New Mexico Assignment of Property in Attached Schedule

Description

How to fill out Assignment Of Property In Attached Schedule?

If you need to finish, retrieve, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Employ the site’s straightforward and user-friendly search to locate the documents you require.

Multiple templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you seek, select the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the New Mexico Assignment of Property in Attached Schedule in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the New Mexico Assignment of Property in Attached Schedule.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for your correct city/state.

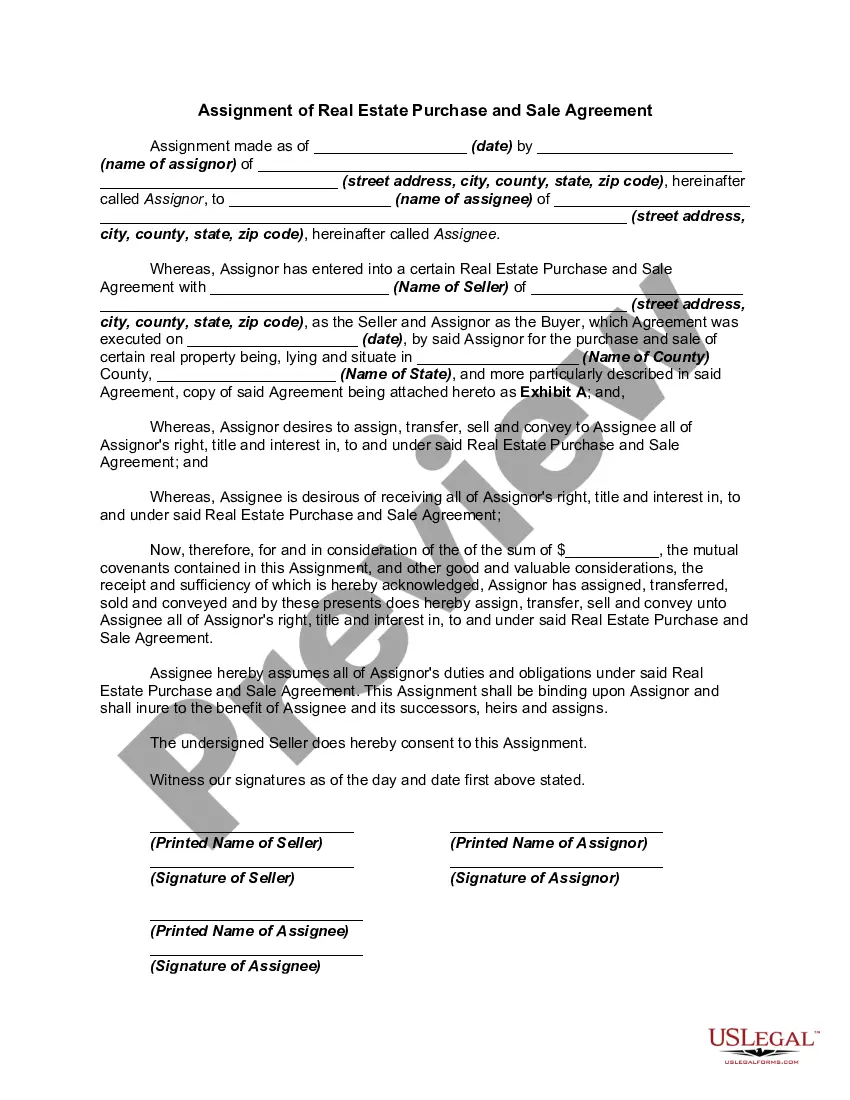

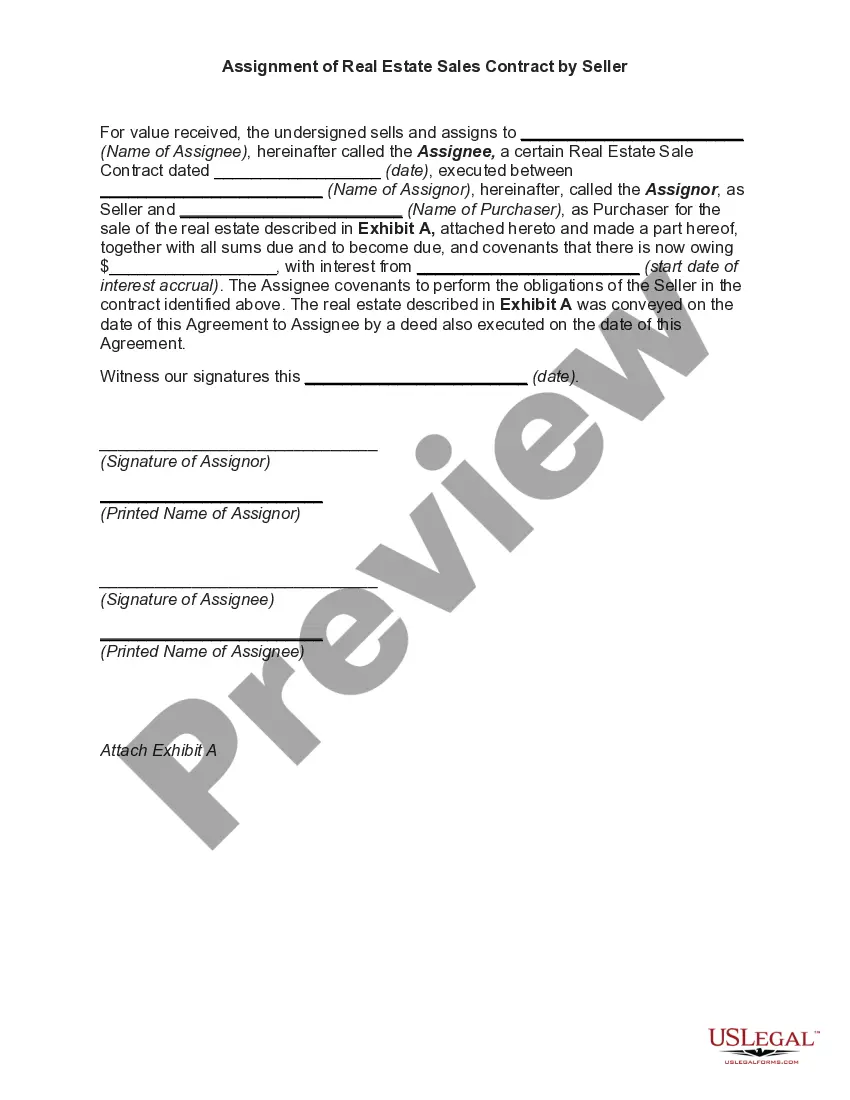

- Step 2. Use the Preview feature to review the form’s content. Be sure to read the overview.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the page to find other versions of the legal form template.

Form popularity

FAQ

New Mexico does not impose a state gift tax; however, federal gift tax regulations may still apply when gifts exceed certain thresholds. It is essential to remain aware of these limits to avoid complications. For assistance with your New Mexico Assignment of Property in Attached Schedule and understanding potential tax impacts, consult the resources available on US Legal Forms.

To gift property in New Mexico, execute a deed that indicates your intention to transfer ownership, and ensure it is signed and recorded. It’s essential to disclose the gift nature clearly to simplify potential tax concerns. For a smooth process while managing your New Mexico Assignment of Property in Attached Schedule, consider using US Legal Forms to access appropriate resources.

Transferring a property deed in New Mexico typically requires completing the deed form, having it signed by the appropriate parties, and then recording it with the county clerk. This official process ensures the change in ownership is recognized legally. Helpfully, US Legal Forms can provide you with the exact templates needed to go through your New Mexico Assignment of Property in Attached Schedule effortlessly.

For a property transfer to qualify as a gift, it must be given voluntarily without any expectation of receiving something in return. This donation of property requires clear intentions documented properly through legal means. If you’re managing your New Mexico Assignment of Property in Attached Schedule, consult US Legal Forms to ensure all aspects are covered.

