An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

Are you in a location where you will require documents for either professional or personal purposes almost every time.

There are numerous legal document templates available online, but finding forms you can rely on isn’t straightforward.

US Legal Forms offers thousands of form templates, such as the New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, which can be designed to meet federal and state requirements.

You can find all the document templates you have purchased in the My documents section.

You can obtain another copy of New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary at any time if needed. Just click on the necessary form to download or print the document template. Use US Legal Forms, one of the most extensive selections of legal documents, to save time and prevent errors. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/region.

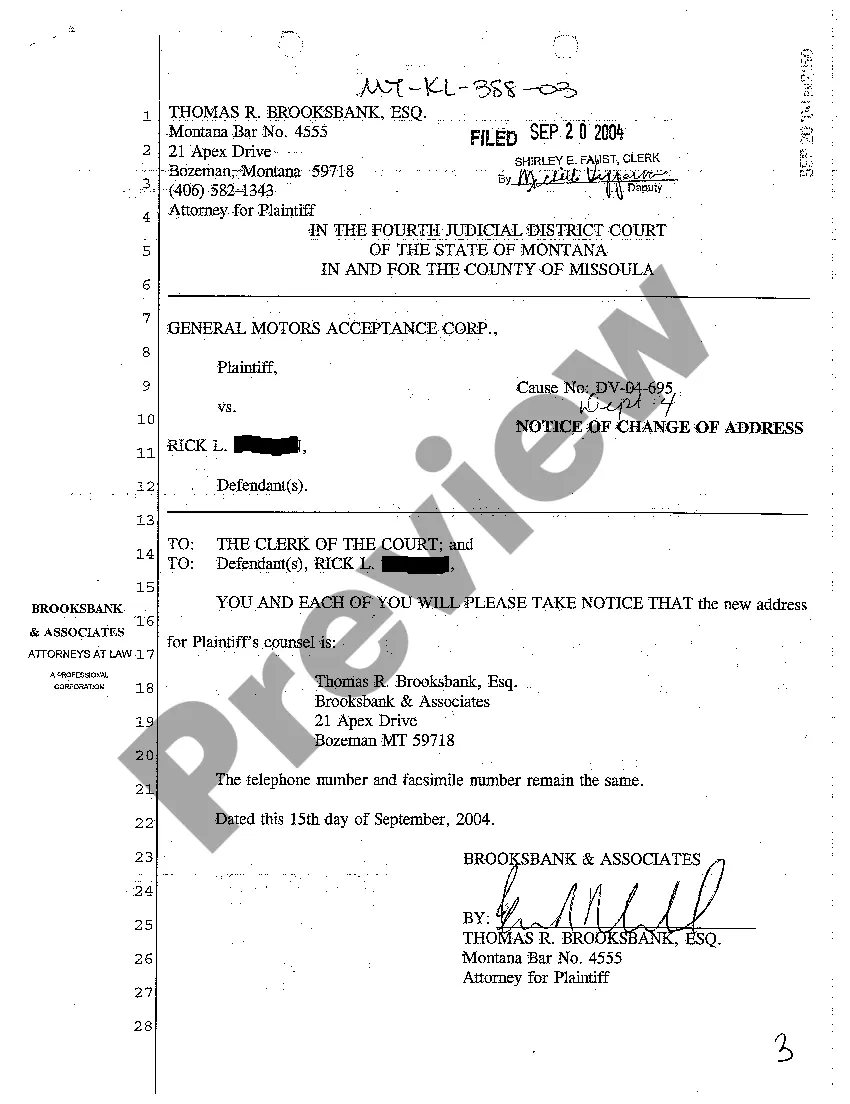

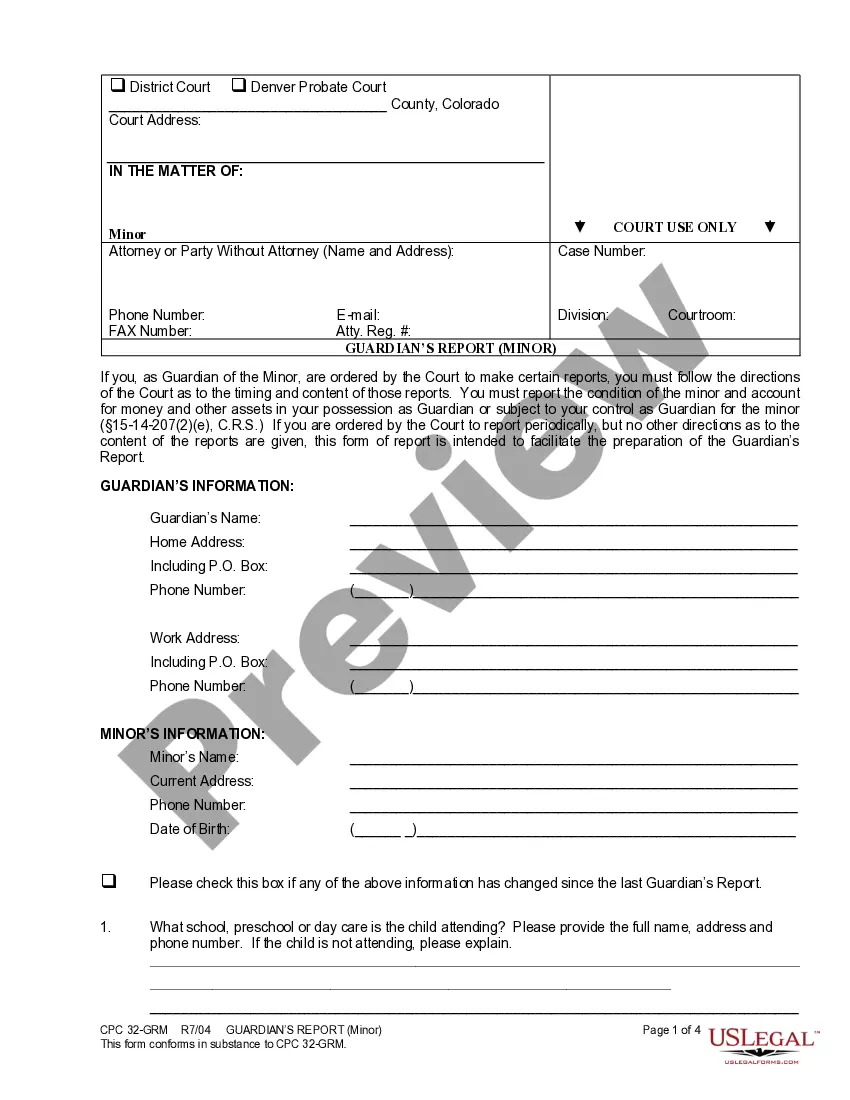

- Use the Review button to check the form.

- Review the details to ensure that you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that suits your needs and requirements.

- If you find the appropriate form, click on Get now.

- Choose the pricing plan you want, fill in the required details to create your account, and pay for the transaction using PayPal or credit card.

- Select a convenient paper format and download your copy.

Form popularity

FAQ

Naming a trust as a beneficiary for a life insurance policy often creates administrative burdens, as it requires careful management of the trust’s terms and distributions. Additionally, the life insurance payout may be subject to estate taxes, which could diminish the intended benefits for your heirs. Instead, consider the New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to streamline your approach and secure more favorable outcomes for your beneficiaries.

A trust can complicate the distribution process, leading to potential delays and increased administrative costs. When a trust is a beneficiary, it may be subject to taxation, hindering the financial advantages it is meant to provide. By utilizing a New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, you can simplify your estate planning and ensure that your assets are effectively transferred to the intended parties.

In New Mexico, a beneficiary may assign their interest in the trust to another individual, but this action often requires consent from the trustee and adherence to the trust's terms. It is vital to examine any restrictions within the trust document to ensure that such assignments are allowed and executed correctly. Engaging a legal professional can help clarify the process and facilitate a smooth assignment of interest, if necessary.

