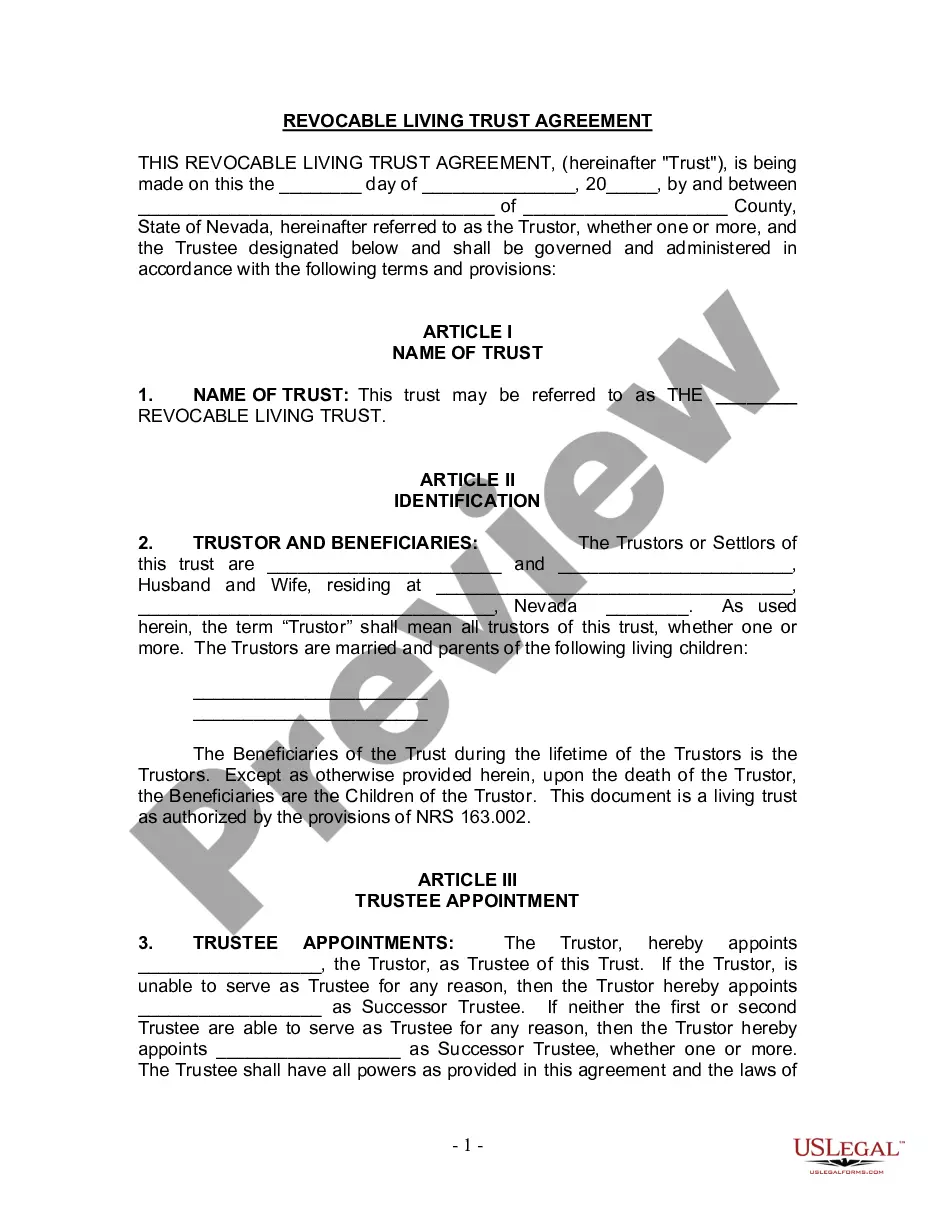

Nevada Living Trust for Husband and Wife with Minor and or Adult Children

Description

How to fill out Nevada Living Trust For Husband And Wife With Minor And Or Adult Children?

US Legal Forms is really a unique platform where you can find any legal or tax template for completing, including Nevada Living Trust for Husband and Wife with Minor and or Adult Children. If you’re tired with wasting time looking for perfect samples and spending money on document preparation/legal professional fees, then US Legal Forms is precisely what you’re seeking.

To reap all the service’s benefits, you don't need to download any application but simply select a subscription plan and sign up your account. If you already have one, just log in and look for an appropriate template, save it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need to have Nevada Living Trust for Husband and Wife with Minor and or Adult Children, take a look at the guidelines below:

- Double-check that the form you’re checking out applies in the state you need it in.

- Preview the form and look at its description.

- Click on Buy Now button to reach the sign up webpage.

- Select a pricing plan and proceed registering by entering some information.

- Select a payment method to complete the sign up.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain concerning your Nevada Living Trust for Husband and Wife with Minor and or Adult Children form, contact a lawyer to examine it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

The process of funding your living trust by transferring your assets to the trustee is an important part of what helps your loved ones avoid probate court in the event of your death or incapacity. Qualified retirement accounts such as 401(k)s, 403(b)s, IRAs, and annuities, should not be put in a living trust.

The cost will vary. There will be two types of fees that you will encounter legal fees and filing fees. For lawyer fees, many offer living will trust packages that range from $1,000 $5,000. The cost is dependent on how complex your case is and what you need included.

How Much Does a Living Trust Cost in California? A common question that people ask when they're considering if a living trust is right for their family is how much it costs. On average, a living trust costs between $1000 and $5000 to put together.

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse's ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse's trust cannot be amended after death.

When it comes to cost, a basic trust plan may run anywhere from $1,600 to $3,000, possibly more depending on the complexity of the trust, states the editors of Money magazine. At Cassady Law Offices, we offer our clients a basic revocable living trust plan for only $995.

Normally a Nevada trust only requires a notary public affirmation; that is, witnesses are not required. If however the trust is likely to be administered in a state that requires witnesses, sound discretion would mandate that witnesses and a notary public be used in executing the trust.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document. Sign the document in front of a notary public.