Nevada Unrestricted Charitable Contribution of Cash

Description

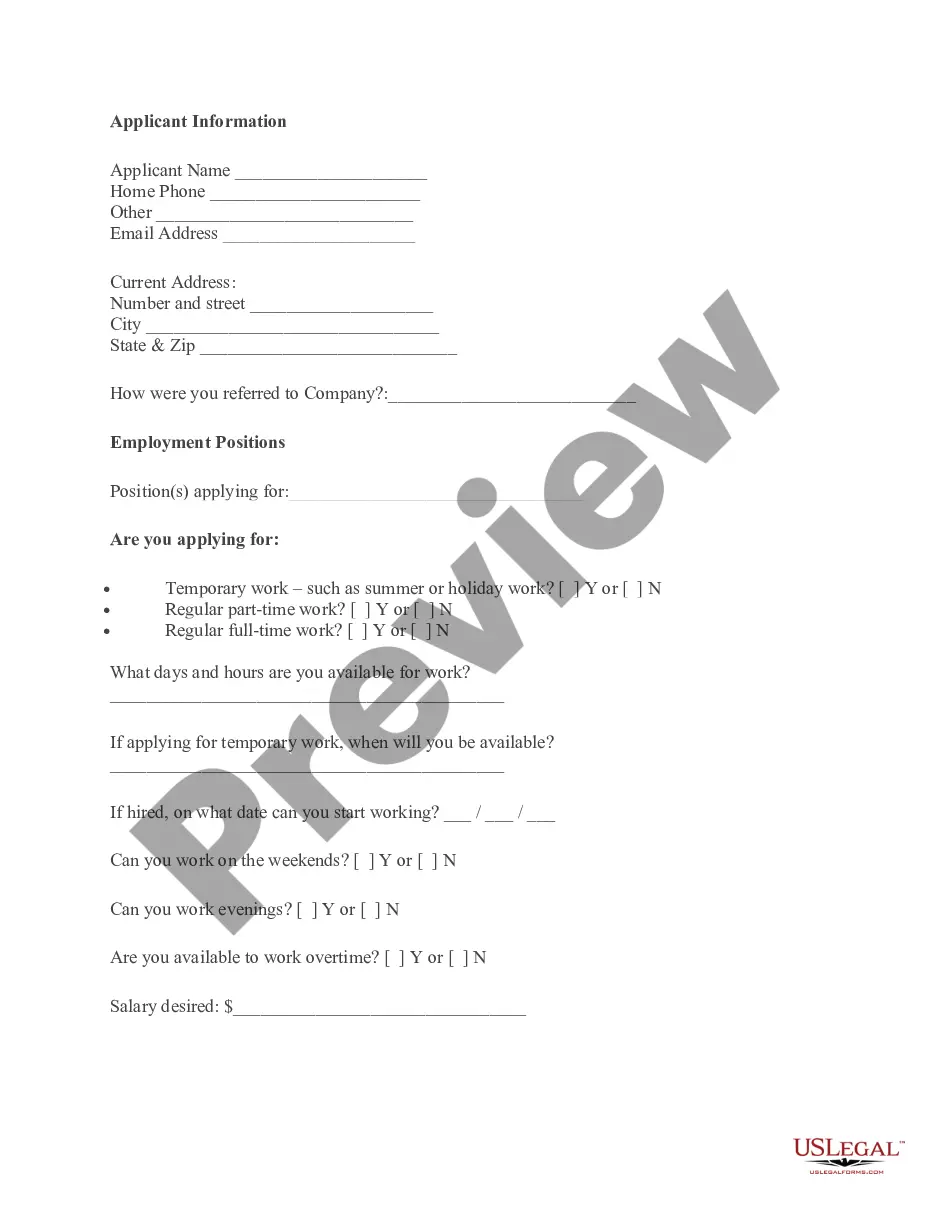

How to fill out Unrestricted Charitable Contribution Of Cash?

Choosing the right legitimate document web template could be a struggle. Obviously, there are a variety of layouts available online, but how can you find the legitimate type you want? Take advantage of the US Legal Forms site. The support provides thousands of layouts, including the Nevada Unrestricted Charitable Contribution of Cash, that can be used for enterprise and private demands. Each of the types are checked out by specialists and meet up with state and federal needs.

When you are already listed, log in to the bank account and click on the Download option to find the Nevada Unrestricted Charitable Contribution of Cash. Make use of your bank account to search throughout the legitimate types you may have ordered earlier. Proceed to the My Forms tab of your bank account and have one more backup of the document you want.

When you are a whole new user of US Legal Forms, here are simple guidelines for you to stick to:

- Initial, make sure you have chosen the appropriate type for the town/region. You may look over the form while using Review option and look at the form information to make certain it will be the right one for you.

- In case the type will not meet up with your expectations, utilize the Seach industry to obtain the appropriate type.

- Once you are certain the form is suitable, select the Purchase now option to find the type.

- Pick the pricing program you want and enter in the needed information. Build your bank account and pay for your order utilizing your PayPal bank account or credit card.

- Opt for the file structure and acquire the legitimate document web template to the product.

- Complete, modify and print out and sign the attained Nevada Unrestricted Charitable Contribution of Cash.

US Legal Forms may be the largest catalogue of legitimate types for which you can discover different document layouts. Take advantage of the service to acquire appropriately-made papers that stick to condition needs.

Form popularity

FAQ

Your deduction for charitable contributions is generally limited to 60% of your AGI. For tax years 2020 and 2021, you can deduct cash contributions in full up to 100% of your AGI to qualified charities. There are limits for non-cash contributions.

See Contributions of Property, later. Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply. Table 1 gives examples of contributions you can and can't deduct.

You can carryover your contributions that you are not able to deduct in the current tax year because they exceed your adjusted-gross-income limits. You can deduct the excess in each of the next 5 years until it is all used but not beyond that time.

Overall deductions for donations to public charities, including donor-advised funds, are generally limited to 50% of adjusted gross income (AGI). The limit increases to 60% of AGI for cash gifts, while the limit on donating appreciated non-cash assets held more than one year is 30% of AGI.

Charitable Organizations must register with the Nevada Secretary of State's office before soliciting charitable contributions in Nevada.

You may refer to the CRA's List of Charities to verify whether the organization you wish to donate to is a ?qualified donee?. Gifts made to U.S. charities outside of the above categories can be claimed on a Canadian tax return but the tax benefits are limited.

For contributions of non-cash assets held more than one year, the limit is 30% of your adjusted gross income (AGI). Your deduction limit will be 60% of your AGI for cash gifts.

When you make donations to public organizations such as churches, educational institutions and hospitals, your total charitable deduction (including both cash and noncash donations) cannot exceed 50% of your adjusted gross income (AGI).