Nevada Employment Application for Soldier

Description

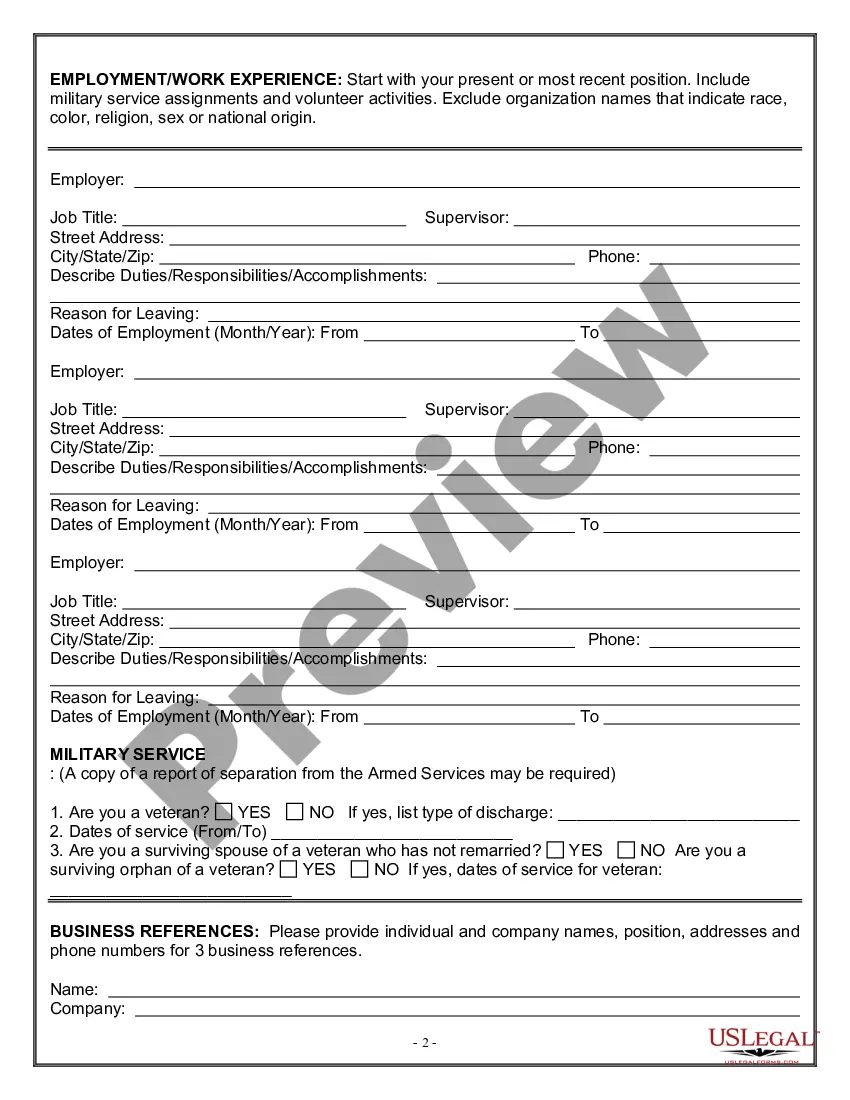

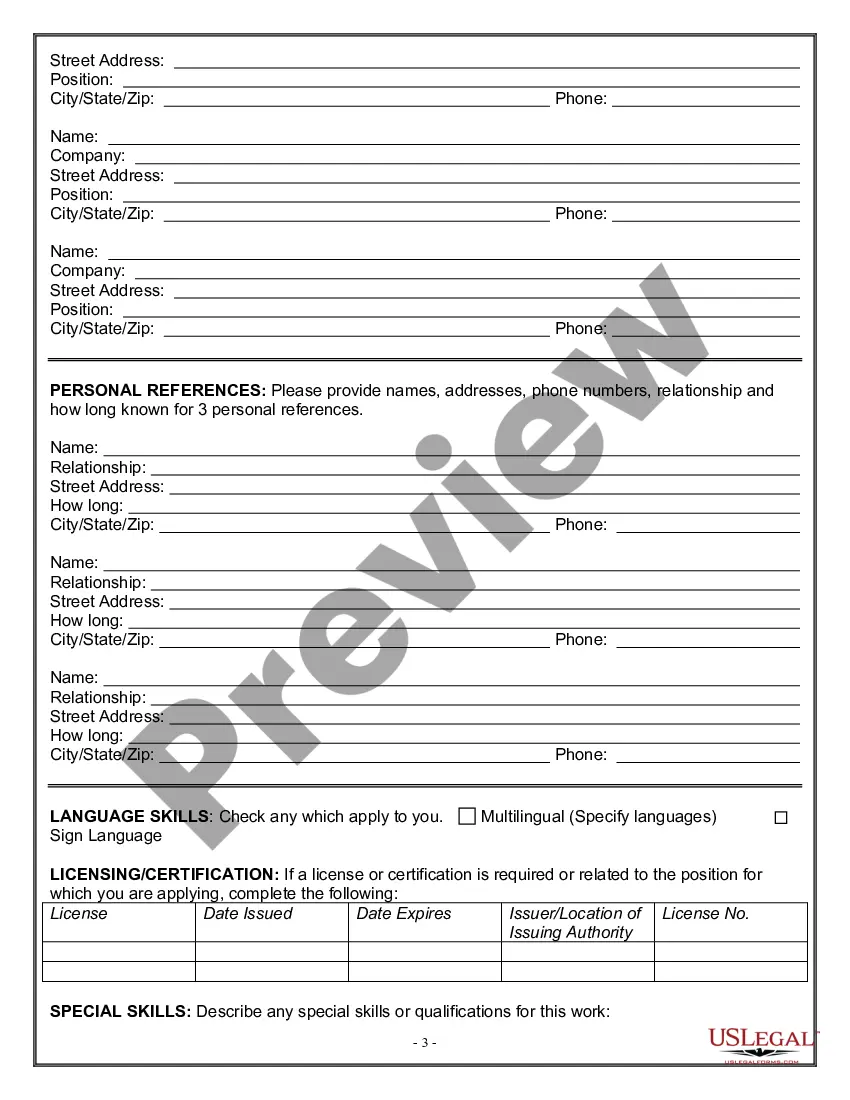

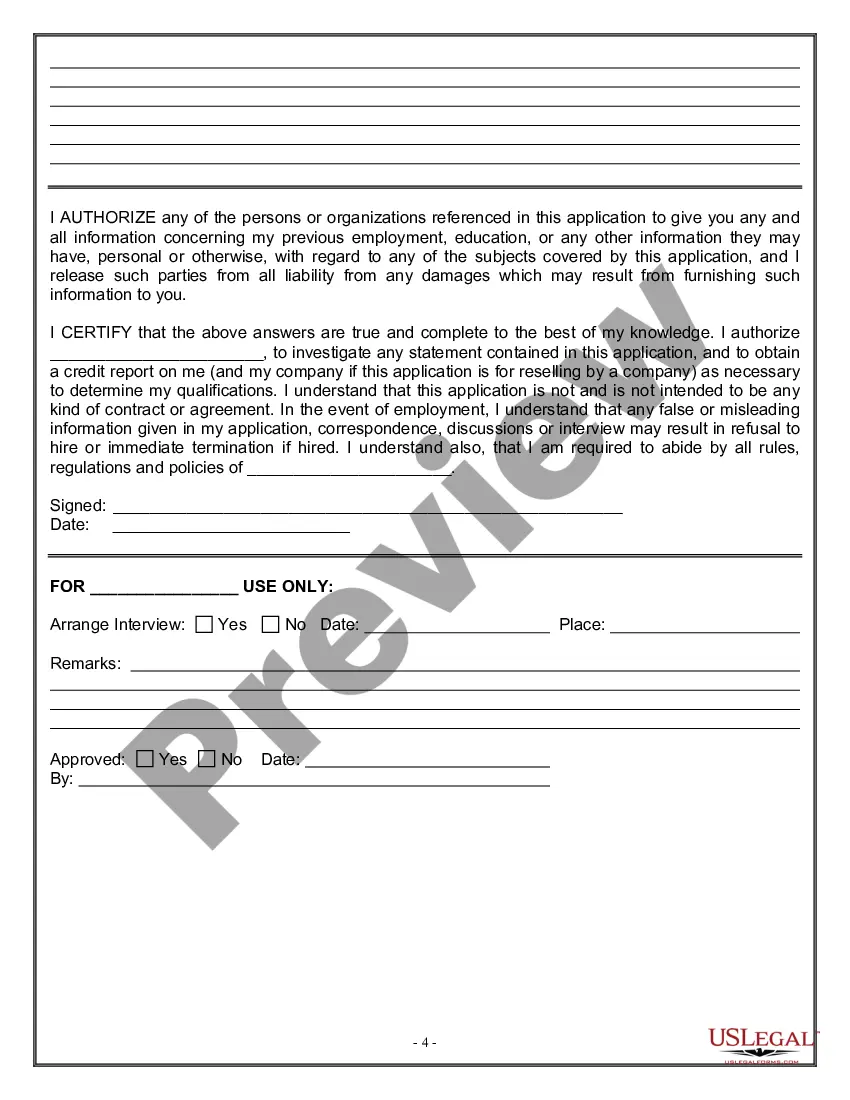

How to fill out Employment Application For Soldier?

You can spend numerous hours online seeking the legal document format that meets both state and federal requirements you have in mind.

US Legal Forms offers thousands of legal templates that have been assessed by experts.

You are able to download or print the Nevada Employment Application for Soldier from my services.

If available, utilize the Preview button to review the format as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- After that, you can complete, modify, print, or sign the Nevada Employment Application for Soldier.

- Every legal document format you acquire is yours to keep indefinitely.

- To retrieve another copy of a purchased form, navigate to the My documents section and click the related button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

- Firstly, make sure you have selected the correct format for your state/city of choice.

- Check the form description to ensure you have chosen the correct form.

