New Mexico Office Sharing Agreement

Description

How to fill out Office Sharing Agreement?

You can spend hours online searching for the valid document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that are vetted by experts.

You can easily download or print the New Mexico Office Sharing Agreement from their service.

If available, make use of the Review button to examine the document template as well.

- If you have an account with US Legal Forms, you can Log In and click on the Acquire button.

- Then, you can fill out, modify, print, or sign the New Mexico Office Sharing Agreement.

- Every legal document template you purchase is yours to keep indefinitely.

- To obtain another copy of the purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for your chosen county/city.

- Check the form description to ensure you have chosen the right one.

Form popularity

FAQ

New Mexico does not tax Social Security benefits, providing some relief for retirees. However, retirement income from pensions or annuities may be subject to taxation. Always check your income sources to determine tax requirements fully. For those entering agreements like New Mexico Office Sharing Agreements, understanding tax implications can be crucial, and resources from U.S. Legal Forms can guide you.

To become a property manager in New Mexico, you typically need to obtain a real estate license, along with relevant education in property management. It's also helpful to have experience in landlord-tenant laws and strong organizational skills. Effective property management ensures compliance with state regulations, particularly with rental agreements, including New Mexico Office Sharing Agreements. Utilize assets from U.S. Legal Forms to better understand the necessary documents.

Yes, if you earn income in New Mexico, you are generally required to file a state tax return. This applies to residents as well as non-residents who earn income sourced from within the state. Understanding your tax obligations is crucial, especially for business agreements like New Mexico Office Sharing Agreements. For guidance on filing, U.S. Legal Forms provides valuable resources.

You can get New Mexico tax forms from the official website of the New Mexico Taxation and Revenue Department. Additionally, paper forms are available in various public locations, such as libraries and tax offices. If you have specific needs surrounding tax filings related to business operations, including New Mexico Office Sharing Agreements, U.S. Legal Forms offers comprehensive resources to assist you.

A property manager in New Mexico must provide a written tenancy agreement to a new tenant before occupancy begins. This agreement should outline all terms of the lease, including duration, rent amount, and rules. Having a clear tenancy agreement is vital to protect both the tenant and the property owner. For easily customizable agreements, including New Mexico Office Sharing Agreements, consider using the templates available at U.S. Legal Forms.

Tax forms in New Mexico are available online through the New Mexico Taxation and Revenue Department's website, as well as in physical locations such as their local offices. Furthermore, you can often find forms at libraries and some municipal buildings. If you are dealing with specific forms related to business agreements like New Mexico Office Sharing Agreements, U.S. Legal Forms has a comprehensive library that could help.

In New Mexico, tenants are required to provide at least 30 days notice before moving out for most month-to-month rental agreements. For fixed-term leases, the notice requirement may depend on the terms outlined in the lease itself. This allows landlords enough time to find new tenants. If you are involved in a New Mexico Office Sharing Agreement, it's essential to clearly specify notice requirements within your contract.

Renters in New Mexico are protected by laws that cover various aspects of the rental agreement, including security deposits, eviction procedures, and tenant rights. It is important for tenants to understand these laws to ensure they are treated fairly. Resources on the rights and responsibilities of renters under New Mexico laws can be found at local legal aid organizations. For agreements such as New Mexico Office Sharing Agreements, it is advisable to consult legal forms on U.S. Legal Forms tailored to your needs.

You can pick up paper tax forms at local offices of the New Mexico Taxation and Revenue Department. Additionally, most public libraries and some post offices may carry these forms. To ensure you have the correct forms needed for your filing, consider visiting the official website of the New Mexico Taxation and Revenue Department. If you need assistance with specific forms related to New Mexico Office Sharing Agreements, U.S. Legal Forms provides detailed resources.

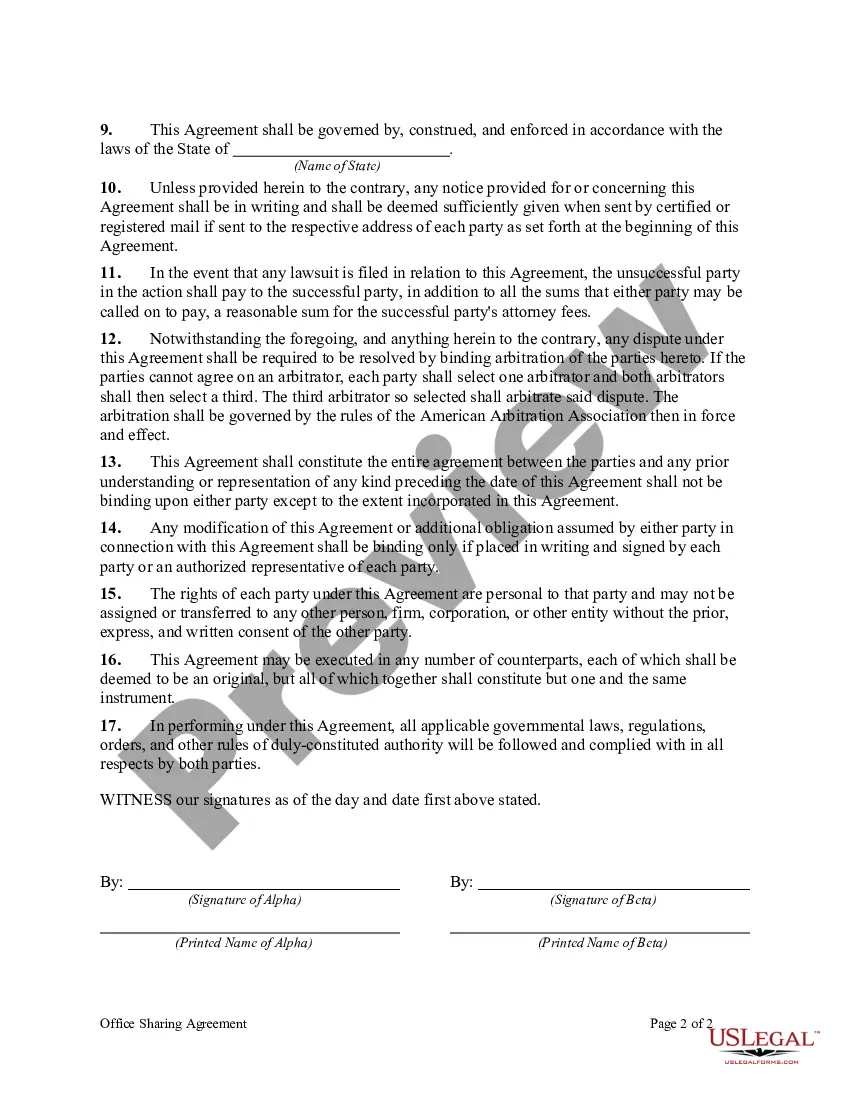

Yes, you can create your own lease agreement for a New Mexico Office Sharing Agreement. However, it’s crucial to ensure that your lease complies with local laws and includes all necessary elements for legality. If you feel uncertain about drafting this document, consider using resources available through U.S. Legal Forms, which can guide you in creating a comprehensive and compliant lease agreement.