New Mexico Employee Payroll Records Checklist

Description

How to fill out Employee Payroll Records Checklist?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that you can either download or print.

By utilizing the website, you can access thousands of forms for both commercial and personal purposes, organized by categories, states, or keywords.

You can find the most current versions of forms such as the New Mexico Employee Payroll Records Checklist in just moments.

Examine the document overview to confirm that you've picked the appropriate form.

If the document does not meet your needs, use the Search field at the top of the page to find one that does.

- If you already possess a membership, Log In and retrieve the New Mexico Employee Payroll Records Checklist from the US Legal Forms library.

- The Obtain button will be visible for every document you examine.

- You can access all previously downloaded forms in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to assist you.

- Ensure you have selected the correct document for your city/state.

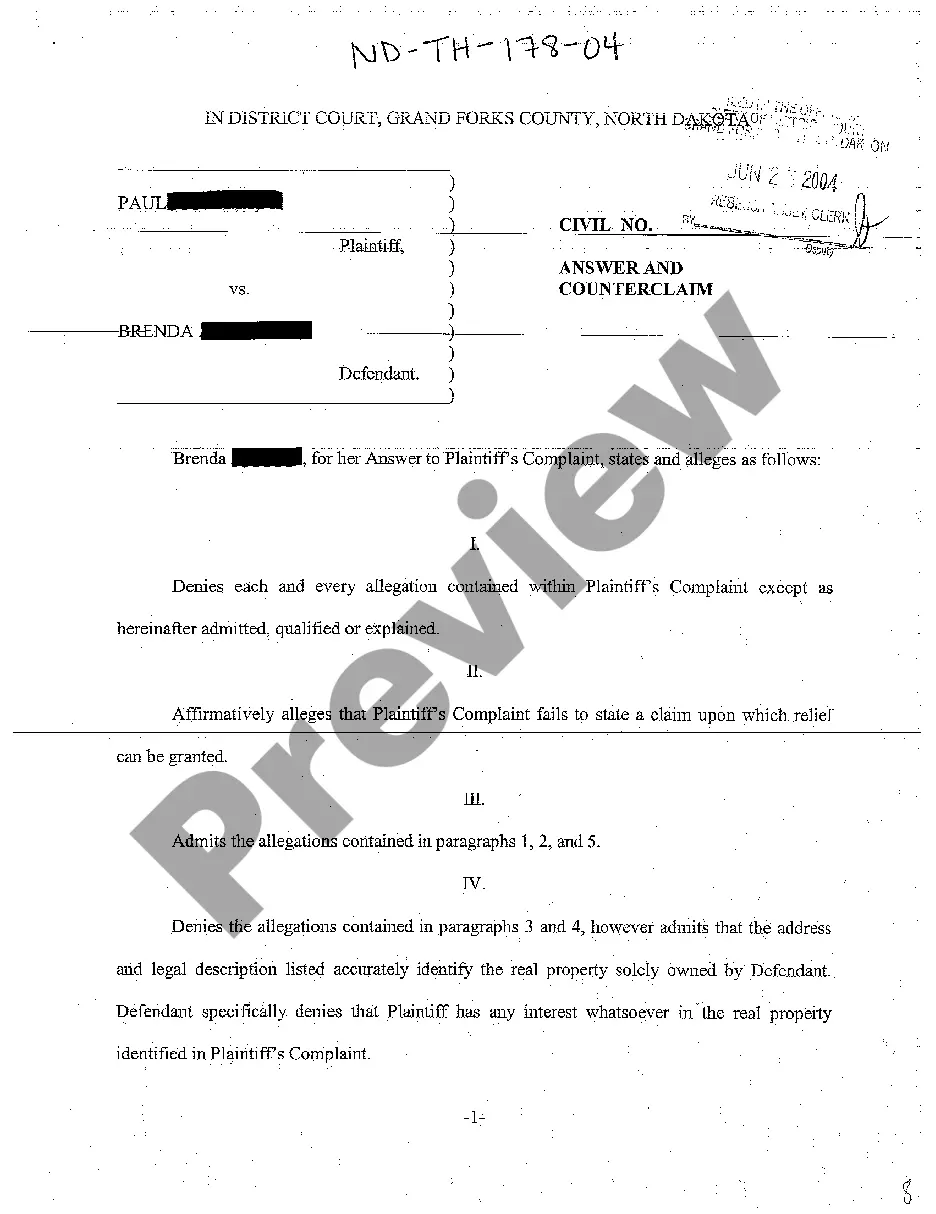

- Click the Preview button to review the document’s content.

Form popularity

FAQ

Most, but not all, important job-related documents should go in the file, including:job description for the position.job application and/or resume.offer of employment.IRS Form W-4 (the Employee's Withholding Allowance Certificate)receipt or signed acknowledgment of employee handbook.performance evaluations.More items...

Payroll records are the combined documents pertaining to payroll that businesses must maintain for each individual that they employ. This includes pay rates, total compensation, tax deductions, hours worked, benefit contributions and more.

Generally, here are the documents you should include in each employee's payroll record:General information. Employee name. Address.Tax withholding forms. Form W-4. State W-4 form.Time and attendance records. Time cards.Payroll records. Pay rate.Termination/separation documents, if applicable. Final paycheck information.

Payroll records is a blanket term that applies to all documentation associated with paying employees, from hiring documents and direct deposit authorization forms to paystubs. This includes anything that documents total hours worked, their pay rate, tax deductions, employee benefits, etc.

Payroll records contain information about the compensation paid to employees and any deductions from their pay. These records are needed by the payroll staff to calculate gross pay and net pay for employees. Payroll records typically include information about the following items: Bereavement pay. Bonuses.

You can store payroll records via paper or online files. Develop a recordkeeping system that works best for you. With paper-based recordkeeping, you can store files in locked cabinets. Be sure to label each of your folders so you can easily access your records.

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...

Seven Types of Records an Employer Should Keep Under Fair Work LegislationGeneral Records.Wages & Pay Records.Payslip Records.Hours of Work Records.Leave Records.Superannuation Records.Termination Records.Recordkeeping with Cloud Payroll.

This includes time cards, work and time schedules, wage rate tables, job evaluations, etc. 3 years: Payroll records should be kept 3 years, including paystubs, payroll advance records, etc. 4 years: Employment tax documentation includes Form W-4, W-2s, records detailing fringe benefits, tip allocation, sick pay, etc.

To get started:Step 1: Have all employees complete a W-4 form.Step 2: Find or sign up for Employer Identification Numbers.Step 3: Choose your payroll schedule.Step 4: Calculate and withhold income taxes.Step 5: Pay payroll taxes.Step 6: File tax forms & employee W-2s.