Form popularity

FAQ

4 Ways to Create a Targeted Veteran Recruiting ProgramA few statistics to set the stage:1) Tap into TAP (Transition Assistance Program)2) Participate in veteran career fairs.3) Position your staffing firm as military-friendly.4) Learn the language.

In fact, many U.S. employers have recruiters who look specifically for candidates with military backgrounds. These companies understand that service members are prepared with the best possible training and work ethic and make an effort to employ those who have served.

The state's lack of income tax as well as the property tax exemptions make Nevada an increasingly veteran-friendly state. Other benefits include state employment preferences, tuition assistance, vehicle tax exemptions and recreational privileges.

By Bryan Wolfe Finding a job after leaving the military is almost never an easy task. Unless you're transferring into a civilian field that directly relates to your military experience, you will need to change fields in order to enter the civilian workforce.

South Dakota is the best state for veterans. The state also has the second-lowest veterans unemployment rate.

Each of the following positions values the skills and experience that former servicemembers can bring to the civilian workforce from their time in the military.1) Financial Advisor.2) Information Security Analyst.3) Management Consultant.4) Nurse Practitioner.5) Operations Research Analyst.6) Sales Manager.More items...?

Nevada Wartime Veteran's Tax Exemption applies to residents who have served in the Armed Forces of the United States in any of the following branches: Army, Navy, Marines, Air Force, Coast Guard, the National Guard, or Reserves, while on active duty and the Merchant Marine during time of war or national emergency.

Nevada. No state income tax. No taxes on military retirement pay.

Las Vegas is home to many active military members and veterans but one study found that Nevada isn't the best place for military retirees. According to WalletHub, Nevada ranked No. 48 overall.

Summary of Nevada Military and Veterans Benefits: Nevada offers special benefits for its Service members, Beterans and their Famiies including state employment preferences, education and tuition assistance, vehicle tags, disabled Veteran tax exemption, State Veterans cemeteries, as well as hunting and fishing license