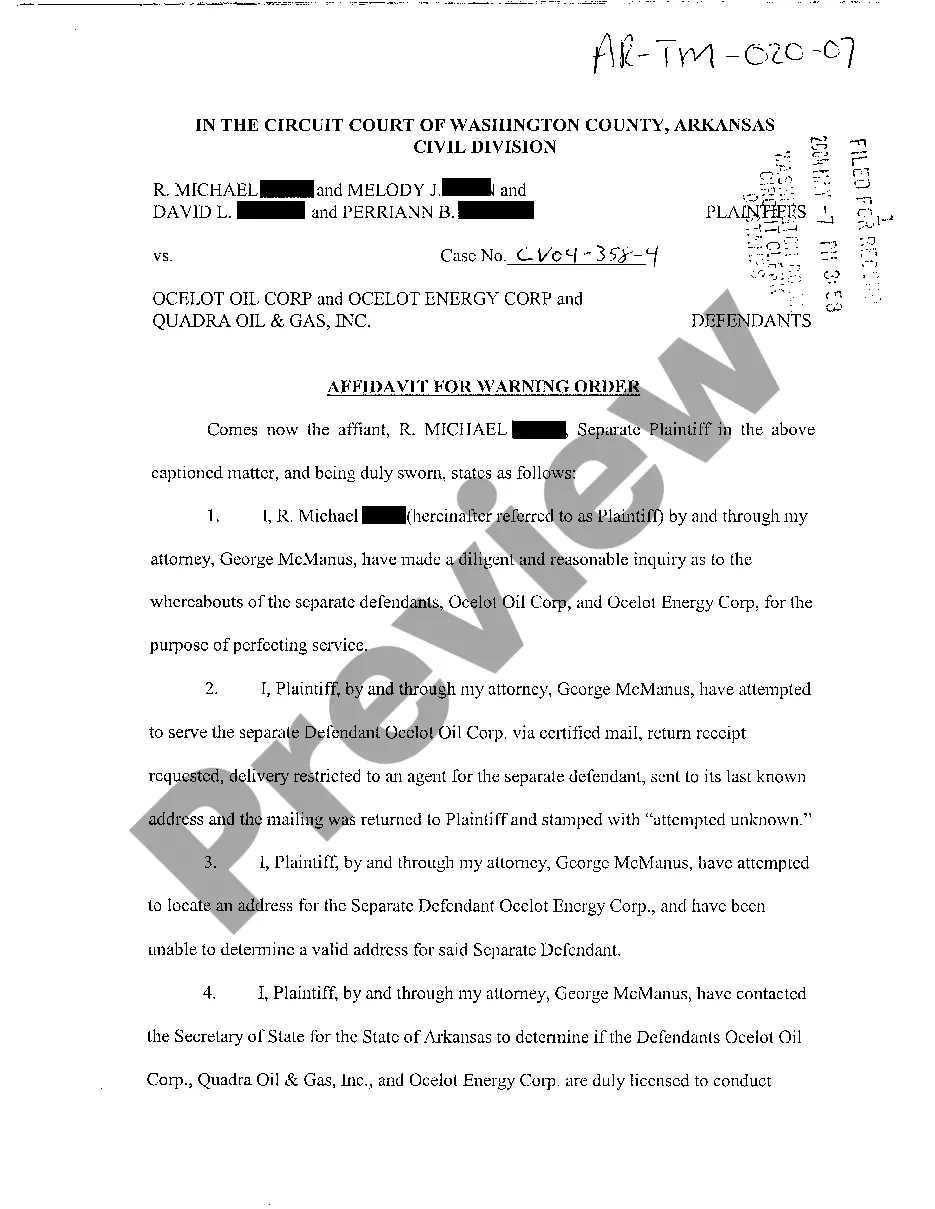

- Find the document you need and confirm it is for the correct city/state.

- Use the Preview feature to review the document.

- Read the description to ensure you have selected the correct form.

- If the document is not what you are looking for, use the Search box to find the form that suits your needs and requirements.

- Once you obtain the right document, click Get now.

- Choose the pricing plan you desire, fill in the necessary details to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

If your promissory note is lost, it is crucial to act quickly. You can request a replacement from the lender or financial institution that issued it. They may require you to provide certain details to facilitate the issuance of a new note. For a Nevada Promissory Note - Satisfaction and Release, replacement processes can vary, making it important to consult your lender for guidance.

In Nevada, a release of a promissory note generally does not require notarization to be valid. However, having a notary public sign the document can add an extra layer of security and authenticity. This ensures all parties involved are in agreement, particularly for a Nevada Promissory Note - Satisfaction and Release. It's always wise to check local regulations or consult a legal expert for specific requirements.

Cancellation and release of a Nevada Promissory Note involve formally ending the obligations outlined in the note. This process typically requires a written document stating that the note is canceled and the debt is satisfied. By completing this, all parties can feel secure that the financial responsibility has been resolved. Utilizing services like USLegalForms can streamline this process.

When a person who issued a Nevada Promissory Note passes away, the note does not automatically vanish. Instead, it becomes part of their estate. The executor of the estate must address the note and determine whether it should be collected or settled. Understanding the implications of a promissory note after death can help ensure proper management of the estate.

To fill out a promissory demand note, start with the names of the parties involved, the principal amount, and indicate that repayment can be requested at any time. You should also detail the terms surrounding interest and repayment methods. Utilizing US Legal Forms can make this task easier, providing you with a standardized framework for your Nevada Promissory Note.

Rules for a promissory note include clarity in the terms, proper signatures, and compliance with applicable state laws. The note should clearly outline payment terms, consequences for late payments, and any interest rates involved. By following these rules, individuals can create a strong Nevada promissory note that is legally enforceable and protects the interests of both the borrower and lender.

Releasing a promissory note involves the lender formally acknowledging that the obligation to repay has been fulfilled. This often requires a written document, stating that the borrower has satisfied their debt. With the Nevada promissory note - satisfaction and release in mind, having a clear release can help prevent future misunderstandings.

Yes, a promissory note is a legally binding document. Once it is signed by the borrower, it creates an obligation to repay the specified amount under the outlined conditions. Thus, a Nevada promissory note - satisfaction and release serves as solid evidence in legal situations if disputes arise regarding repayment.

The borrower is primarily liable on a promissory note. This means that if the borrower fails to meet the payment obligations set forth in the note, the lender can seek repayment directly from them. In the context of a Nevada promissory note, understanding this liability is essential for both parties to manage their financial responsibilities effectively.