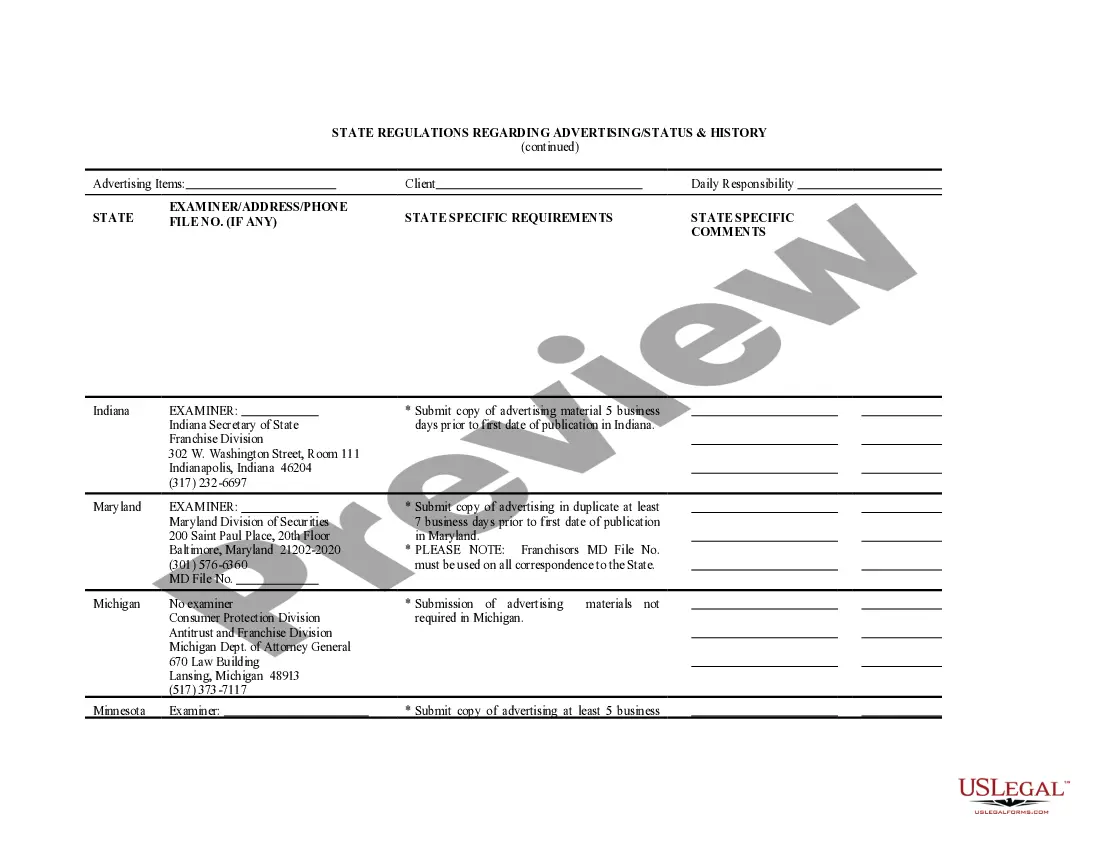

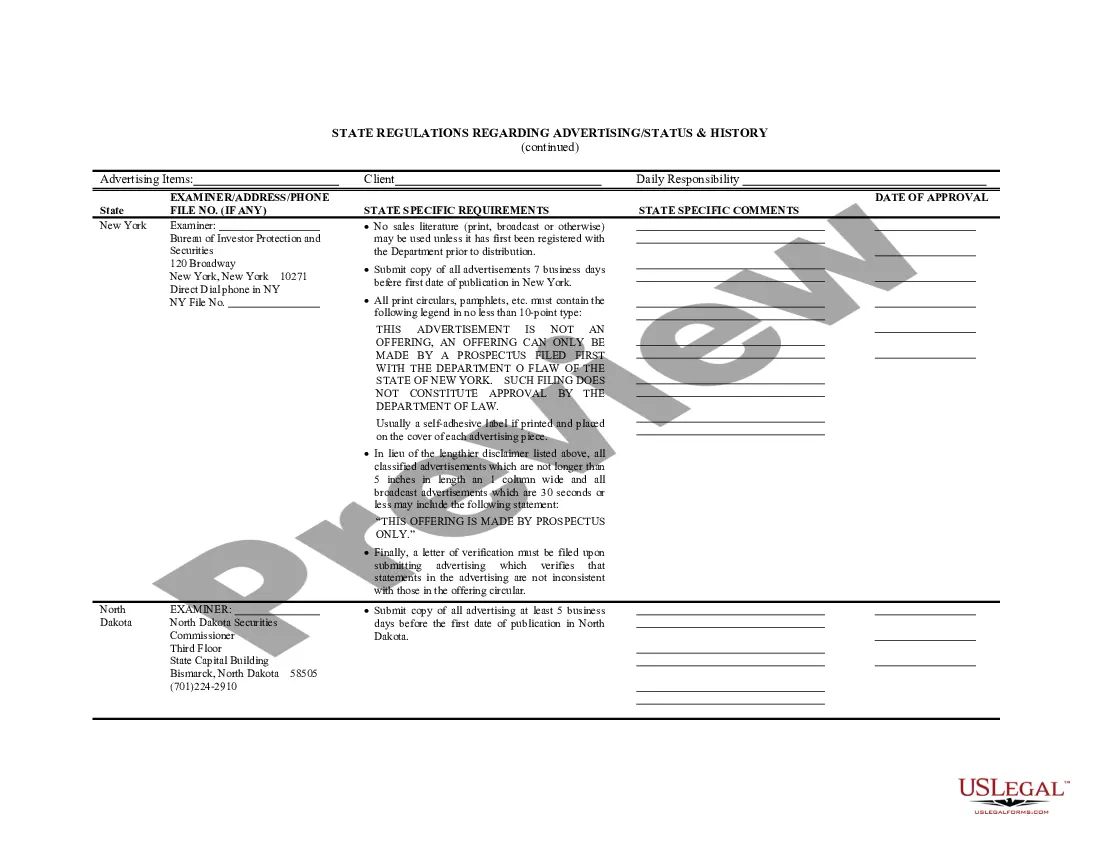

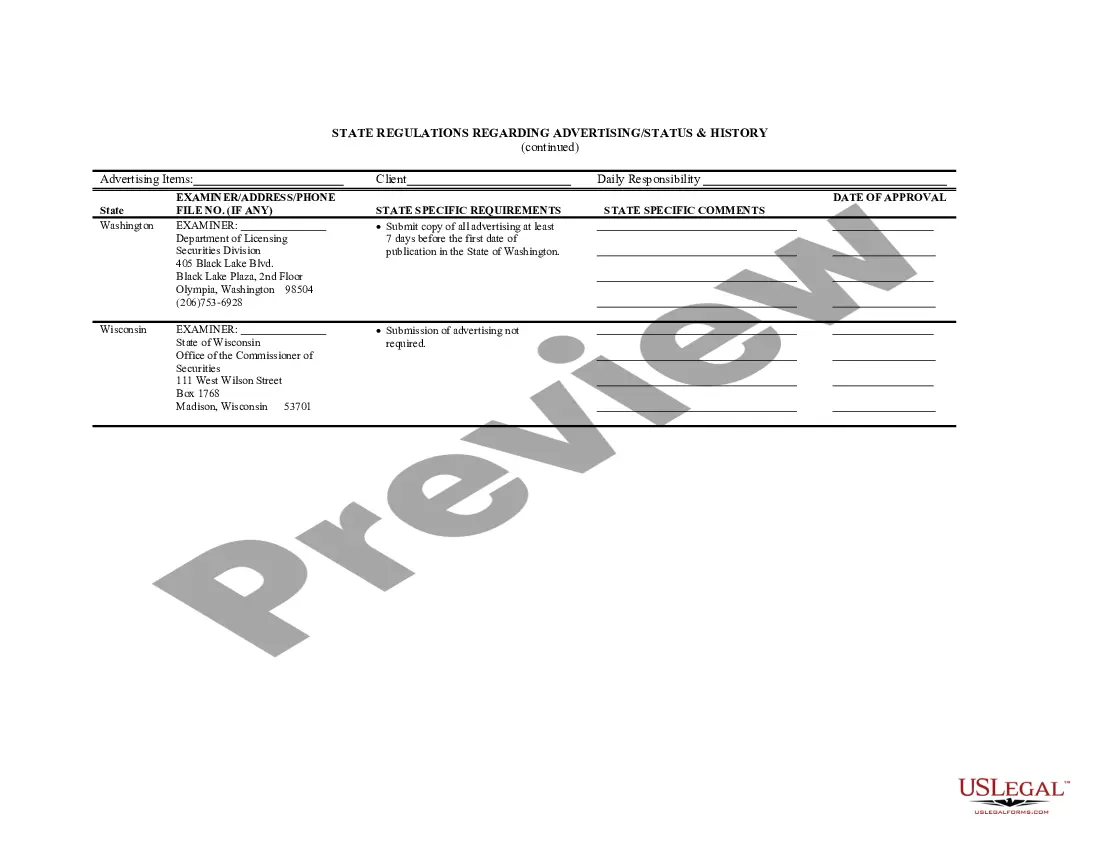

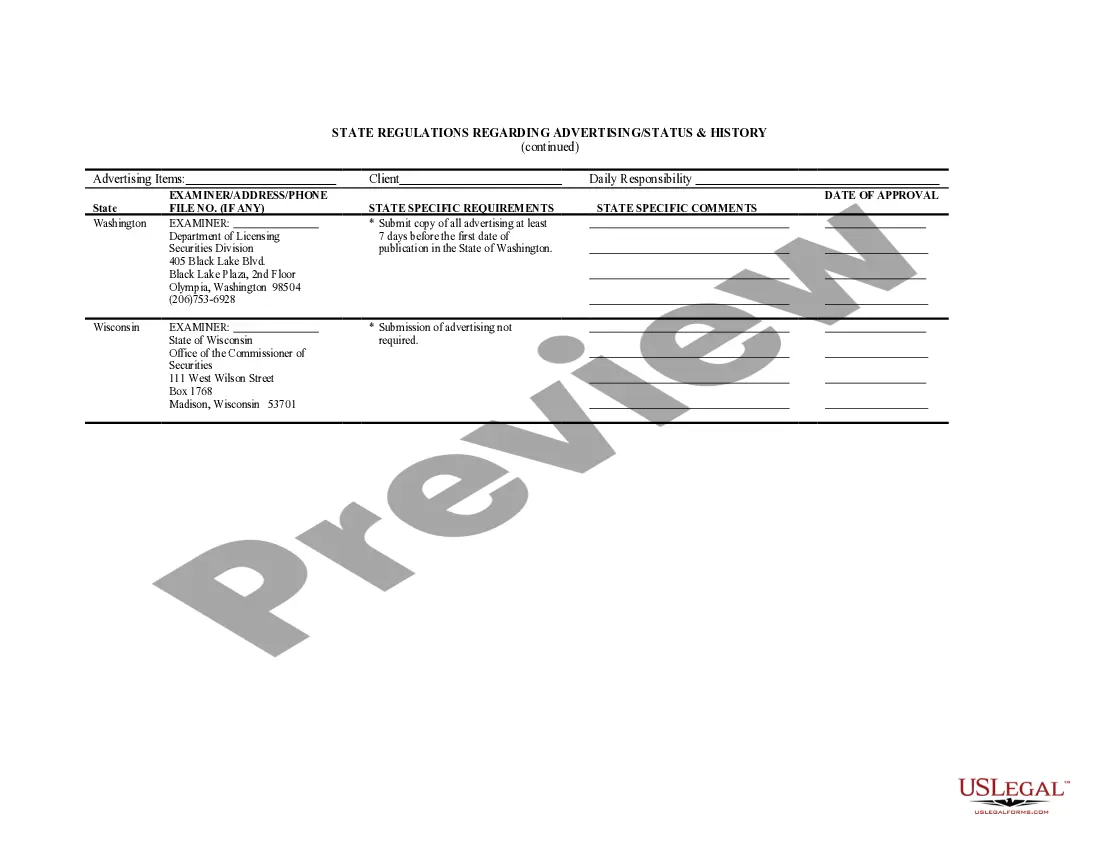

New Mexico State Regulations Regarding Advertising - Status and History

Description

How to fill out State Regulations Regarding Advertising - Status And History?

Are you within a placement where you need files for sometimes enterprise or specific reasons virtually every working day? There are a variety of legitimate document templates available online, but getting kinds you can depend on is not simple. US Legal Forms provides 1000s of develop templates, much like the New Mexico State Regulations Regarding Advertising - Status and History, which can be created to satisfy state and federal demands.

If you are presently informed about US Legal Forms website and get your account, simply log in. Following that, you can download the New Mexico State Regulations Regarding Advertising - Status and History format.

Should you not have an account and need to begin using US Legal Forms, adopt these measures:

