New Mexico Affidavit of Heirship - Descent

Description

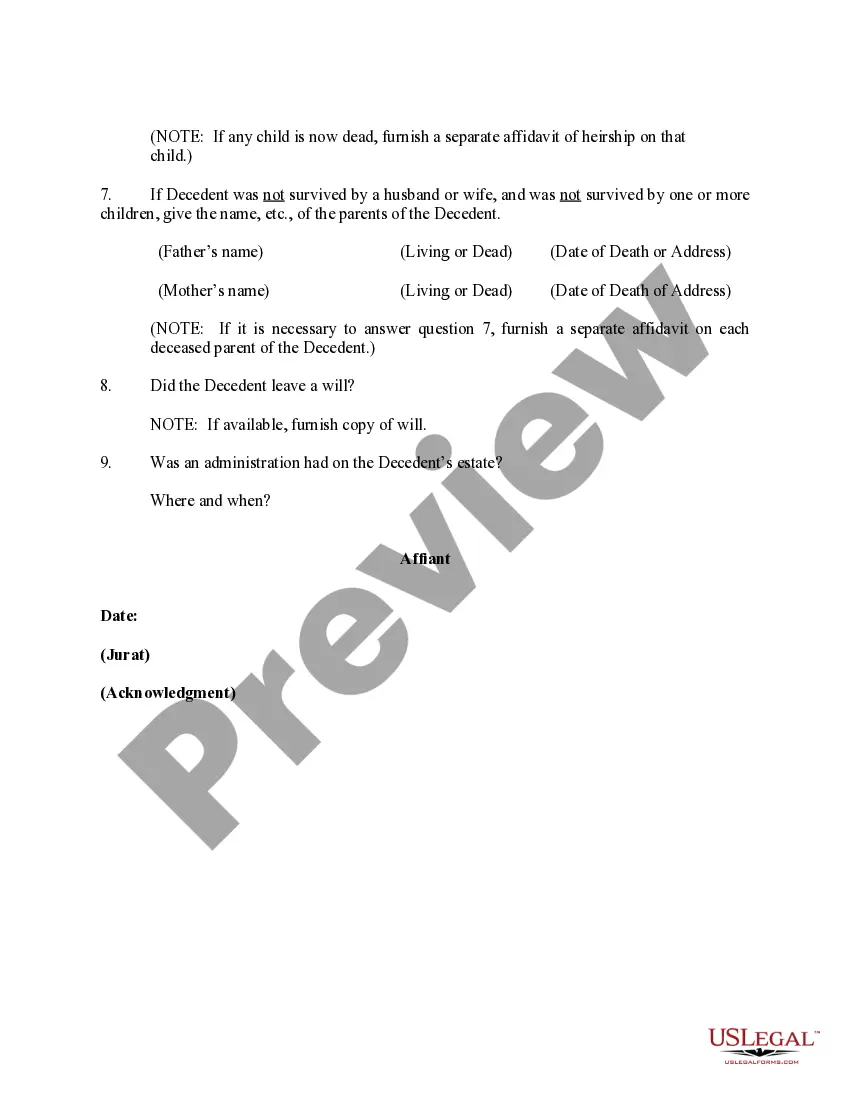

How to fill out Affidavit Of Heirship - Descent?

It is possible to devote hours on-line looking for the authorized papers design that fits the state and federal specifications you require. US Legal Forms supplies a huge number of authorized varieties which can be reviewed by specialists. You can easily acquire or produce the New Mexico Affidavit of Heirship - Descent from our service.

If you already have a US Legal Forms bank account, you may log in and then click the Acquire key. Next, you may complete, edit, produce, or indicator the New Mexico Affidavit of Heirship - Descent. Each and every authorized papers design you buy is your own permanently. To have one more copy of any obtained form, proceed to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms site initially, keep to the easy instructions beneath:

- First, make certain you have selected the best papers design for the county/town of your choice. Look at the form description to ensure you have chosen the correct form. If available, utilize the Preview key to check through the papers design also.

- If you wish to discover one more edition of your form, utilize the Research field to get the design that meets your needs and specifications.

- After you have located the design you want, just click Buy now to continue.

- Find the rates plan you want, key in your references, and sign up for your account on US Legal Forms.

- Comprehensive the deal. You may use your credit card or PayPal bank account to cover the authorized form.

- Find the file format of your papers and acquire it to the system.

- Make modifications to the papers if required. It is possible to complete, edit and indicator and produce New Mexico Affidavit of Heirship - Descent.

Acquire and produce a huge number of papers layouts making use of the US Legal Forms site, which offers the largest selection of authorized varieties. Use professional and express-particular layouts to take on your company or specific requires.

Form popularity

FAQ

The disinterested witnesses must be someone who knew the decedent and was familiar with the decedent's family history. The disinterested witness can be a friend of the decedent, a friend of the family, or a neighbor, but it cannot be an individual who will directly benefit from the estate financially.

Specific information is needed to determine the identity of the Heirs at Law of the Heir Property. A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death.

This document ensures the legal transfer or clean chain of transfer of the property's title. Title companies require a clean train of title transfer to insure the property for sale, and most title companies will accept an affidavit of heirship.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

A ballpark fee for preparation of the affidavit is between $750 for a very simple estate with few heirs to several thousand dollars for a more complicated estate with many heirs. The filing fees to record the affidavit in each county where the real property is located usually run about $50 to $75 in Texas.

If you have no spouse and any of your children are alive, they will be the only heirs to your estate. If you die with a spouse and children, your spouse will inherit all community property and 1/4 of your individual property. Your children will inherit 3/4 of your individual property.

(N.M. Stat. Ann. § 45-3-1201.) If your estate meets the requirements listed above, your inheritor can sign a simple document under oath, called a small estate affidavit or "affidavit for collection of personal property." (Here's a sample of a New Mexico small estate affidavit.)

The mailing address is: Harris County Clerk, P.O. Box 1525, Houston, TX 77251-1525.