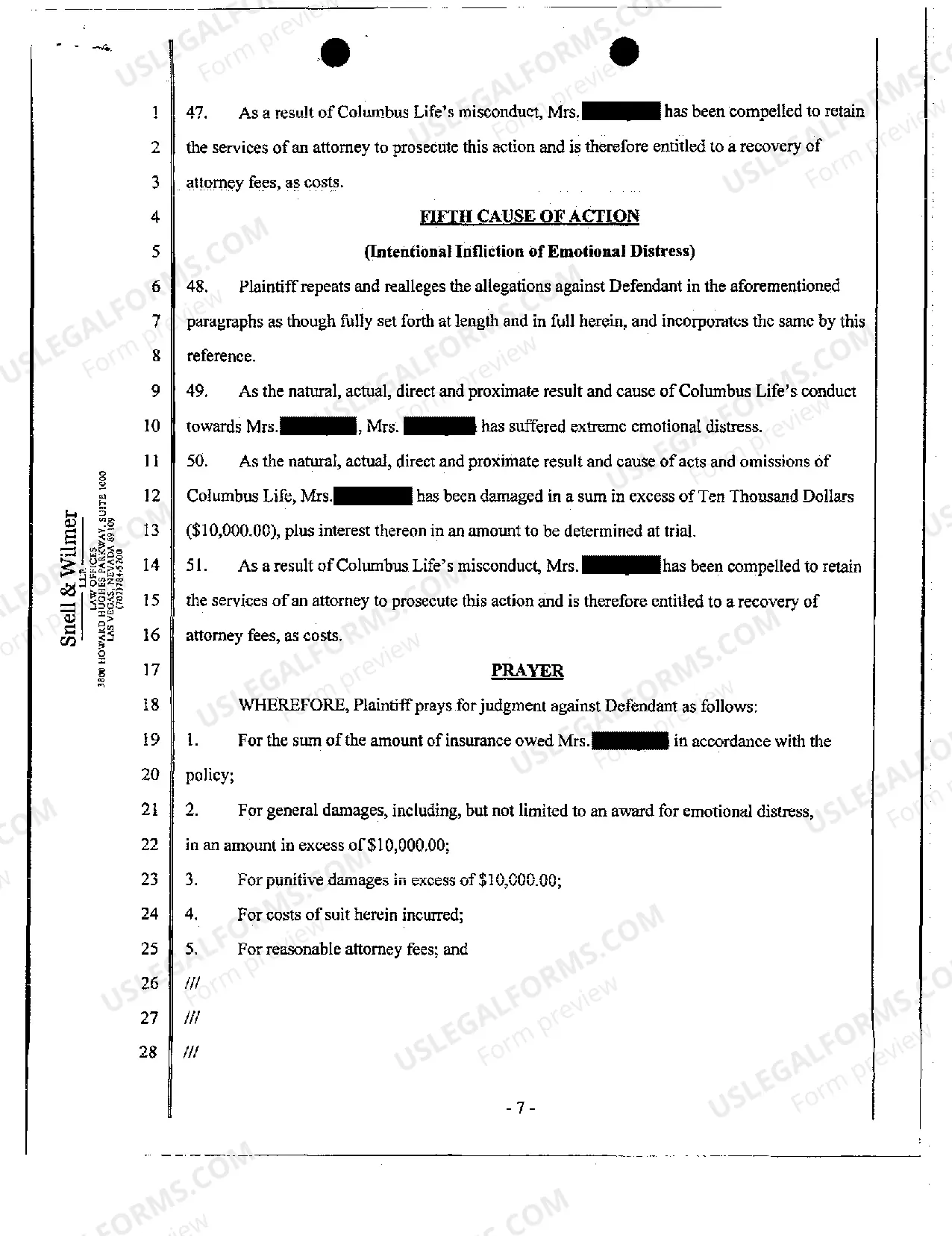

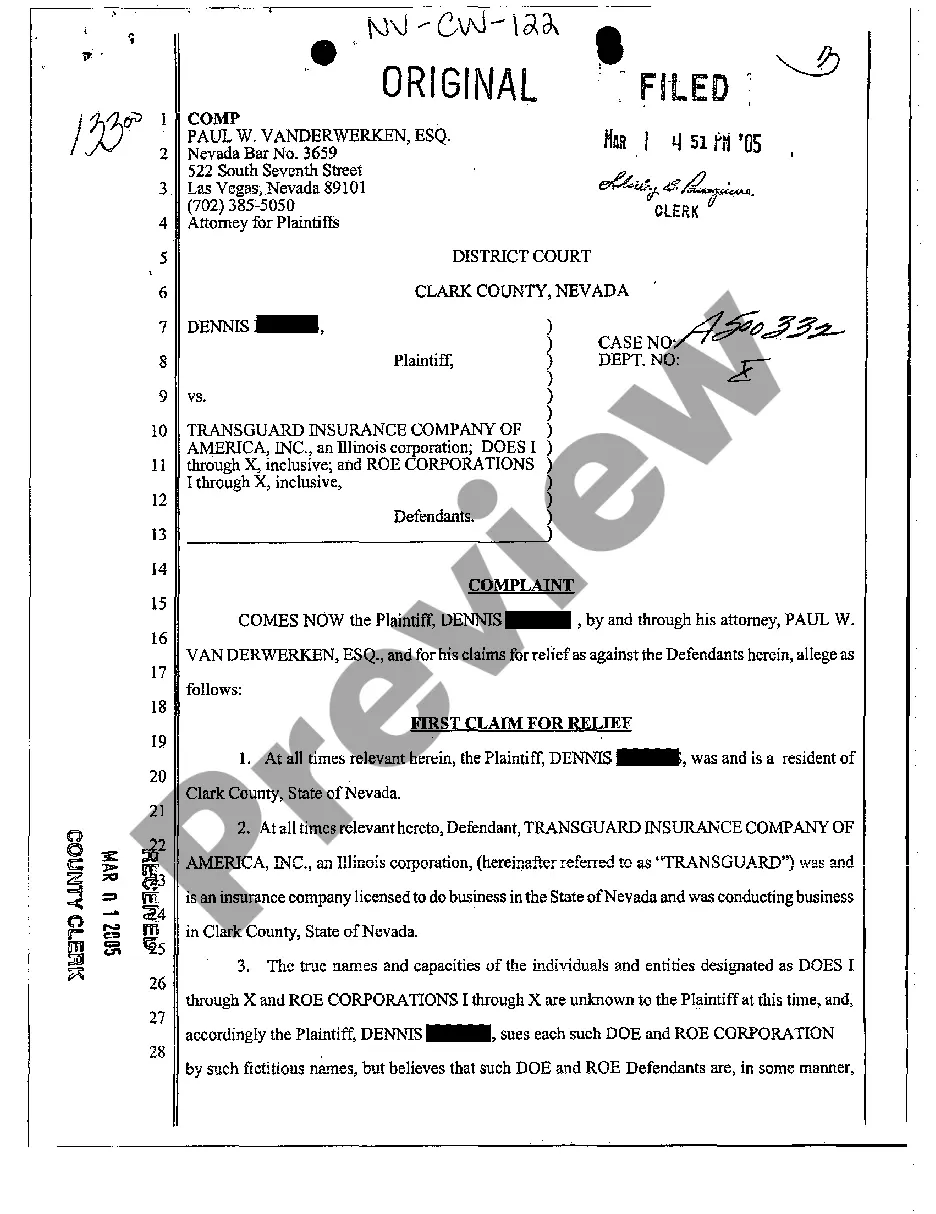

Nevada Complaint - Breach of Life Insurance Coverage Policy

Description

How to fill out Nevada Complaint - Breach Of Life Insurance Coverage Policy?

Among lots of paid and free templates that you get on the net, you can't be sure about their accuracy. For example, who created them or if they’re skilled enough to deal with what you require them to. Always keep relaxed and make use of US Legal Forms! Discover Nevada Complaint - Breach of Life Insurance Coverage Policy templates made by skilled legal representatives and avoid the high-priced and time-consuming process of looking for an lawyer or attorney and then having to pay them to draft a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the form you are searching for. You'll also be able to access all of your earlier acquired examples in the My Forms menu.

If you’re utilizing our website for the first time, follow the tips below to get your Nevada Complaint - Breach of Life Insurance Coverage Policy easily:

- Make certain that the file you find applies in the state where you live.

