New Mexico Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

It is feasible to spend hours on the web seeking the appropriate legal document format that aligns with the state and federal requirements you need.

US Legal Forms provides countless legal documents that have been vetted by professionals.

You can conveniently download or print the New Mexico Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets from your service.

Should you wish to get another version of the document, utilize the Search field to find the format that fits your needs and criteria.

- If you already have a US Legal Forms account, you may Log In and then click the Obtain button.

- After that, you can complete, edit, print, or sign the New Mexico Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

- Every legal document format you obtain is yours forever.

- To retrieve another copy of any downloaded form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the state/area of your choice.

- Read the document description to confirm that you have selected the correct form.

Form popularity

FAQ

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

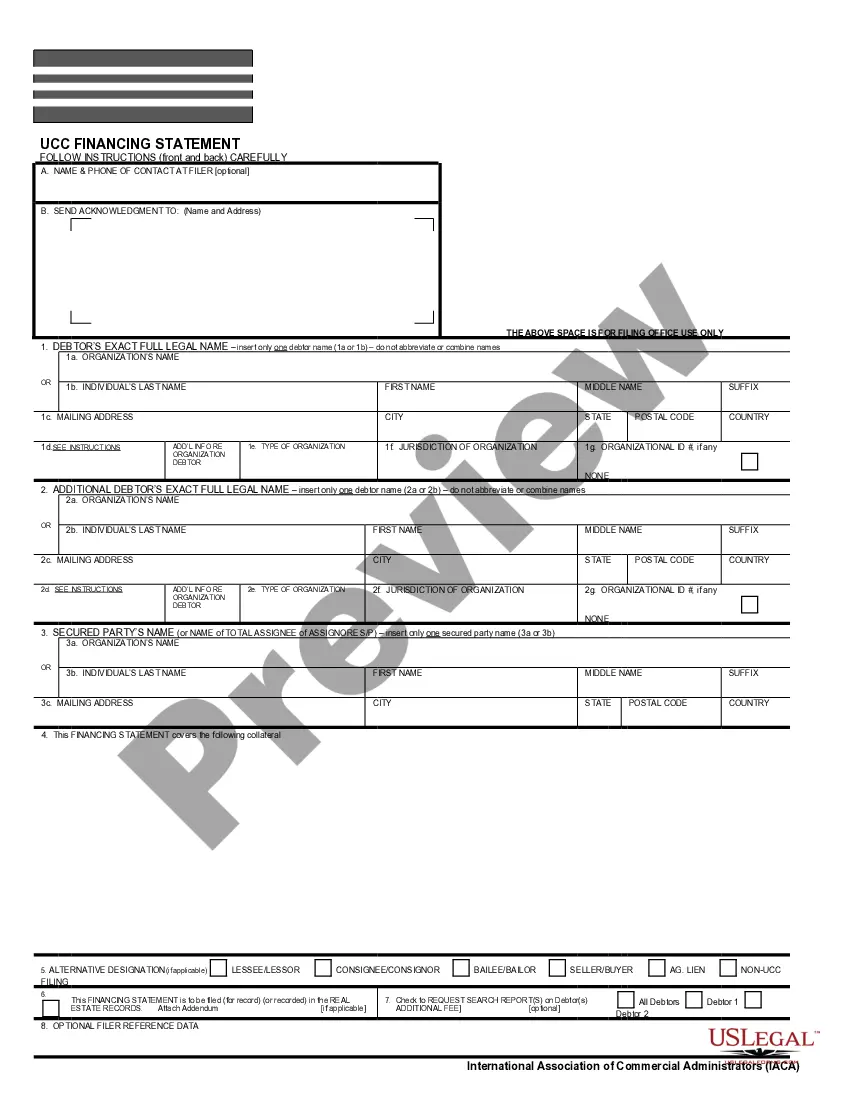

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

What is included in your contract will differ based on your circumstances, but a starting agreement should include:Party information.Definitions.Purchased assets.Purchase price.Additional covenants.Warranties or disclaimers.Indemnification.Breach of contract provisions.More items...

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...