New Mexico Sample Letter for Finalization of Accounting

Description

How to fill out Sample Letter For Finalization Of Accounting?

Choosing the right authorized papers design could be a struggle. Obviously, there are plenty of web templates available on the net, but how will you obtain the authorized develop you will need? Use the US Legal Forms website. The service gives 1000s of web templates, such as the New Mexico Sample Letter for Finalization of Accounting, that you can use for business and private requires. All the types are checked out by experts and meet federal and state requirements.

When you are currently registered, log in in your accounts and click on the Acquire switch to have the New Mexico Sample Letter for Finalization of Accounting. Make use of accounts to check throughout the authorized types you might have ordered formerly. Proceed to the My Forms tab of your own accounts and get an additional copy of your papers you will need.

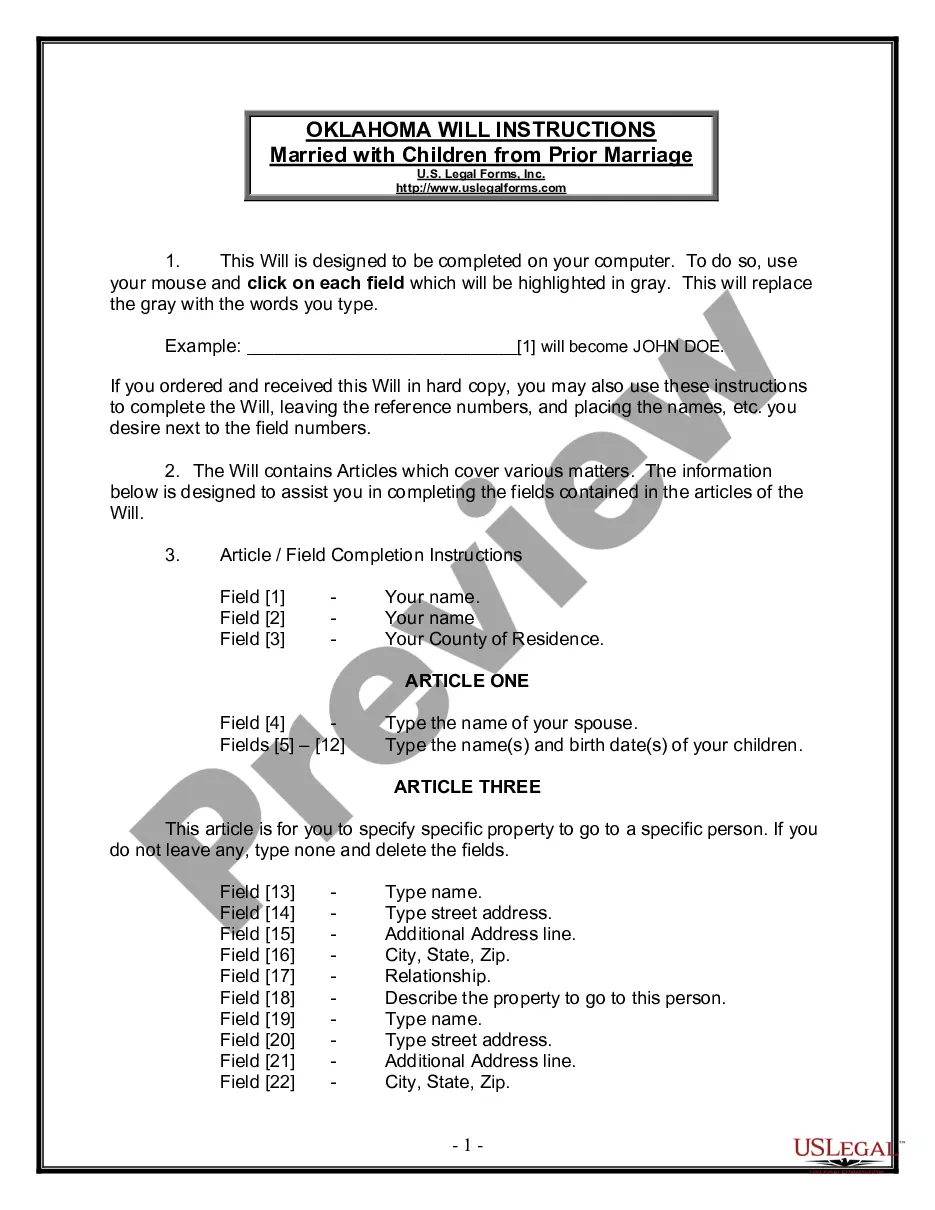

When you are a new end user of US Legal Forms, here are straightforward instructions for you to adhere to:

- Initially, ensure you have chosen the right develop for the city/county. You may look over the shape making use of the Preview switch and look at the shape outline to make sure it is the best for you.

- In case the develop fails to meet your expectations, take advantage of the Seach discipline to get the correct develop.

- Once you are sure that the shape would work, go through the Buy now switch to have the develop.

- Choose the pricing strategy you want and type in the required info. Design your accounts and purchase the order utilizing your PayPal accounts or Visa or Mastercard.

- Choose the document structure and acquire the authorized papers design in your gadget.

- Full, modify and produce and indication the acquired New Mexico Sample Letter for Finalization of Accounting.

US Legal Forms is definitely the largest collection of authorized types where you can discover different papers web templates. Use the service to acquire expertly-manufactured papers that adhere to status requirements.

Form popularity

FAQ

After registering with Taxation and Revenue and receiving a Business Tax Identification Number, you may obtain an NTTC online through the Taxpayer Access Point (TAP). Please note that resale certificates issued by other states are not valid in New Mexico.

A successor to your business may submit form ACD-31096, Tax Clearance Request to receive a Certificate of No Tax Due or to determine if the former business owner has a tax liability. For additional information, contact your local district office.

In order to close your sales tax permit in New Mexico, you will need to complete the New Mexico Business Tax Registration form ACD-31015 or request cancellation through New Mexico's online Taxpayer Access Point (TAP).

In New Mexico a Tax Status Compliance Certificate is called a Tax Compliance Certificate and is issued by the New Mexico Department of Taxation and Revenue for a Company (Corporation or LLC) or Sole Proprietor which has met all of its New Mexico tax obligations.

New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501(c) of the Internal Revenue Code with a classification as an educational or social entity. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978.