New Mexico Property Information Check List - Residential

Description

How to fill out Property Information Check List - Residential?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal template categories available for acquisition or printing.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of documents such as the New Mexico Property Information Checklist - Residential within moments.

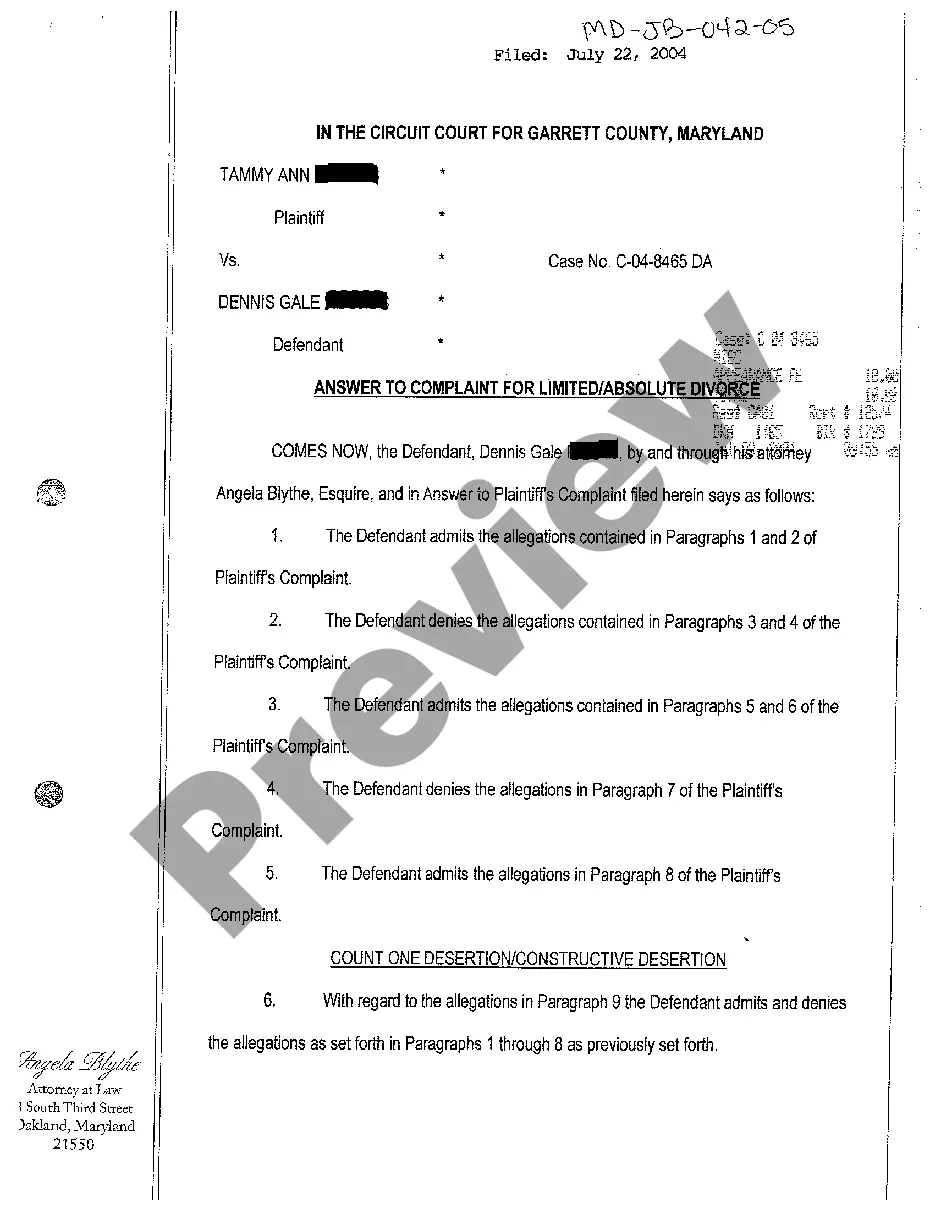

Click the Preview button to examine the form's content. Review the form description to confirm you have chosen the right one.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you already have a subscription, Log In and obtain the New Mexico Property Information Checklist - Residential from the US Legal Forms library.

- The Acquire button will appear on every form you view.

- You can access all previously saved documents in the My documents tab of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to get started.

- Ensure that you have selected the correct form for your city/state.

Form popularity

FAQ

To calculate property taxes in New Mexico, you need to know the property’s assessed value and the local tax rate. The tax rate varies by county and is applied to the assessed value of the property. Incorporating accurate calculations into your New Mexico Property Information Check List - Residential will help you plan your finances and make informed decisions.

Filling out a New Mexico warranty deed requires specific details, such as the names of the grantor and grantee, a description of the property, and the signature of the grantor. It is crucial to follow New Mexico's legal requirements, so consider using resources like USLegalForms to simplify the process. A well-prepared warranty deed is an essential part of your New Mexico Property Information Check List - Residential.

Certain individuals may be exempt from paying property taxes in New Mexico, including veterans, disabled persons, and those age 65 and older. Additionally, some properties used for specific purposes may qualify for exemptions. Understanding these exemptions can enhance your New Mexico Property Information Check List - Residential, ensuring you gather all necessary details.

Currently, New Mexico does not tax Social Security benefits. However, tax laws are subject to change. To stay informed, check with your local tax authority or consult a tax professional. This information is important to include in your New Mexico Property Information Check List - Residential.

In New Mexico, abandoned property laws stipulate that property left unattended for a specified period may become the state's property. The conditions defining abandonment vary depending on the type of property involved. Knowing these regulations can protect your rights, so using the New Mexico Property Information Check List - Residential will enhance your understanding of how abandoned property is classified and handled.

To report unclaimed property in New Mexico, you can file a claim with the Office of the State Treasurer. This process involves submitting required documentation to prove ownership. For a comprehensive overview on how to report unclaimed property efficiently, refer to the New Mexico Property Information Check List - Residential, which provides step-by-step instructions and necessary forms.

Generally, unclaimed property does not need to be reported as taxable income until it is claimed. However, once you receive the funds or assets, they could be subject to taxation. It is essential to stay informed about how this may impact your finances, so keep the New Mexico Property Information Check List - Residential handy for guidance in understanding your responsibilities regarding unclaimed properties.

In New Mexico, seniors aged 65 and older may qualify for a property tax exemption, which can provide relief from property taxes. This exemption is available for their primary residence, helping many seniors manage their financial resources better. It is beneficial to familiarize yourself with the New Mexico Property Information Check List - Residential to understand eligibility criteria and application steps for this exemption.

The dormancy period for unclaimed property in New Mexico typically lasts three years for most types of property. This means if you do not engage with your asset for three years, it may be classified as unclaimed. After this period, the property can be reported and turned over to the state. Referencing the New Mexico Property Information Check List - Residential will provide you with detailed information on various property types and their dormancy periods.

When you file a claim for unclaimed property, you initiate a process to recover assets that belong to you. The state reviews your claim to verify your identity and ownership of the property. Once approved, you will receive the property or its equivalent value. Our New Mexico Property Information Check List - Residential can help guide you through the steps to ensure a smooth claim process.