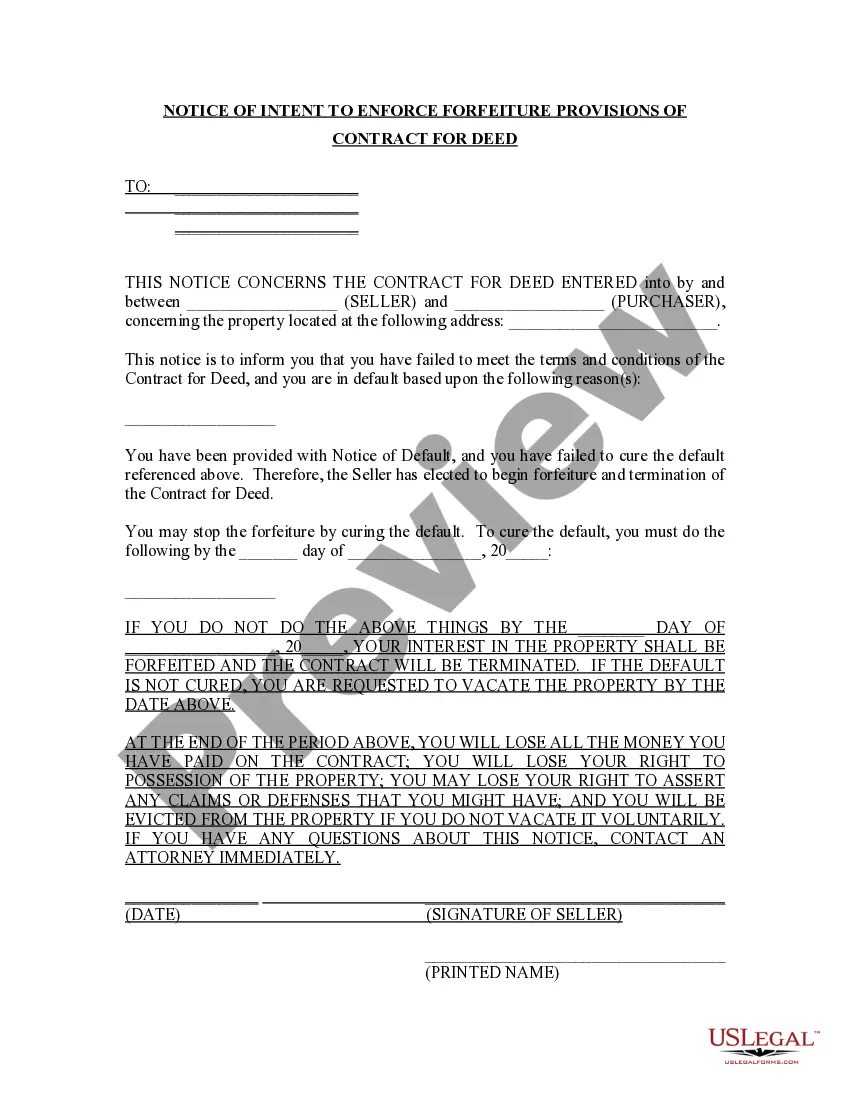

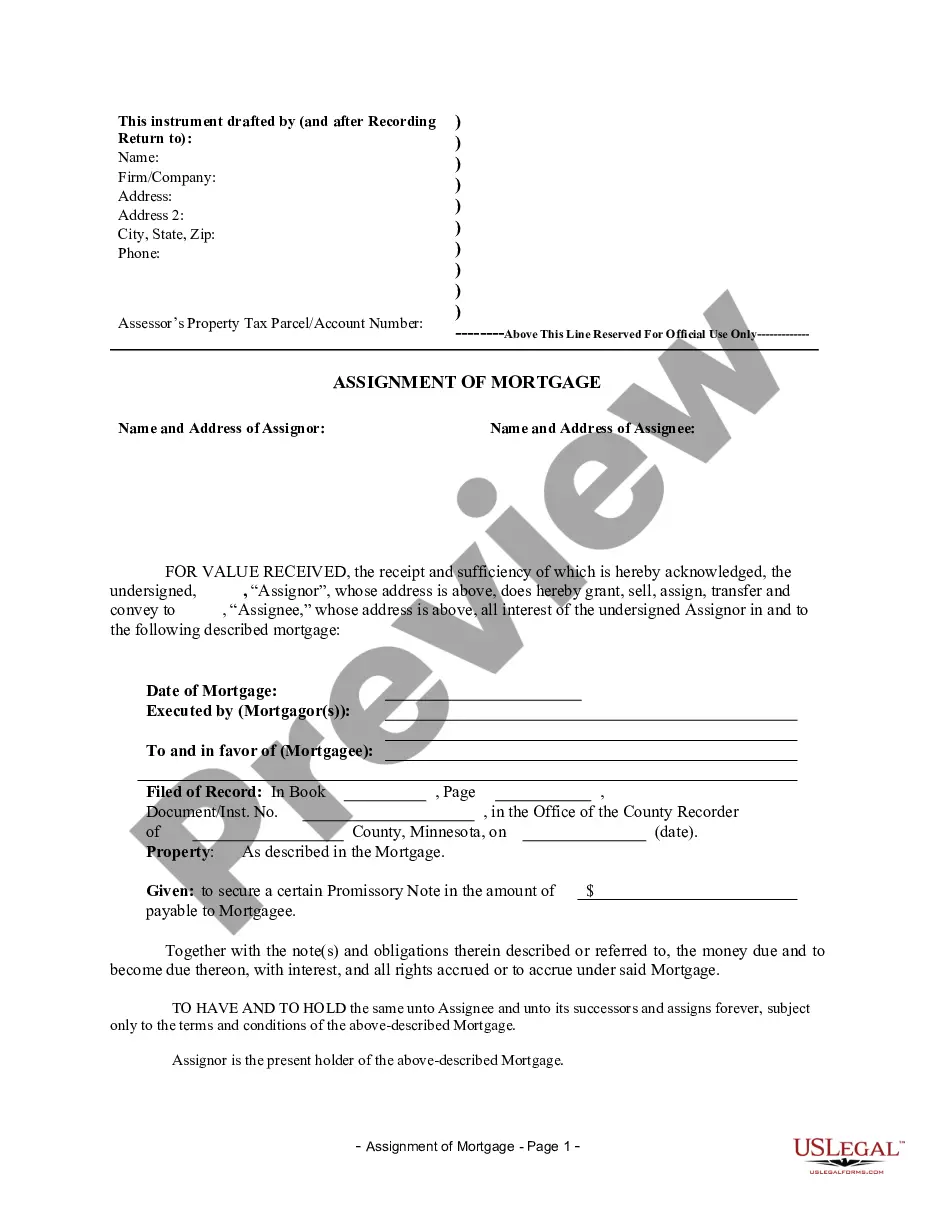

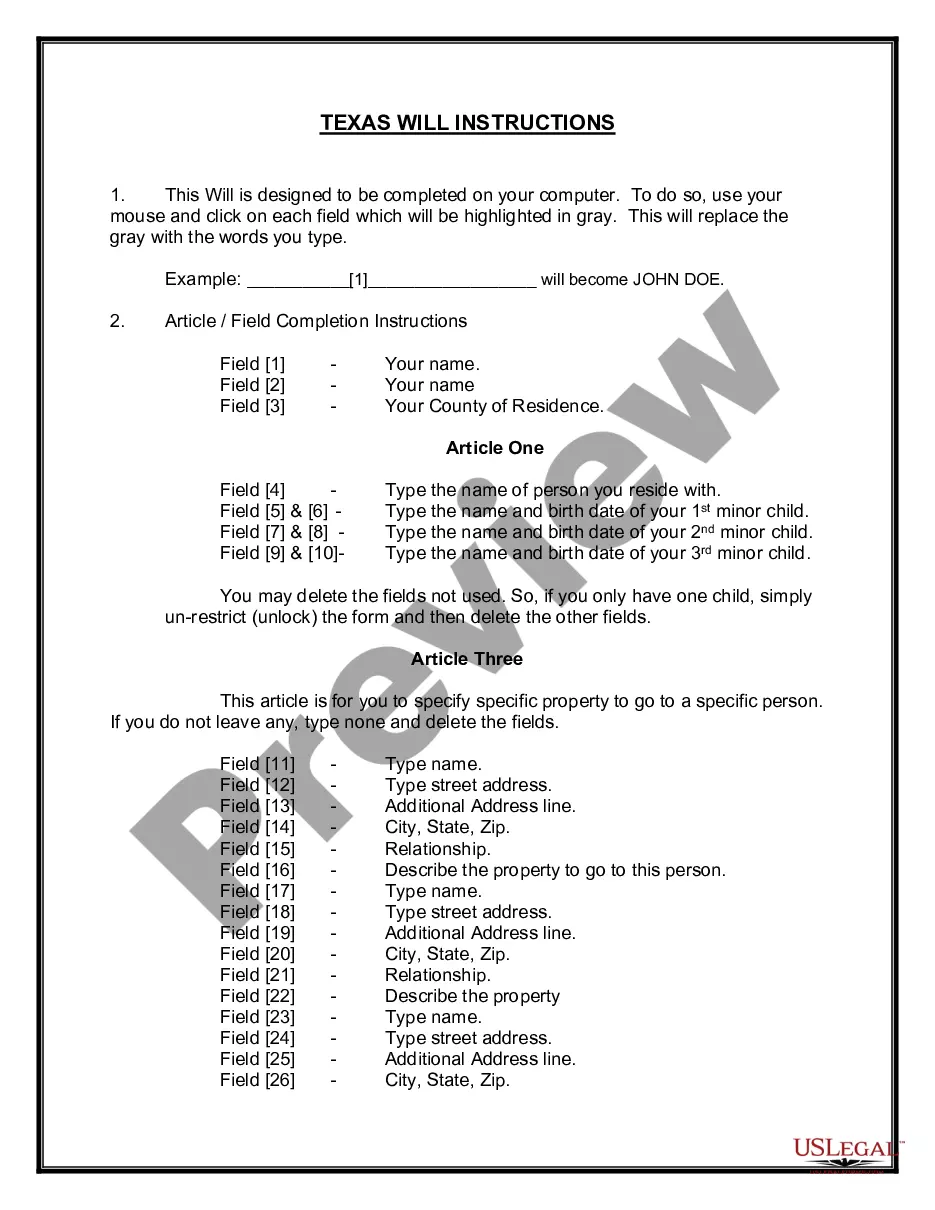

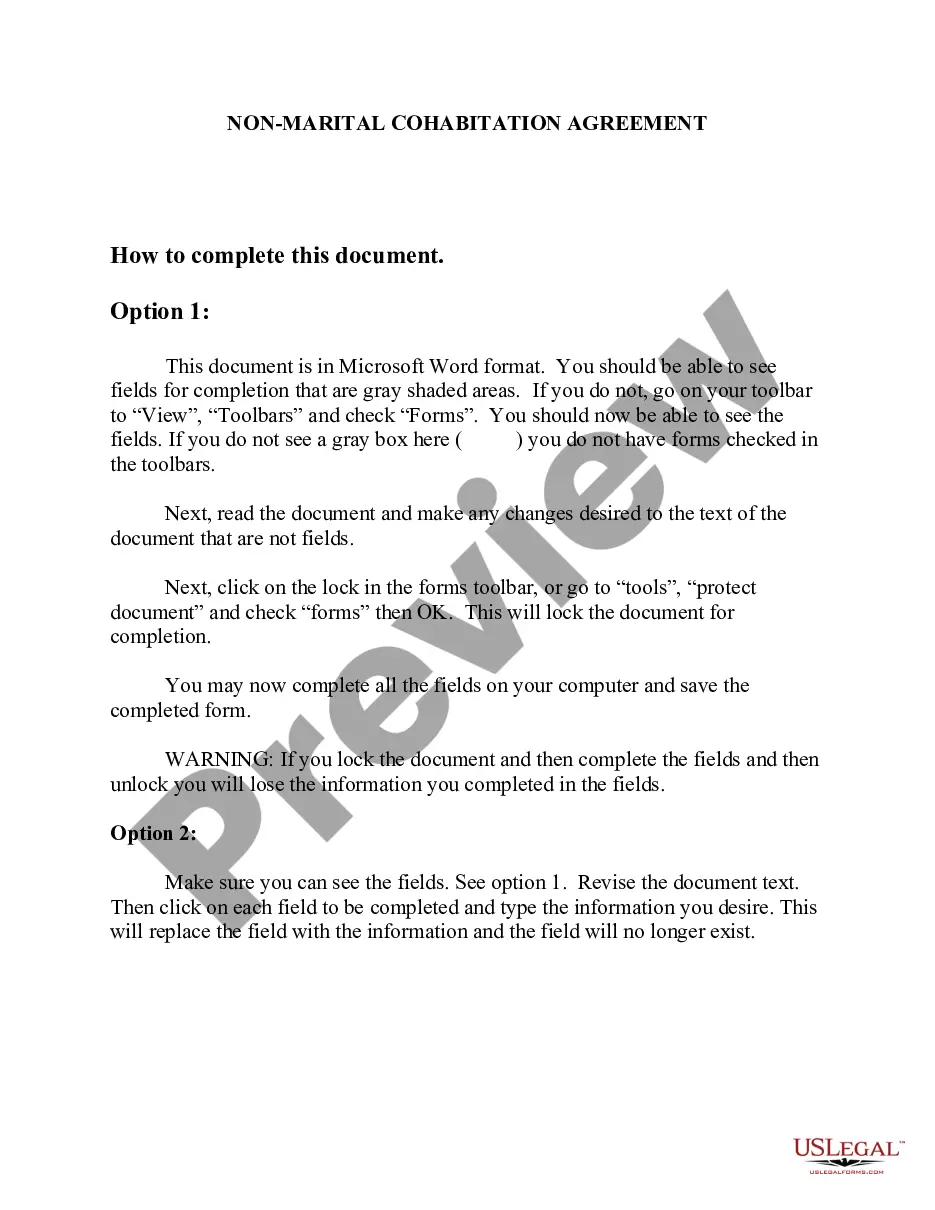

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering process or look for another template utilizing the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you have signed up and purchased your subscription, you may use your Nevada Complaint - Breach of Life Insurance Coverage Policy as often as you need or for as long as it continues to be active in your state. Revise it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

In California, insurance companies breach the implied covenant of good faith and fair dealing, commonly referred