New Mexico Insulation Services Contract - Self-Employed

Description

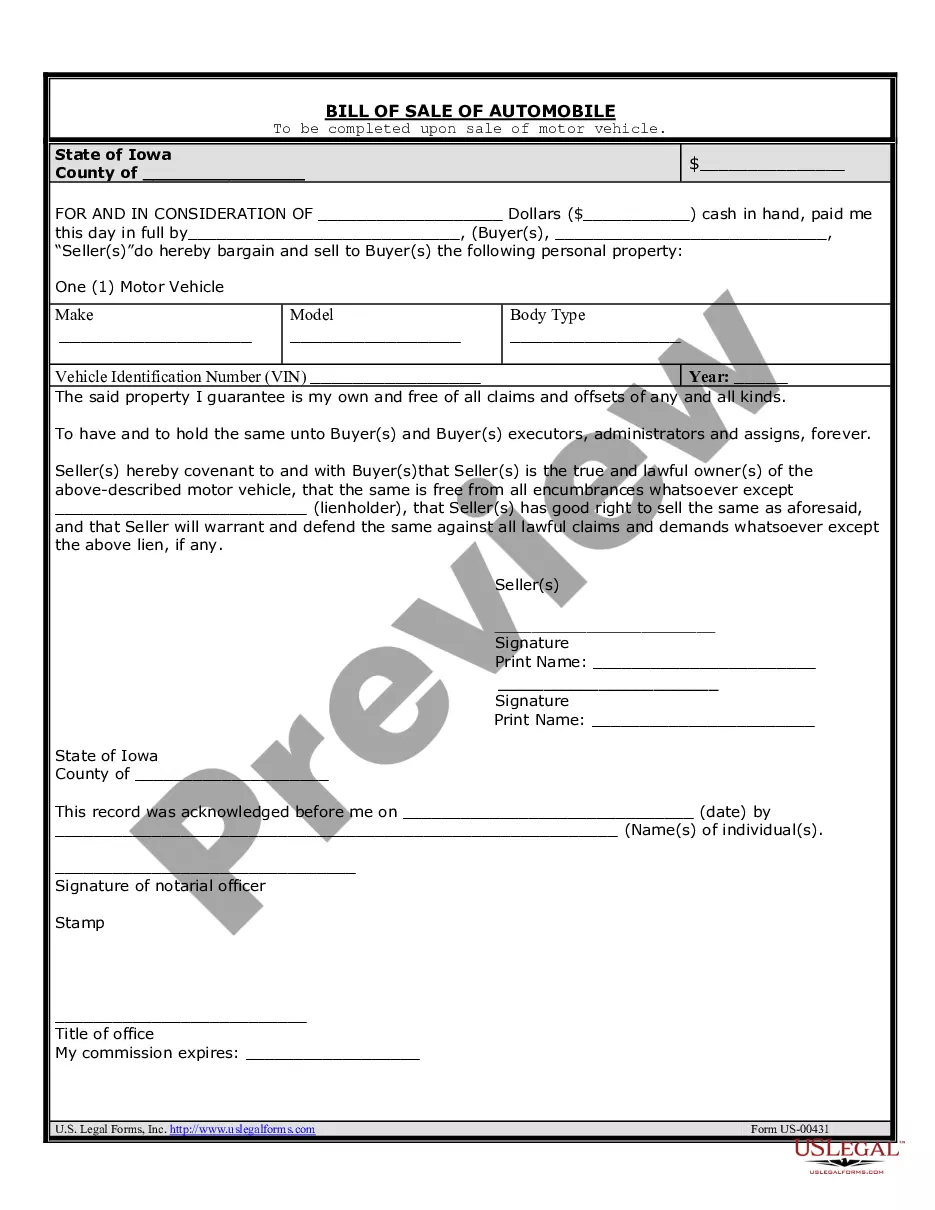

How to fill out Insulation Services Contract - Self-Employed?

You can spend time online looking for the legal document template that meets your state and federal requirements.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can conveniently download or print the New Mexico Insulation Services Contract - Self-Employed from my platform.

If available, use the Preview button to review the document format simultaneously.

- If you possess a US Legal Forms account, you may sign in and click on the Download button.

- Then, you may complete, modify, print, or sign the New Mexico Insulation Services Contract - Self-Employed.

- Every legal document template you purchase is yours for life.

- To obtain an additional copy of any acquired document, navigate to the My documents section and click on the respective button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, verify that you have selected the correct document format for the area/city you choose.

- Check the document description to ensure you have selected the right form.

Form popularity

FAQ

Filling out an independent contractor form requires attention to detail. Start by entering your personal information and the contracting entity's details clearly. Next, specify the project or services covered under the New Mexico Insulation Services Contract - Self-Employed, including payment terms and any specific conditions. Using uSlegalforms provides easy access to user-friendly forms that can help you complete this task efficiently.

Writing an independent contractor agreement involves outlining essential elements in a clear and organized format. Begin with the contract title, then define the roles of each party, describe the services provided, and establish payment processes. Including references to the New Mexico Insulation Services Contract - Self-Employed can enhance clarity and compliance. For convenience, consider using uSlegalforms to access templates that simplify this process.

To fill out an independent contractor agreement effectively, start by clearly identifying the parties involved. Include details such as the scope of work, payment terms, and deadlines. Additionally, ensure that you specify any obligations related to the New Mexico Insulation Services Contract - Self-Employed. Utilizing an online resource can guide you through the process, making it straightforward.

In New Mexico, certain services may be exempt from taxation, including some professional and personal services. However, installation services, particularly those outlined in a New Mexico Insulation Services Contract - Self-Employed, are generally taxable. Understanding the specifics of your service offerings can help you navigate tax matters effectively, and platforms like uslegalforms can support this process.

Yes, New Mexico requires businesses to file 1099 forms when payments to independent contractors exceed $600. This requirement applies to those working on a New Mexico Insulation Services Contract - Self-Employed as well. Timely filing not only reflects good business practice but also ensures you meet state regulations.

In New Mexico, installation labor is generally considered taxable unless it falls under specific exemptions. If you provide services under a New Mexico Insulation Services Contract - Self-Employed, you must account for any applicable tax when billing clients. Understanding your tax obligations helps avoid unexpected costs, so consult resources or experts as necessary.

Filing taxes for independent contract work involves reporting your income, expenses, and paying estimated taxes throughout the year. If you are working under a New Mexico Insulation Services Contract - Self-Employed, keep detailed records for potential deductions. Consider consulting a tax professional or using services like uslegalforms for step-by-step guidance on the filing process.

Many states have their own 1099 filing requirements, including New Mexico, where businesses must report payments to self-employed individuals. Each state sets specific thresholds and deadlines, so it is essential to stay informed. Utilizing resources like uslegalforms can provide guidance tailored to your New Mexico Insulation Services Contract - Self-Employed and help ensure you fulfill all obligations.

Any individual or business that earns income in New Mexico, including those working under a New Mexico Insulation Services Contract - Self-Employed, must file a tax return. This obligation applies regardless of residency status. Returning the correct forms ensures compliance while maximizing any potential tax benefits available to self-employed workers.

The new 1099 reporting requirements mandate that businesses report payments made to self-employed individuals and independent contractors if they exceed $600 within a tax year. This change impacts those who engage in a New Mexico Insulation Services Contract - Self-Employed, as they will need accurate records for their income. Proper documentation can simplify tax filing, and platforms like uslegalforms can support you in meeting these requirements effectively.