New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits

Description

How to fill out Affidavit Of Domestic Partnership For Employer In Order To Receive Benefits?

If you wish to finish, obtain, or print sanctioned document templates, utilize US Legal Forms, the primary assortment of legal forms, accessible on the web.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now option. Choose the pricing plan you prefer and enter your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Employ US Legal Forms to find the New Mexico Affidavit of Domestic Partnership for Employer to Obtain Benefits in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire option to access the New Mexico Affidavit of Domestic Partnership for Employer to Obtain Benefits.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

In New Mexico, couples seeking to enter into a domestic partnership must fulfill certain conditions, such as being at least 18 years old and sharing a residence. Furthermore, both partners must submit a signed Declaration of Domestic Partnership to the appropriate authority. If you're pursuing a New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, ensure you follow these guidelines to strengthen your application's validity.

To determine if your girlfriend qualifies as a domestic partner, you need to consider your living situation, mutual commitment, and the legal requirements of your state. Generally, you must have been living together for a specific period and share a domestic life. For clarity on how to fill out a New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, consulting legal resources can offer invaluable guidance.

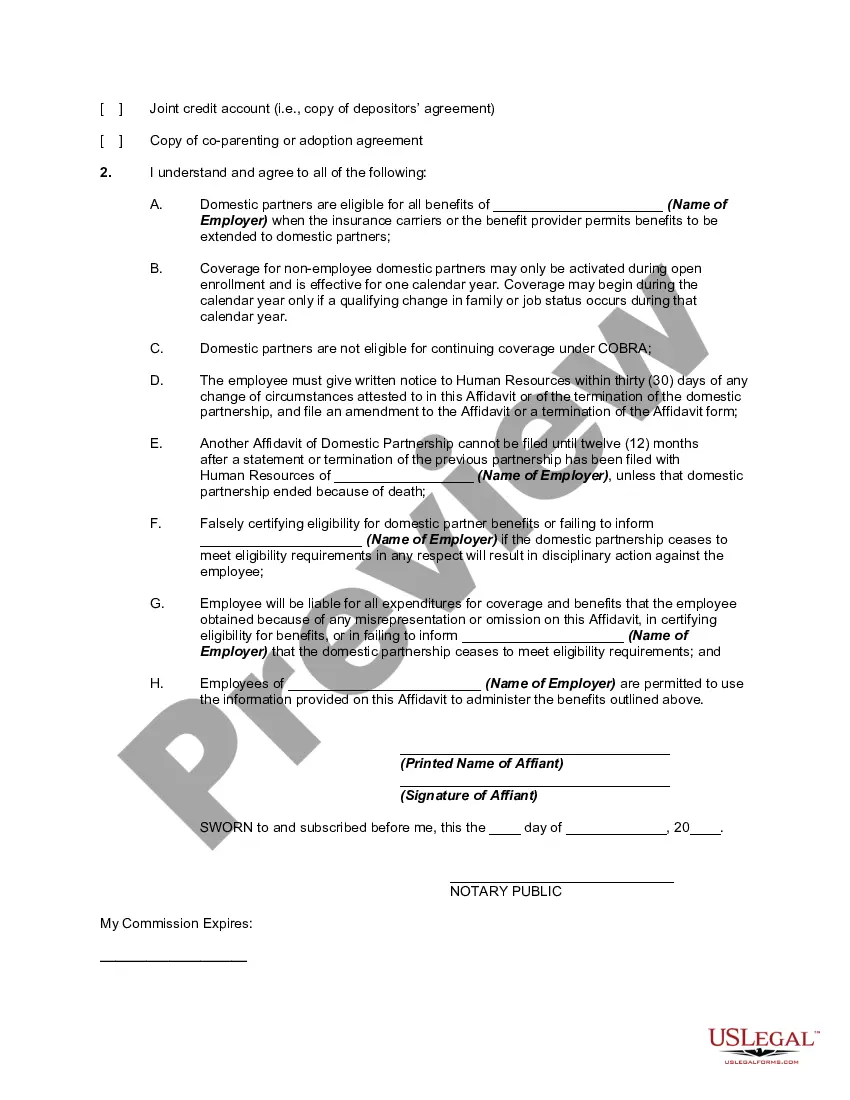

A domestic partner affidavit is a sworn statement declaring that two individuals meet the criteria to be considered domestic partners. This document often serves as proof when applying for benefits related to employment, healthcare, and more. If you are looking to submit a New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, using a reliable platform like uslegalforms can simplify the process significantly.

A declaration of domestic partnership is a legal document stating that two individuals are in a committed relationship and wish to receive certain benefits typically reserved for married couples. This document enables partners to access health benefits, insurance, and other employment-related advantages. If you're looking for a New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, understanding this declaration is fundamental for securing those rights.

In New York, a couple must meet specific criteria to establish a domestic partnership. These include living together for at least six months, sharing a common residence, and being at least 18 years old. Additionally, both partners must sign a domestic partnership agreement. For those seeking a New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, it's essential to understand your state's regulations and how they may differ.

The filing status for domestic partners often depends on the recognition of the partnership by the state. In states like New Mexico, partners may still need to file as singles or possibly as head of household, but not as married. If you complete the New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits, it may help clarify your tax benefits and obligations. Always check with a tax professional for the best options based on your specific circumstances.

If you and your partner live together but are not married, you generally file taxes as individuals. To maximize your benefits, consider completing the New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits if applicable. This affidavit can help establish your relationship when seeking tax benefits that might otherwise be unavailable. Consulting a financial advisor can guide you through the right choices for your tax situation.

Typically, domestic partners file taxes as single unless they choose to file jointly in states that recognize domestic partnerships. Because your domestic partnership is not considered a marriage federally, it may limit your options for filing. However, the New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits can streamline some tax benefits for domestic partners. Always verify with a tax professional to ensure compliance with state and federal regulations.

Domestic partner relationship status refers to a legal designation acknowledging a committed partnership between two individuals. This status can provide benefits similar to marriage, applicable for health care, taxes, and inheritance, though it may vary by state. In New Mexico, filing a New Mexico Affidavit of Domestic Partnership for Employer in Order to Receive Benefits is often necessary to obtain such recognition. This formal acknowledgment can be key in accessing essential rights and benefits.

While domestic partnerships offer many benefits, they can also come with disadvantages. Unlike marriage, a domestic partnership may lack certain federal benefits and protections, such as social security benefits. Additionally, the state may impose stricter requirements or limitations, which can affect legal standing in various matters. Always consider these factors carefully before entering a domestic partnership.