to as acting in bad faith, when they unreasonably or willfully deny benefits under an existing and enforceable California insurance policy on a valid claim.

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.There are many ways in which an insurance company may act in bad faith.

1Ask For an Explanation. Several car insurance companies are quick to support their own policyholder.2Threaten Their Profits. Most insurance companies will do anything to increase their profits.3Use Your Policy.4Small Claims Court & Mediation.5File a Lawsuit.

Step 1: Review Your Insurance Contract. Step 2: Keep Logs on Your Claim. Step 3: Document Denial of Claim. Step 4: Make a Final Demand. Step 5: File a Complaint with Your State's Department of Insurance. Step 6: Initiate a Bad Faith Lawsuit.

Step 1: Review Your Insurance Contract. Step 2: Keep Logs on Your Claim. Step 3: Document Denial of Claim. Step 4: Make a Final Demand. Step 5: File a Complaint with Your State's Department of Insurance. Step 6: Initiate a Bad Faith Lawsuit.

Download and complete a complaint form from the Financial Ombudsman Service website. Send it off with a copy of the final response letter from your insurance company plus any other documents you have that support your case. Find out how to complain to the Financial Ombudsman Service on their websiteopens in new window.

In California, Insurance Adjusters Can Be Sued for Negligent Misrepresentation. Recently, a California appellate court held that a policyholder can assert a negligent misrepresentation claim against an insurance adjuster.Consequently, the claims adjuster was able to obtain a dismissal.

You can sue your insurance company if they violate or fail the terms of the insurance policy. Common violations include not paying claims in a timely fashion, not paying properly filed claims, or making bad faith claims.

Sign 1) Refusal to Pay a Claim Without a Reasonable Basis. Sign 2) Refusal to Properly Investigate Your Claim In A Timely Manner. Sign 3) The Insurance Company Tries to Settle for Less than You Deserve. Sign 4) Your Insurer Demands a Stupid Amount of Paperwork or Evidence.