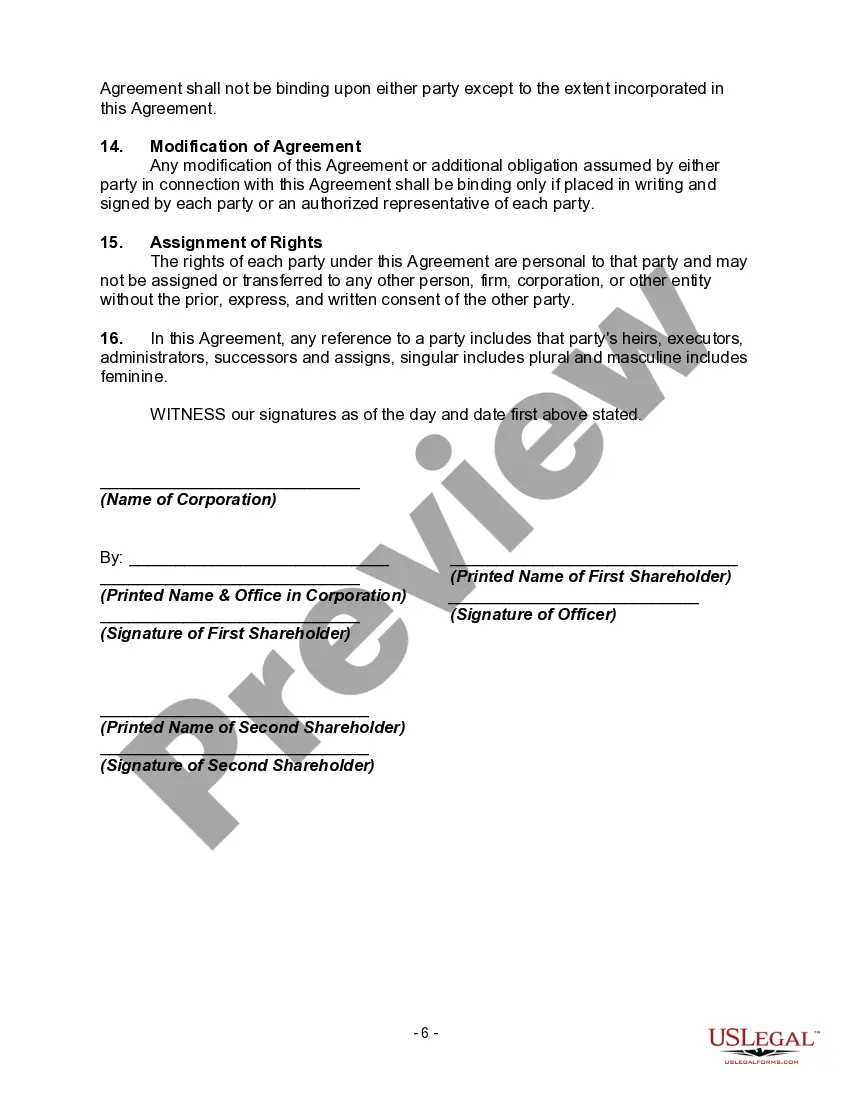

New Mexico Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions

Description

A buy-sell agreement is an agreement between the owners (shareholders) of a firm, defining their mutual obligations, privileges, protections, and rights. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

How to fill out Shareholders' Agreement Between Two Shareholders Of Closely Held Corporation With Buy Sell Provisions?

If you want to thorough, obtain, or printing sanctioned document templates, use US Legal Forms, the largest collection of legal forms, which can be found online.

Utilize the site’s simple and efficient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the New Mexico Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Obtain button to download the New Mexico Shareholders' Agreement between Two Shareholders of Closely Held Corporation with Buy Sell Provisions.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review feature to go through the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A buy and sell agreement is a legally binding contract that stipulates how a partner's share of a business may be reassigned if that partner dies or otherwise leaves the business. Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership.

A buyout agreement can stand on its own or can be several provisions in your written partnership agreement that control the following business decisions: whether a departing partner must be bought out. what price will be paid for the departing partner's interest in the partnership.

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

Establish a market for the corporation's stock that might otherwise be difficult to sell; Ensure that the ownership of the business remains with individuals selected by the owners or remains closely held; Provide liquidity to the estate of a deceased shareholder to pay estate taxes and costs; and.

Events Covered Under a Buyout Agreementa divorce settlement in which a partner's ex-spouse stands to receive a partnership interest in the company. the foreclosure of a debt secured by a partnership interest. the personal bankruptcy of a partner, or. the disability, death, or incapacity of a partner.

Company purchase agreements are essential for transferring the ownership of a business upon a trigger event, such as death or disability. They generally contain the terms and conditions of the sale, including obligations, warranties, and liabilities.

One benefit of a buy-sell agreement is that it outlines terms to ensure the former spouse is compensated. The agreement avoids the risk of having to manage the business alongside a co-owner's ex-spouse or lose control of the company altogether. Tensions are often high in a divorce.

How to set up your buy-sell agreementStart early. Just as you would with any other binding legal document, you'll want to establish a buy-sell agreement as early as you can.Set up ground rules.Take out life insurance policies.Include a valuation clause.Pay attention to taxes.

In general, shareholders can only be forced to give up or sell shares if the articles of association or some contractual agreement include this requirement. In practice, private companies often have suitable articles or contracts so that the remaining owner-managers retain control if an individual leaves the company.

A buyout agreement is a contract between the shareholders of a company. The agreement determines whether a company must buyout a departing shareholder or whether a company has the right to buyout a shareholder when a certain event, such as a shareholder's death, occurs.