New Mexico Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership

Description

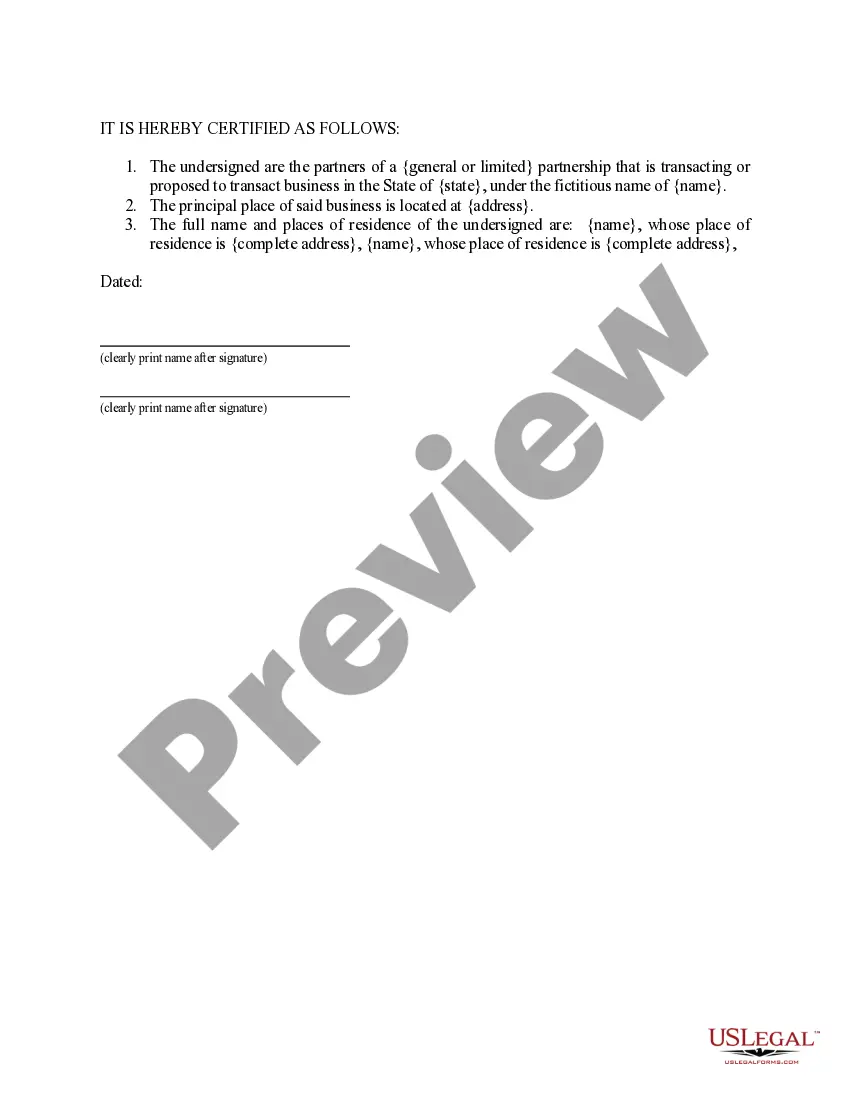

How to fill out Sample Letter For Certificate Of Transaction Of Business Under Fictitious Name - By Partnership?

US Legal Forms - one of many greatest libraries of authorized varieties in America - provides a wide array of authorized record templates it is possible to acquire or print out. While using internet site, you will get thousands of varieties for company and personal reasons, categorized by categories, states, or search phrases.You will find the most recent versions of varieties like the New Mexico Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership in seconds.

If you have a membership, log in and acquire New Mexico Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership through the US Legal Forms local library. The Download option can look on each kind you look at. You gain access to all earlier acquired varieties from the My Forms tab of your own accounts.

If you wish to use US Legal Forms the first time, listed here are basic directions to help you started:

- Make sure you have selected the correct kind for your personal metropolis/state. Select the Review option to examine the form`s content material. See the kind explanation to ensure that you have chosen the appropriate kind.

- In the event the kind doesn`t match your demands, make use of the Look for area towards the top of the display to discover the one who does.

- If you are happy with the form, affirm your option by clicking on the Buy now option. Then, pick the costs prepare you favor and provide your accreditations to register to have an accounts.

- Approach the purchase. Utilize your credit card or PayPal accounts to perform the purchase.

- Choose the format and acquire the form on your own device.

- Make alterations. Complete, edit and print out and indication the acquired New Mexico Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership.

Every design you included with your account lacks an expiry time which is yours permanently. So, if you wish to acquire or print out one more duplicate, just visit the My Forms portion and then click in the kind you require.

Get access to the New Mexico Sample Letter for Certificate of Transaction of Business under Fictitious Name - By Partnership with US Legal Forms, by far the most substantial local library of authorized record templates. Use thousands of specialist and express-particular templates that satisfy your small business or personal needs and demands.

Form popularity

FAQ

To change your registered agent in New Mexico, you must complete and file a Statement of Change of Registered Agent form with the New Mexico Secretary of State. The New Mexico Statement of Change of Registered Agent must be submitted by mail or in person and costs $25 for corporations and $20 for LLCs to file.

What are the steps for changing an LLC name in New Mexico? Check if your new LLC name is available. File the Amendment form (and wait for approval) Update the IRS. Update New Mexico Taxation and Revenue Department. Update financial institutions (credit card companies, banks) Update business licenses.

In order to a get a court order changing your name or a child's name, you must file a petition in the District Court in the county where you live. After you file your petition to change the name, you will get a court hearing.

All owners of New Mexico businesses registered as a Partnership, Limited Liability Company or Corporation must obtain a New Mexico CRS Tax ID number.

You can apply for a New Mexico Business Tax Identification Number (NMBTIN) online using the Departments website, Taxpayer Access Point (TAP) . From the TAP homepage, under Businesses select Apply for a New Mexico Business Tax ID. Follow the steps to complete the business registration.

You can also find printed forms: At your local District Office. See the CONTACT US link at the top of this page. At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

If you are a new business, register online with the New Mexico Taxation and Revenue Department to retrieve your CRS Identification Number and filing frequency. Your filing frequency refers to the frequency at which you need to make withholding tax payments to the agency.

New Mexico requires anyone engaged in business in New Mexico to register with the Taxation and Revenue Department. During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number.

Anyone who engages in business in New Mexico must register with the Taxation and Revenue Department. ?Engaging in business? means carrying on or causing to be carried on any activity with the purpose of direct or indirect benefit.

FAQs on New Mexico Business Taxes Yes, New Mexico levies a Gross Receipts Tax on businesses. You can read more about it above. Does New Mexico Have a State Income Tax? Yes, New Mexico currently holds graduated income tax rates ranging from 1.7 percent to 4.9 percent.