New Mexico Subscription Receipt

Description

How to fill out Subscription Receipt?

You have the capability to spend time online searching for the valid document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

You can easily download or print the New Mexico Subscription Receipt from my service.

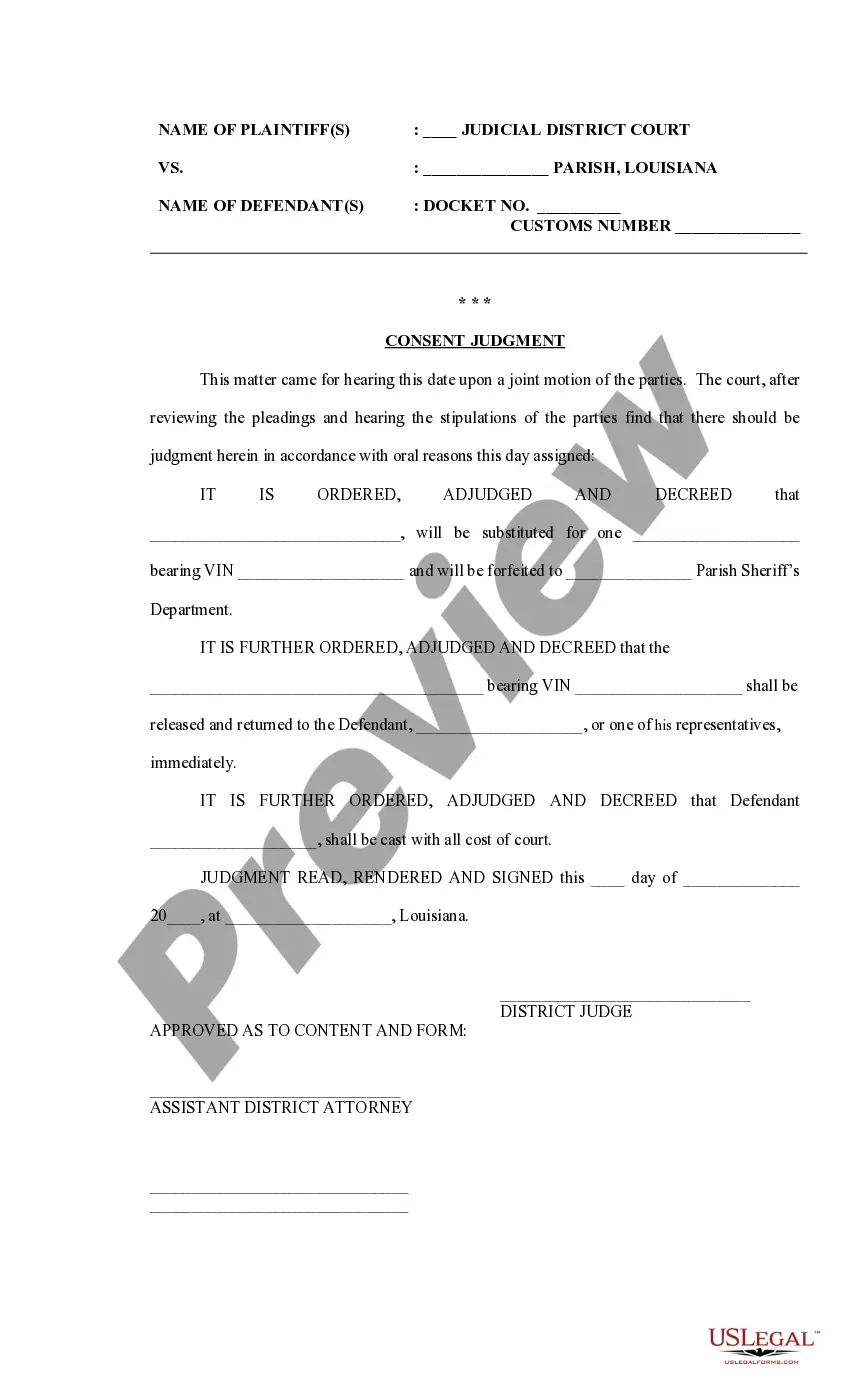

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can sign in and then select the Download button.

- After that, you can complete, modify, print, or sign the New Mexico Subscription Receipt.

- Each legal document template you obtain is yours for life.

- To acquire another copy of the downloaded form, visit the My documents section and click the respective button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/town of your choice.

- Review the form outline to confirm that you have chosen the appropriate form.

Form popularity

FAQ

Yes, New Mexico provides an e-file authorization form that simplifies the electronic filing process for taxes. This form enables faster processing and helps ensure all your filings, including those related to New Mexico Subscription Receipts, are compliant and timely. You can find this form on the New Mexico Taxation and Revenue Department's website.

To find your gross receipts for personal income, add up your sales. Then, subtract your cost of goods sold and sales returns and allowances to get total income. The better your financial records are, the easier the process will be.

The state imposes a governmental gross receipts tax of 5.00% on the receipts of New Mexico state and local governments.

New Mexico is an origin-based state. This means you're responsible for applying the tax rate determined by the ship-from address on all taxable sales.

New Mexico Tax Rates, Collections, and Burdens New Mexico has a 5.125 percent state sales tax rate, a max local sales tax rate of 4.313 percent, and an average combined state and local sales tax rate of 7.84 percent. New Mexico's tax system ranks 28th overall on our 2022 State Business Tax Climate Index.

The governor's initiative will comprise a statewide 0.25 percent reduction in the gross receipts tax rate, lowering the statewide rate to 4.875 percent.

Every person required to file a New Mexico gross receipts tax return must complete and file a TRD-41413 New Mexico Gross Receipts Tax Return. Use the Schedule A, New Mexico Gross Receipts Tax Schedule A if additional space is needed to report gross receipts from multiple locations.

The gross receipts tax rate for purchases made in the metro area ranges from 6.375 to 8.3125 percent throughout the MSA; Albuquerque's Gross Receipts Tax rate is 7.875 percent. The compensation tax (use tax) for purchases made outside New Mexico is 5.125 percent.

Because gross receipts taxes are imposed at intermediate stages of production and do not allow deductions for costs, they are not based on profits or net income (like a corporate income tax) or final consumption (like a well-constructed sales tax).

How GRT Differs From Income Taxes or Franchise Taxes. Some states tax the incomes of businesses, but in most cases that taxable income is net incomesales minus expenses. The gross receipts tax doesn't deduct expenses. Other states have franchise taxes, which are similar to income taxes.