New Mexico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

US Legal Forms - among the biggest libraries of authorized kinds in the USA - gives a wide array of authorized file themes you are able to obtain or printing. While using internet site, you can find 1000s of kinds for enterprise and personal uses, sorted by types, says, or keywords.You can get the most recent versions of kinds just like the New Mexico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust in seconds.

If you have a registration, log in and obtain New Mexico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust from the US Legal Forms catalogue. The Acquire option will appear on each type you look at. You have access to all earlier acquired kinds inside the My Forms tab of your account.

If you want to use US Legal Forms for the first time, listed here are straightforward recommendations to help you began:

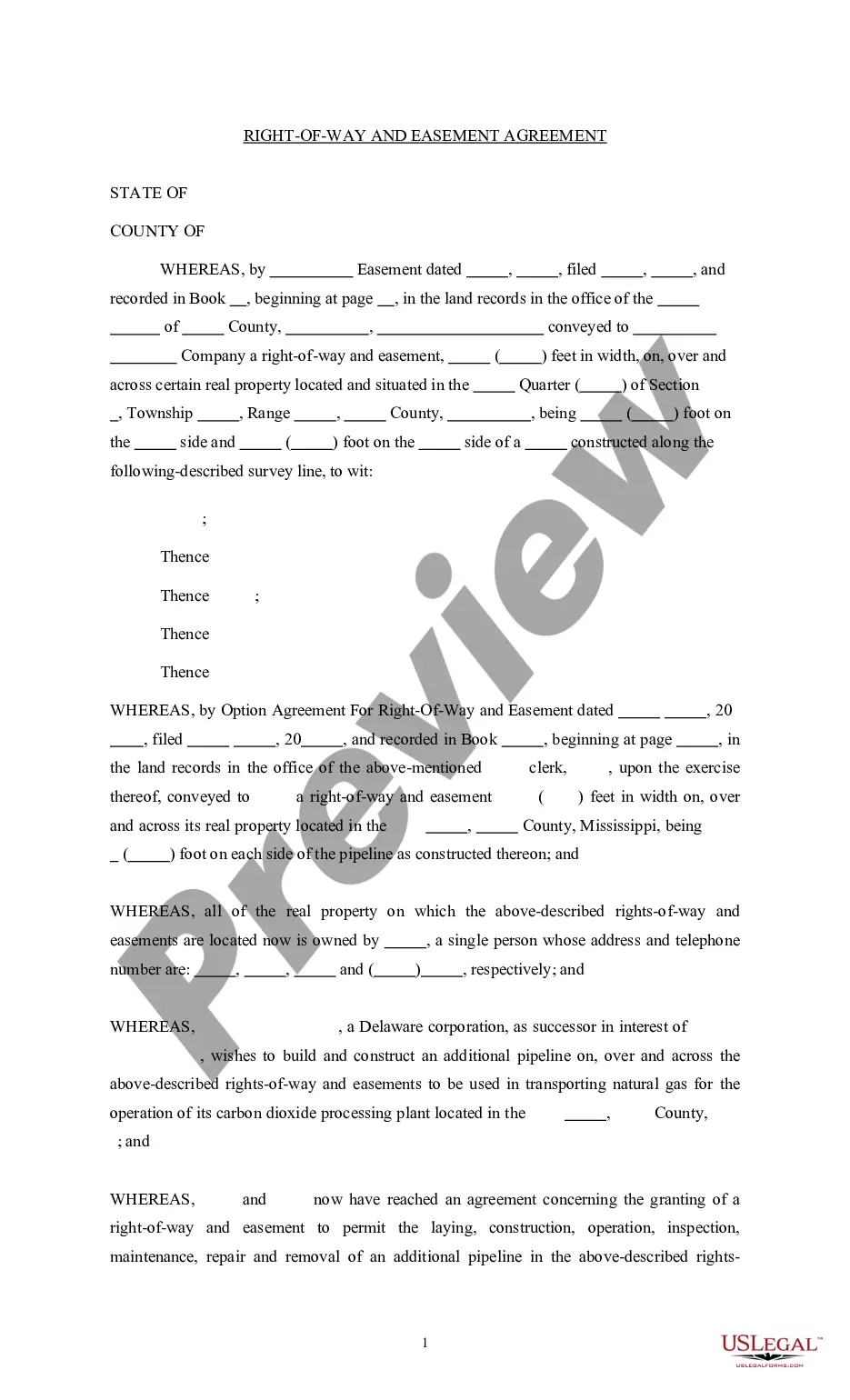

- Make sure you have selected the right type for your city/county. Click the Review option to analyze the form`s articles. Read the type description to ensure that you have selected the right type.

- In case the type does not match your demands, make use of the Look for industry at the top of the monitor to get the one which does.

- Should you be happy with the shape, validate your selection by clicking the Buy now option. Then, choose the prices prepare you favor and offer your qualifications to sign up to have an account.

- Process the financial transaction. Make use of your charge card or PayPal account to perform the financial transaction.

- Choose the formatting and obtain the shape on your product.

- Make modifications. Fill up, change and printing and indication the acquired New Mexico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Each design you included in your bank account does not have an expiry date and is also yours permanently. So, in order to obtain or printing an additional version, just proceed to the My Forms section and click on on the type you want.

Get access to the New Mexico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with US Legal Forms, probably the most comprehensive catalogue of authorized file themes. Use 1000s of specialist and state-certain themes that fulfill your small business or personal needs and demands.

Form popularity

FAQ

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Community Property Law Two items that would not be considered community property, however, are gifts or inheritances?even if that gift was given or that inheritance was received during the marriage.

The information that must be reported on an inheritance disclaimer form includes the name of the person disclaiming the inheritance, the name of the person or entity receiving the inheritance, the relationship of the person disclaiming the inheritance to the deceased, the date of death of the deceased, a description of ...

If you have no spouse and any of your children are alive, they will be the only heirs to your estate. If you die with a spouse and children, your spouse will inherit all community property and 1/4 of your individual property. Your children will inherit 3/4 of your individual property.

For example, if the deceased had significant credit card debt or outstanding medical bills, these debts may be passed on to the beneficiary. In this scenario, it may make sense for the beneficiary to disclaim the inheritance and avoid taking on these financial obligations.

One way for an asset to avoid gift tax liability is if it is a qualified disclaimed gift. The government does not consider a gift or inheritance to be a gift, and it subject to the gift tax if the original recipient refused or disclaimed it.

If you do not have a will, your property may get distributed through intestate procedures. In New Mexico, for any deceased person whose total assets (their estate) exceed a value of $50,000, their will or estate (even without a will) may need to go through probate.

It is an action taken by the beneficiary of an estate or trust to formally give up their right to receive or take a beneficial interest in an asset (or assets) to which they would otherwise be entitled from an estate or trust. A beneficiary can disclaim all or a portion of anything they are earmarked to receive.