- Obtain the develop you want and make sure it is for that correct area/region.

- Make use of the Preview button to analyze the shape.

- Read the description to actually have selected the proper develop.

- If the develop is not what you are trying to find, use the Search field to get the develop that meets your requirements and demands.

- Whenever you find the correct develop, simply click Acquire now.

- Select the rates prepare you desire, complete the necessary information to generate your money, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a practical paper file format and download your backup.

Find all of the document templates you might have bought in the My Forms menu. You can get a extra backup of New Mexico State Regulations Regarding Advertising - Status and History anytime, if possible. Just click the required develop to download or produce the document format.

Use US Legal Forms, the most considerable collection of legitimate varieties, to save time as well as avoid blunders. The support provides skillfully produced legitimate document templates that can be used for an array of reasons. Produce your account on US Legal Forms and initiate producing your life a little easier.

Form popularity

FAQ

Hear this out loud PauseNew Mexico is one of few states that broadly taxes services. Gross receipts tax is ?inclusive? ? services are taxed unless a specific exclusion applies. New Mexico taxes print advertising, billboard advertising, radio advertising, and television advertising.

Hear this out loud PauseNew Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501(c) of the Internal Revenue Code with a classification as an educational or social entity. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978.

Hear this out loud PauseA blanket certificate in California appears to not have an expiration date.

These tax-exempt goods include gasoline, groceries, durable medical equipment, prescription medications, and certain medical services. Additionally, there are certain customers that are exempt from the gross receipts tax, such as nonprofits, government agencies, and merchants buying goods for resale.

Hear this out loud PauseForm RPD-41083, Affidavit to Obtain Refund of New Mexico Tax Due a Deceased Taxpayer; and. A copy of the death certificate or other proof of death.

New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501(c) of the Internal Revenue Code with a classification as an educational or social entity. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978.

Obtain Tax ID Numbers In order to obtain an EIN or a FEIN, visit the IRS Application for Employer Identification Number. Register with the New Mexico Secretary of the State Business Services. You may register online at the New Mexico Taxation & Revenue Department website for your CRS registration.

After registering with Taxation and Revenue and receiving a Business Tax Identification Number, you may obtain an NTTC online through the Taxpayer Access Point (TAP). Please note that resale certificates issued by other states are not valid in New Mexico.