New Mexico Release of Judgment Lien - By Creditor

Description

How to fill out Release Of Judgment Lien - By Creditor?

You can devote hrs on the web trying to find the lawful record design that meets the state and federal demands you will need. US Legal Forms provides thousands of lawful kinds that happen to be evaluated by pros. You can actually down load or print the New Mexico Release of Judgment Lien - By Creditor from our service.

If you have a US Legal Forms profile, you are able to log in and click the Obtain key. Next, you are able to complete, change, print, or indicator the New Mexico Release of Judgment Lien - By Creditor. Each lawful record design you buy is your own property forever. To obtain another duplicate for any purchased kind, proceed to the My Forms tab and click the related key.

Should you use the US Legal Forms web site the first time, stick to the straightforward guidelines listed below:

- Initial, make certain you have chosen the best record design for the state/city of your liking. Look at the kind description to make sure you have selected the proper kind. If offered, take advantage of the Review key to look from the record design as well.

- If you would like get another variation in the kind, take advantage of the Search industry to find the design that suits you and demands.

- After you have identified the design you need, click on Purchase now to carry on.

- Select the rates program you need, type in your references, and sign up for your account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal profile to cover the lawful kind.

- Select the structure in the record and down load it for your device.

- Make alterations for your record if needed. You can complete, change and indicator and print New Mexico Release of Judgment Lien - By Creditor.

Obtain and print thousands of record web templates making use of the US Legal Forms Internet site, which offers the biggest selection of lawful kinds. Use expert and state-distinct web templates to take on your company or individual needs.

Form popularity

FAQ

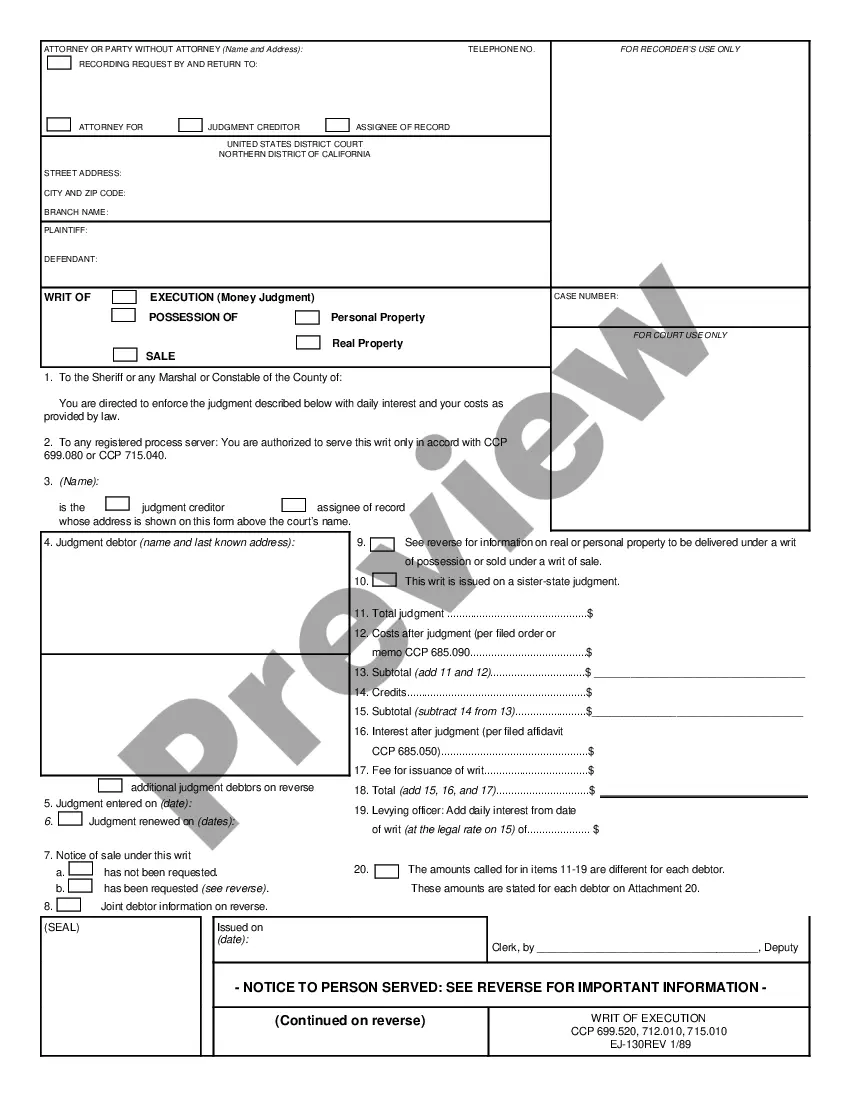

Execution of a Judgment is the legal process of enforcing a Judgment by seizing and selling the Debtor's property. A Writ of Execution permits the Sheriff to take and sell the Debtor's property.

How does a creditor go about getting a judgment lien in New Mexico? To properly attach the lien, the creditor files the judgment with the county clerk in any New Mexico county where the debtor owns property now or may own property in the future.

NEW MEXICO A judgment is a lien on the real estate of the judgment debtor and expires after fourteen years. N.M. Stat. § 39-1-6.

How long does a judgment lien last in New Mexico? A judgment lien in New Mexico will remain attached to the debtor's property (even if the property changes hands) for 14 years.

The purpose of the Lien Protection Efficiency Act is to provide for the efficient filing and recording of documents and the protection of public officials and employees and the citizens of the state against nonconsensual common law liens by imposing limitations on the circumstances in which nonconsensual common law ...

The lien must be signed and verified under oath (notarized). Once completed, a lien should be filed and recorded with the county recorder's office in the county where the property is located. You are not required to serve the lien upon the property owner, as filing the lien is considered sufficient notice under NM law.

In all cases when a notice of lien for taxes, penalties and interest has been filed under Section 7-1-38 NMSA 1978 and a period of ten years has passed from the date the lien was filed, as shown on the notice of lien, the taxes, penalties and interest for which the lien is claimed shall be conclusively presumed to have ...

New Mexico provides mechanics lien protection to ?every person performing labor upon, providing or hauling equipment, tools or machinery for or furnishing materials to be used in the construction, alteration or repair of? a construction project. Protection in New Mexico is fairly broad.