Naming a trust can lead to disadvantages, particularly regarding administrative burdens and costs associated with maintaining the trust. The ongoing need for legal advice, tax filings, and potential disputes among beneficiaries may require time and resources that could detract from the estate's overall value. Therefore, it's crucial to weigh these factors against the benefits of having a trust as part of your New Mexico estate planning.

One disadvantage of naming a trust as a beneficiary can be the complexity involved in managing the trust and its assets. This arrangement may require ongoing legal and administrative oversight, which could incur costs and fees over time. Additionally, the specific terms of the trust may limit the immediate access your beneficiaries have to the funds, potentially affecting their financial situations in the short term.

The beneficiaries' interests in a trust refer to their rights to receive benefits from the trust as outlined in the trust document. This interest can vary significantly based on the terms set by the trust creator, including when and how distributions are made. It's essential to define these interests clearly in your trust to prevent disputes among beneficiaries and ensure that your wishes are honored.

When a trust is named as a beneficiary, the assets typically pass directly to the trust, bypassing probate. This means that the terms of the trust govern how the funds are distributed to your beneficiaries, often protecting the assets from creditors and ensuring that they are managed according to your wishes. Ultimately, this arrangement supports a smoother transition for your loved ones, as they will receive their benefits according to the set conditions.

In New Mexico, a will is a legal document that specifies how your assets will be distributed upon your death, while a trust manages those assets during your lifetime and beyond. With a trust, you can place conditions on asset distribution, which provides more control over how your beneficiaries receive their inheritance. Additionally, trusts often avoid the probate process, making it a more efficient option for many people.

A beneficiary interest in a trust refers to the legal right or entitlement to receive assets from the trust upon certain conditions or events. In the context of the New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is crucial to understand how these interests are defined and managed. Understanding beneficiary interests helps in navigating trust distributions smoothly and ensures clarity in the process.

To effectively fill out a beneficiary designation, use your New Mexico Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary as a guide. Provide each beneficiary's full name, relationship to you, and their percentage of interest. After completing the designation, double-check for accuracy to ensure your wishes are honored.