New Mexico Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease

Description

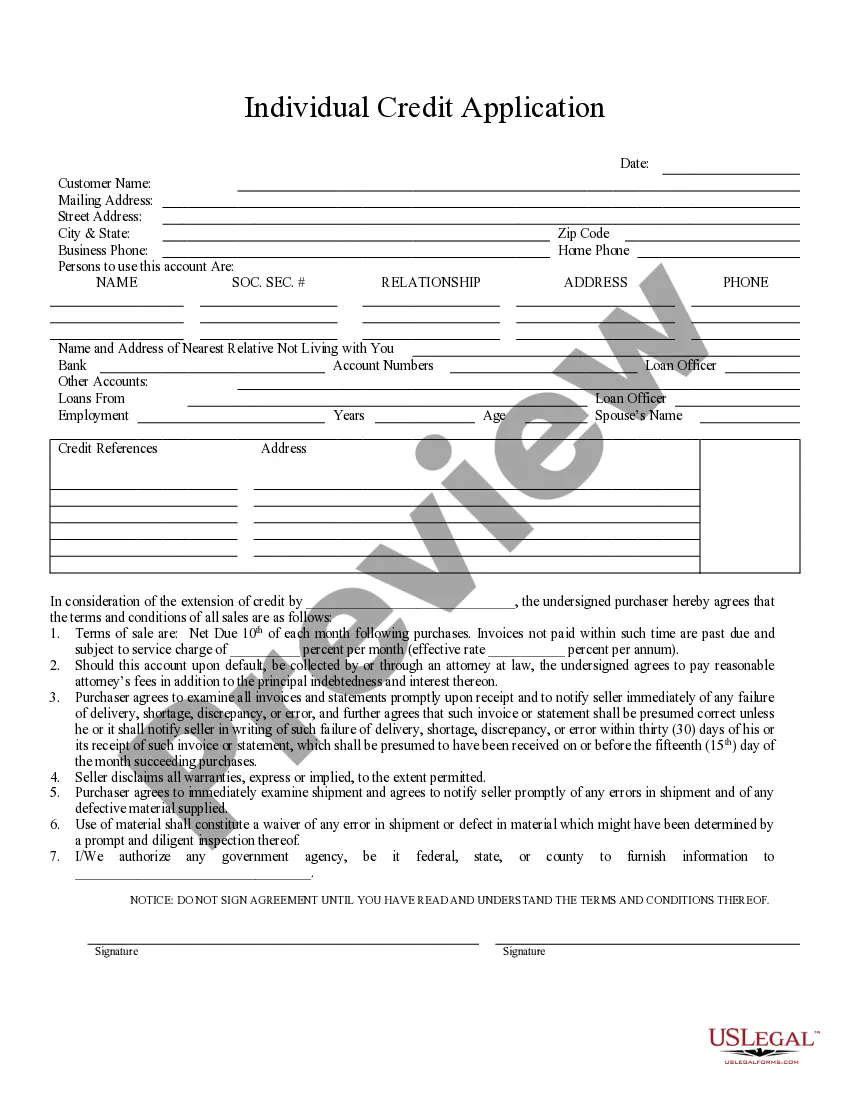

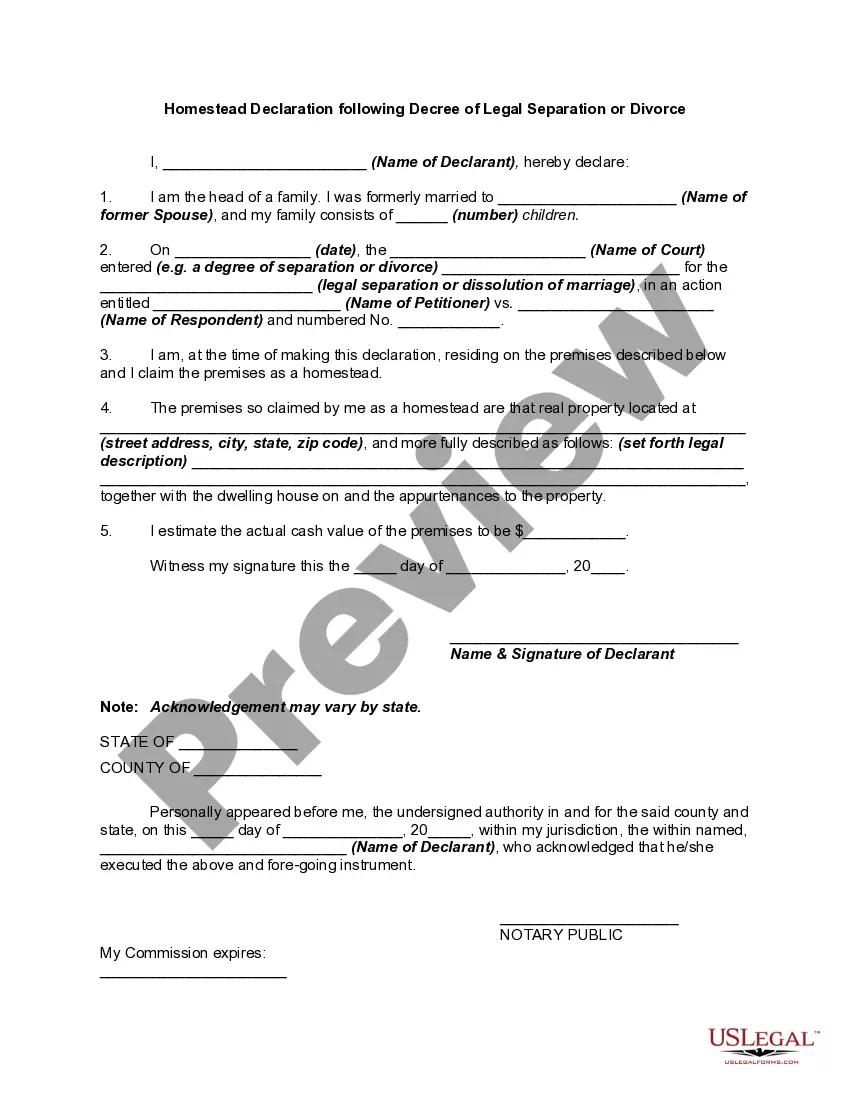

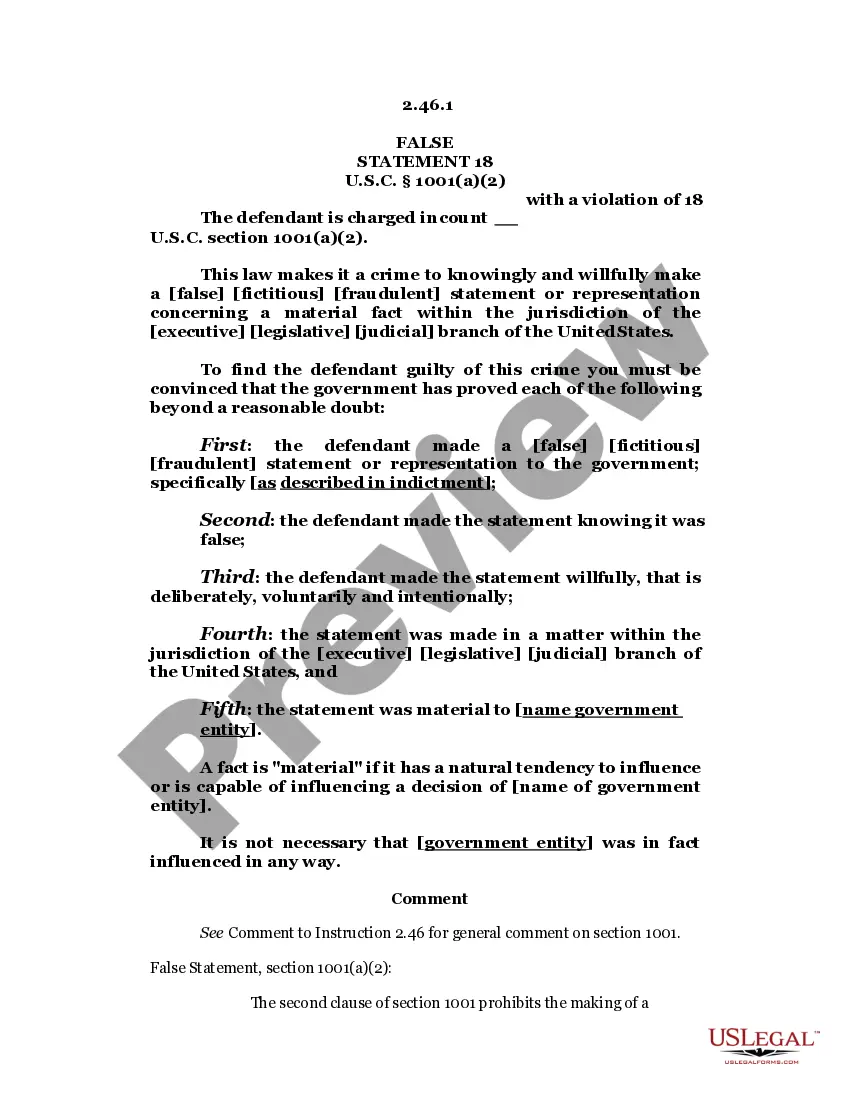

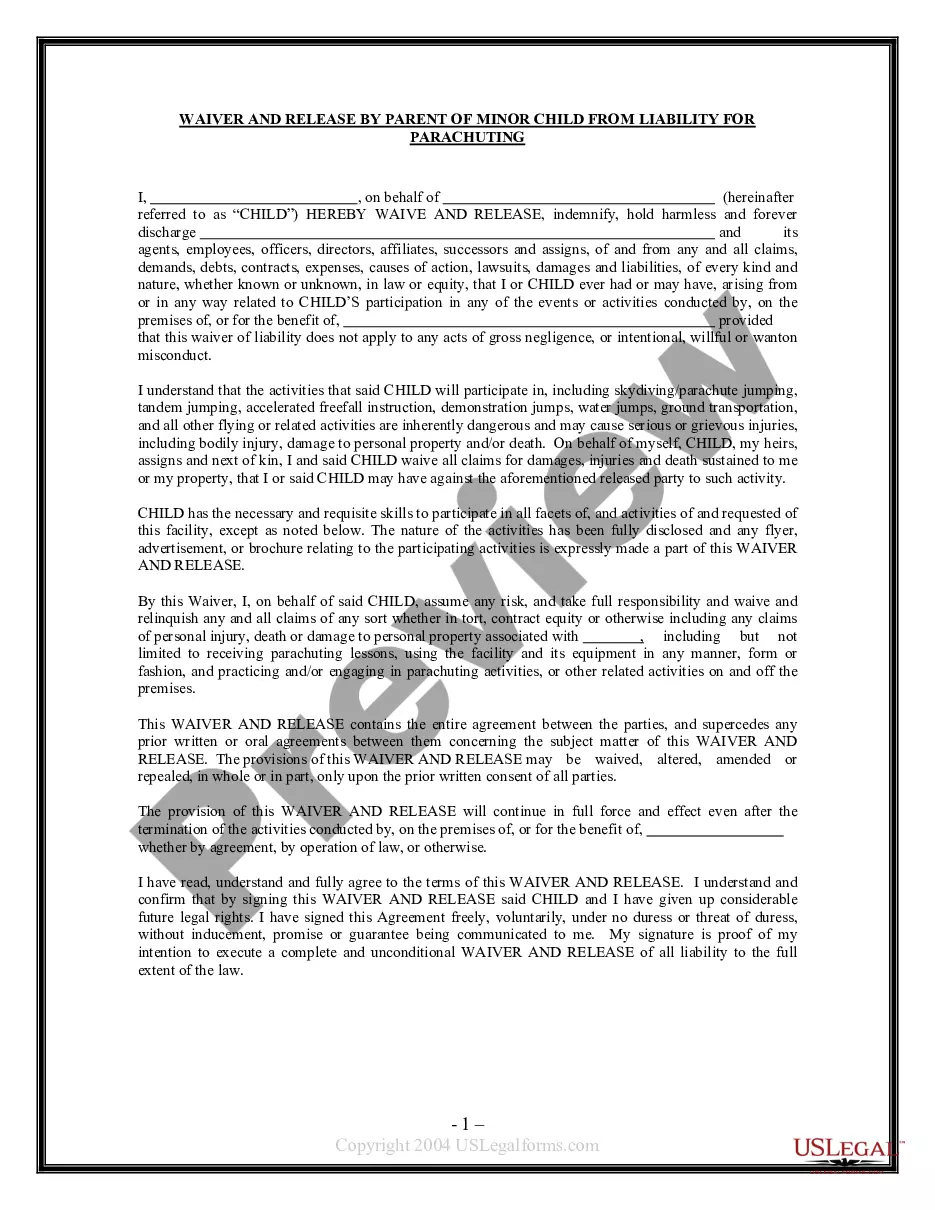

How to fill out Geophysical Exploration Agreement Between Mineral Owner And Operator, With Option To Purchase Oil And Gas Lease?

You can devote several hours online attempting to find the legal record template that suits the state and federal needs you need. US Legal Forms gives a huge number of legal types that happen to be evaluated by pros. You can easily download or printing the New Mexico Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease from my services.

If you already have a US Legal Forms profile, you are able to log in and click on the Obtain switch. After that, you are able to full, edit, printing, or indicator the New