New Mexico Checklist - Leasing vs. Purchasing Equipment

Description

Every lease decision is unique so it's important to study the lease agreement carefully. When deciding to obtain equipment, you need to determine whether it is better to lease or purchase the equipment. You might use this checklist to compare the costs for each option.

How to fill out Checklist - Leasing Vs. Purchasing Equipment?

Have you found yourself in a circumstance where you require documents for both business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but discovering reliable ones is not easy.

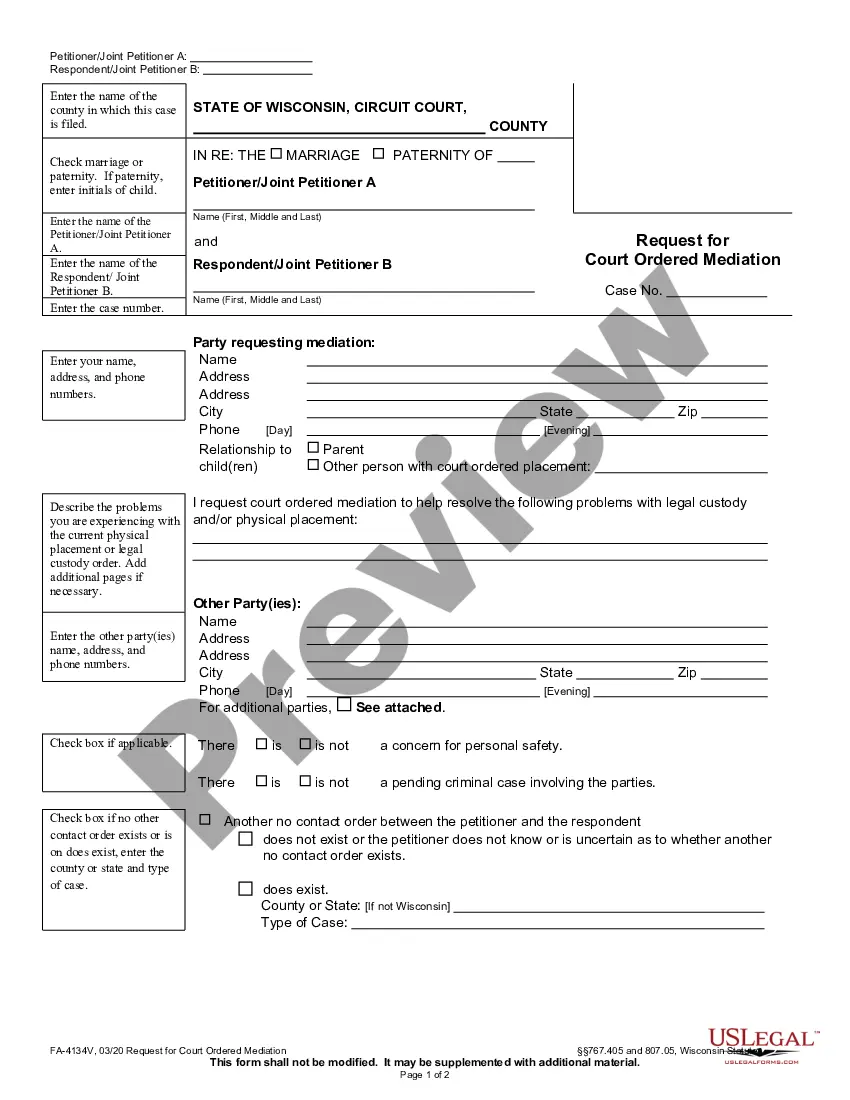

US Legal Forms offers a vast array of form templates, including the New Mexico Checklist - Leasing vs. Purchasing Equipment, which are crafted to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the order with your PayPal or Visa or Mastercard.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Checklist - Leasing vs. Purchasing Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify that it corresponds to the correct city/region.

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that suits your needs and requirements.

- When you find the correct form, click Get now.

Form popularity

FAQ

Before agreeing to a lease, clarity on the terms and total costs is essential. Understand the duration of the lease, payment structure, and any penalties for early termination. Being informed protects you from unexpected fees. The New Mexico Checklist - Leasing vs. Purchasing Equipment can guide you through these crucial considerations.

Leasing can be advantageous as it preserves capital, giving you the flexibility to invest in other areas of your business. It often includes maintenance, reducing your operational burdens. Moreover, leasing allows access to the latest technology without large upfront costs. Utilize the New Mexico Checklist - Leasing vs. Purchasing Equipment to identify how leasing can fit your company’s unique needs.

The critical factor often revolves around your financial situation and equipment usage frequency. If you need the equipment for a short-term project, leasing may be more beneficial. If you plan to use it long-term, purchasing might be the better choice. Always refer to the New Mexico Checklist - Leasing vs. Purchasing Equipment for thorough guidance.

Buying equipment means you own it outright, allowing you to use it without limitations. Leasing, on the other hand, allows you to use the equipment for a specified period while making regular payments. The ownership, maintenance responsibilities, and tax implications differ significantly between the two options. Consult the New Mexico Checklist - Leasing vs. Purchasing Equipment for a detailed comparison of these two approaches.

Deciding to buy or lease a machine depends on your specific business needs. If your operations require long-term use of a machine, purchasing might make sense. However, if you anticipate changing needs or want to utilize the latest technology, leasing could be a better option. Our New Mexico Checklist - Leasing vs. Purchasing Equipment can help clarify your decision-making process.

Leasing provides various benefits compared to buying equipment outright. It often requires lower initial payments and lets your business avoid long-term debt. Furthermore, leases typically include maintenance and support, ensuring that your equipment remains in top condition. For more insights, check our New Mexico Checklist - Leasing vs. Purchasing Equipment to make an informed choice.

Leases are classified for tax purposes as either operating leases or capital leases. Operating leases do not transfer ownership, allowing you to treat payments as deductible expenses. Capital leases, however, can offer you ownership benefits, permitting depreciation of the asset over time. A New Mexico Checklist - Leasing vs. Purchasing Equipment will help you navigate these classifications effectively.

Lease to own agreements are treated as capital leases for tax purposes. This means that you may be able to depreciate the asset while also claiming interest expenses on the financing. In essence, you benefit from both the use of the equipment and potential tax deductions. Make sure to consult a New Mexico Checklist - Leasing vs. Purchasing Equipment to understand how this can affect your overall tax strategy.

For tax purposes, leased equipment is typically treated differently depending on whether it is classified as an operating or capital lease. Operating leases often allow you to deduct lease payments as business expenses, which can lower your taxable income. On the other hand, capital leases require different treatment, as you may be able to depreciate the asset. Using a New Mexico Checklist - Leasing vs. Purchasing Equipment will enhance your understanding of these distinctions.

To record a lease on equipment, start by identifying whether the lease is an operating lease or a capital lease. For operating leases, you will record monthly lease payments as an expense on your income statement. For capital leases, record the asset and liability on your balance sheet. Utilize a New Mexico Checklist - Leasing vs. Purchasing Equipment to ensure you adhere to local regulations and financial reporting standards.