Schedule Pit B is a form utilized in New Mexico for reporting interests that warrant special treatment under tax laws. This schedule typically applies to property transfers that may have tax implications. Understanding how this relates to your New Mexico Assignment of Property in Attached Schedule is vital, and US Legal Forms can provide clarity and the forms you may need.

Transferring a property title in New Mexico involves executing a deed that clearly states the transfer and the names of both the granter and grantee. You need to record this deed with the county clerk where the property is located. Consider using US Legal Forms to acquire the correct documentation for your New Mexico Assignment of Property in Attached Schedule, which simplifies the entire transfer process.

To file a lien on a property in New Mexico, you must complete the necessary lien form and file it with the appropriate county clerk's office. Ensure that your lien is accompanied by the required documents and fees, as this will help enforce your claim. Utilizing the US Legal Forms platform can guide you through this process efficiently, especially when tackling your New Mexico Assignment of Property in Attached Schedule.

Business personal property includes assets such as machinery, equipment, office furniture, and tools used for business operations. These items are essential for running a business, and they can vary in value significantly. When documenting these assets under the New Mexico Assignment of Property in Attached Schedule, clarity is critical to ensure accurate taxation. Proper classification helps protect your business and enhances financial management.

You can look up tax liens in New Mexico through the county clerk's office or online databases provided by the New Mexico Taxation and Revenue Department. This search provides insight into any outstanding business liabilities. Understanding your liens is crucial for managing your assets linked with the New Mexico Assignment of Property in Attached Schedule. Accurate records prevent complications in future transactions.

Several states do not impose business personal property taxes. Among these are Florida, Texas, and Nevada, which may appeal to entrepreneurs. If you're considering either relocating or managing properties across state lines, understanding the implications of the New Mexico Assignment of Property in Attached Schedule is vital. It is important to consult local tax rules for clarity.