Mexico Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease. Each and every legal record template you get is your own for a long time. To get one more copy of any purchased type, proceed to the My Forms tab and click on the related switch.

If you work with the US Legal Forms website initially, follow the straightforward instructions beneath:

- First, be sure that you have selected the correct record template to the area/metropolis of your choice. Look at the type description to make sure you have picked out the correct type. If accessible, make use of the Review switch to check throughout the record template also.

- In order to locate one more model of your type, make use of the Lookup field to get the template that suits you and needs.

- When you have identified the template you need, click Buy now to proceed.

- Pick the rates strategy you need, type in your qualifications, and register for your account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal profile to cover the legal type.

- Pick the structure of your record and download it to your gadget.

- Make changes to your record if required. You can full, edit and indicator and printing New Mexico Geophysical Exploration Agreement Between Mineral Owner and Operator, with Option to Purchase Oil and Gas Lease.

Obtain and printing a huge number of record templates while using US Legal Forms Internet site, that provides the most important assortment of legal types. Use professional and state-distinct templates to deal with your business or specific requirements.

Form popularity

FAQ

Taxes: The #1 reason for selling mineral rights is taxes. If you inherited mineral rights and then sold them for $100,000, you could pay only $5,250 in taxes and keep $94,750. If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

Yes, it can be beneficial to sell your mineral rights for a fair price, even producing rights. First, sellers must be aware of the different stages of the production process. They must also know the value their minerals and royalties command in every development stage.

How do I buy mineral rights in New Mexico? Becoming the owner of minerals in the state follows an easy process. After confirming the legitimacy of the owner on the public database website, your attorney can start evaluating the relevant rights to that property.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Unsolicited purchase offers are happening in greater numbers and for greater ? sometimes much greater ? amounts than in the past. The upshot? Sometimes selling makes good sense. Indeed, depending on your situation, the sale of your mineral rights can represent a prudent ? and even compelling ? opportunity.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.