New Mexico Revocable Trust for Estate Planning

Description

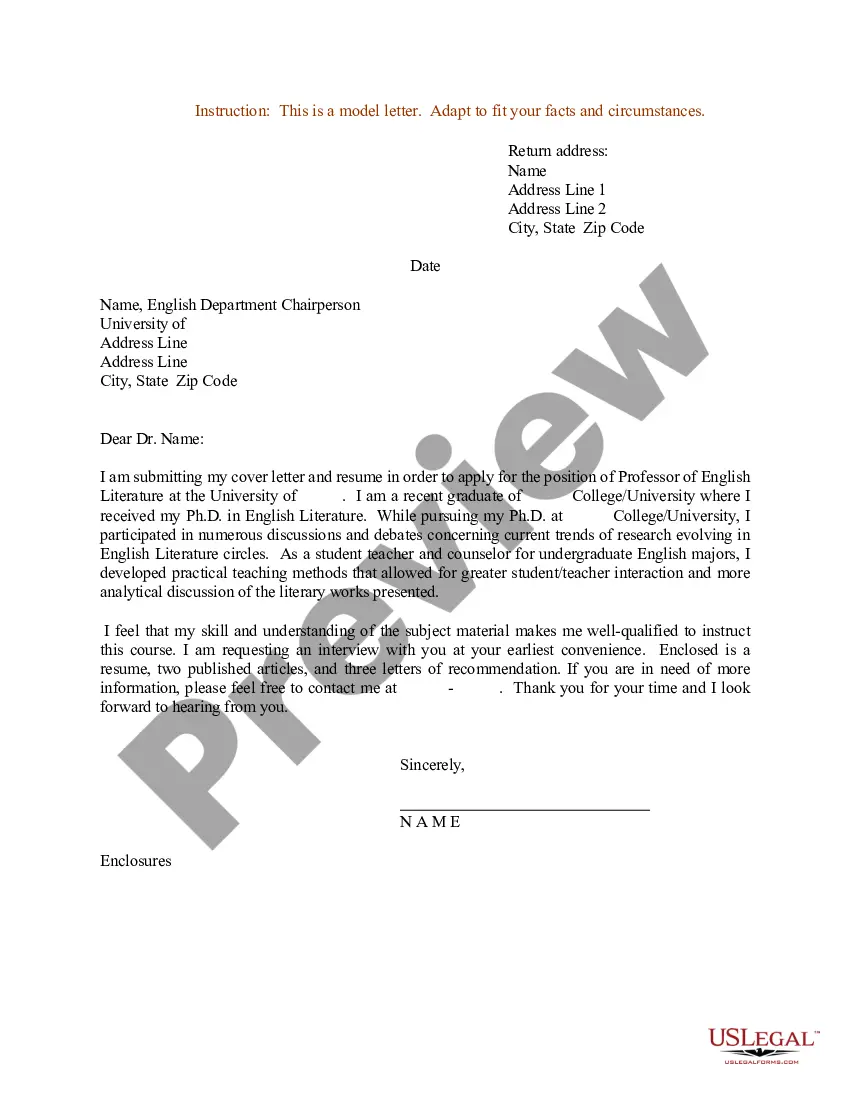

How to fill out Revocable Trust For Estate Planning?

If you require to sum up, procure, or print authentic document templates, utilize US Legal Forms, the most extensive assortment of legal forms, accessible online.

Take advantage of the website's simple and user-friendly search feature to find the documents you need.

Many templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the New Mexico Revocable Trust for Estate Planning in just a few clicks.

Every legal document template you acquire is yours to keep indefinitely.

You have access to every form you purchased in your account. Click on the My documents section and select a form to print or download again. Stay competitive and acquire, and print the New Mexico Revocable Trust for Estate Planning with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to obtain the New Mexico Revocable Trust for Estate Planning.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you're using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Review method to check the form's content. Don't forget to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other versions in the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Mexico Revocable Trust for Estate Planning.

Form popularity

FAQ

Some assets, like certain retirement accounts, cannot be placed into a trust until specific conditions are met. For example, moving these assets may have tax implications or penalties. A New Mexico Revocable Trust for Estate Planning can still complement your overall estate plan while ensuring that those assets are managed appropriately. It's crucial to understand the implications of each asset and consult with a professional for guidance.

An irrevocable trust generally cannot include assets the grantor wants to retain control over after establishing the trust. Once you transfer assets into an irrevocable trust, you typically relinquish ownership and control. Analyze your long-term goals when considering a New Mexico Revocable Trust for Estate Planning, as flexibility is often a priority during estate planning.

You should avoid placing assets that could jeopardize your financial security in your trust. Items like personal possessions that lack value or assets with high associated costs may not be ideal for a New Mexico Revocable Trust for Estate Planning. Additionally, keep in mind that certain debts and liabilities should remain outside the trust. Consult with a professional to develop a clear strategy for your trust.

Generally, certain assets cannot be placed in a trust, including specific retirement accounts and some insurance policies. However, a New Mexico Revocable Trust for Estate Planning can accommodate most personal assets like real estate, bank accounts, and investments. To maximize your estate plan, consult with a legal expert to identify which of your assets can be effectively placed in the trust.

One of the biggest mistakes parents make is failing to fund the trust after establishing it. A New Mexico Revocable Trust for Estate Planning is only effective if assets are transferred into it. Without proper funding, the trust cannot serve its purpose, leading to potential complications for your heirs. Regularly review and update your trust to ensure it aligns with your current financial situation.

To avoid probate in New Mexico, consider establishing a New Mexico Revocable Trust for Estate Planning. This type of trust allows your assets to bypass the probate process, making the transition smoother for your heirs. By funding your trust with your assets, you ensure they are distributed according to your wishes without court intervention. Additionally, review your beneficiary designations on accounts to support your estate planning goals.

Yes, you can place gold in a New Mexico Revocable Trust for Estate Planning. Gold, as a tangible asset, can be included in your trust to ensure its proper management and distribution according to your wishes. When you transfer gold into the trust, you maintain control over it during your lifetime. This approach can also help protect the asset for your beneficiaries from taxes or probate.

Having a trust in New Mexico can simplify estate planning and provide peace of mind. A New Mexico Revocable Trust for Estate Planning allows you to manage your assets during your lifetime and dictate how they are distributed after your passing. It can help you avoid probate, ensuring your loved ones receive their inheritance promptly. Consider consulting with a legal professional to determine if a trust fits your specific needs.

A disadvantage of a family trust is that it may create disputes among family members if they feel entitled to different assets or benefits. In the context of a New Mexico Revocable Trust for Estate Planning, clear guidelines and open discussions about the trust's intentions can minimize misunderstandings. However, without careful planning and communication, a family trust can lead to tension and conflict in family dynamics.

Setting up a trust can have pitfalls such as overlooking critical details during creation and funding. Failing to transfer assets into the trust or not updating the trust with life changes can lead to complications. Utilizing a New Mexico Revocable Trust for Estate Planning can help avoid these issues, but it's essential to work with experienced professionals to ensure everything is completed correctly.