New Mexico Revocable Trust Agreement - Grantor as Beneficiary

Description

How to fill out Revocable Trust Agreement - Grantor As Beneficiary?

If you wish to finalize, download, or print legal document formats, utilize US Legal Forms, the most extensive collection of legal templates available online.

Employ the site’s user-friendly and efficient search feature to locate the documents you need.

A range of formats for business and personal purposes is categorized by type and description, or by keywords and phrases.

Step 4. Once you have found the form you need, select the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use a credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to find the New Mexico Revocable Trust Agreement - Grantor as Beneficiary in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Purchase button to locate the New Mexico Revocable Trust Agreement - Grantor as Beneficiary.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

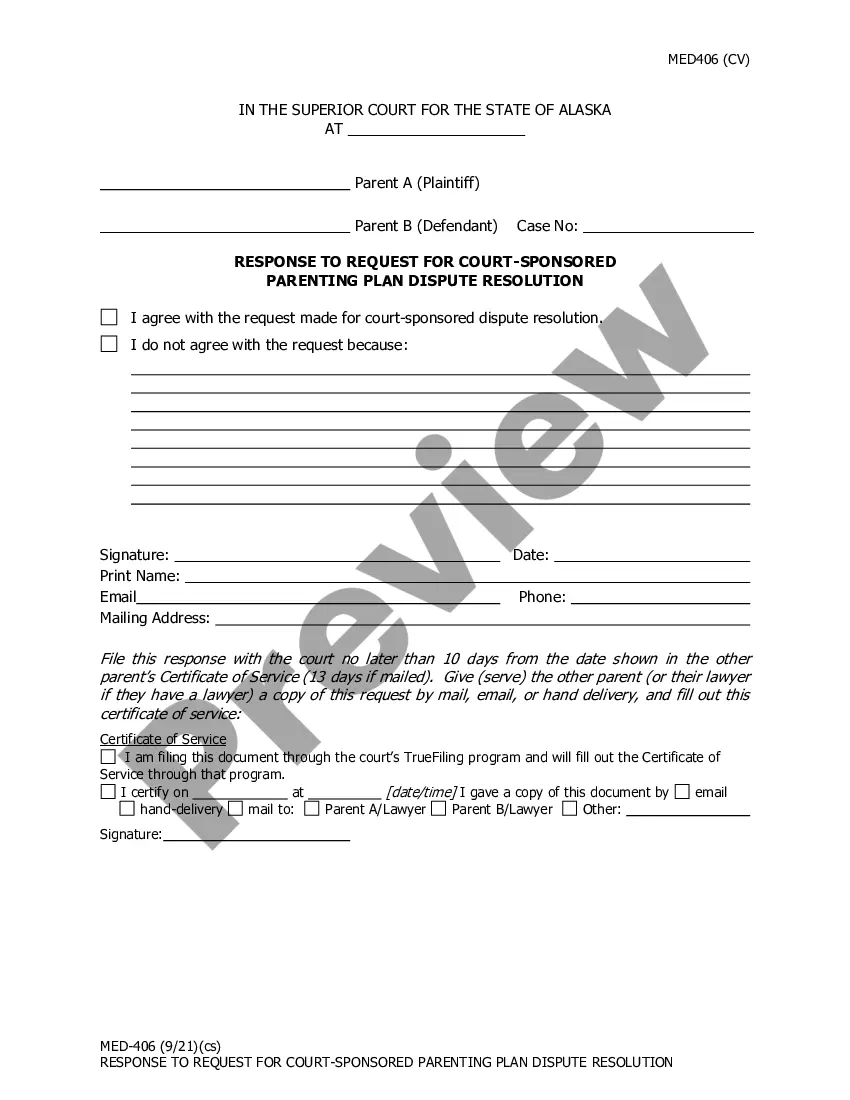

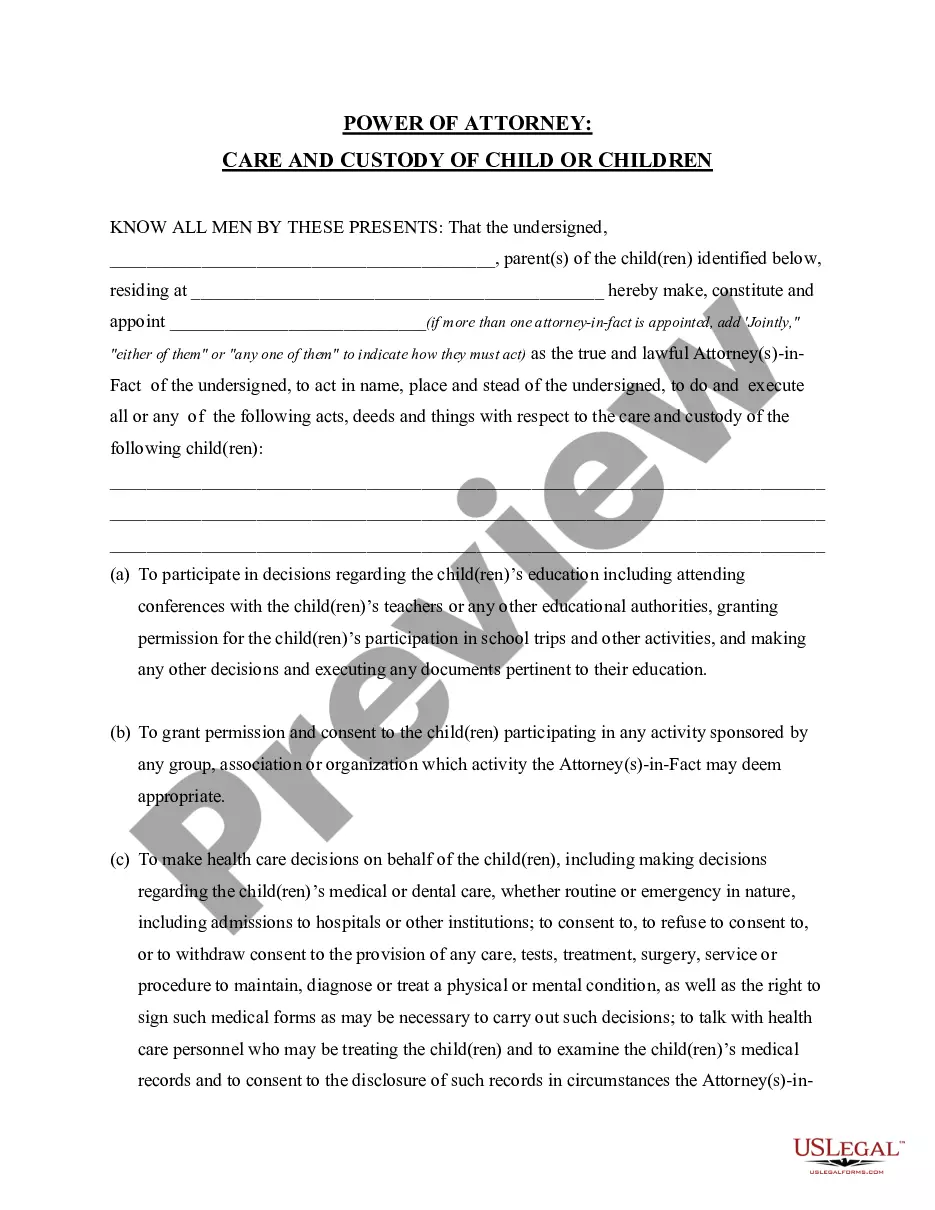

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Certainly, a grantor can also be a beneficiary of their own trust. This feature can provide flexibility in managing assets and distributing them according to your wishes. When creating a New Mexico Revocable Trust Agreement - Grantor as Beneficiary, it's essential to understand how this arrangement works to protect your interests while ensuring your beneficiaries' needs are also met.

To put a house in a trust in New Mexico, you need to prepare a deed that transfers the property to the trust. This process involves filling out the correct forms and submitting them to your local county clerk. Using a New Mexico Revocable Trust Agreement - Grantor as Beneficiary simplifies this process, offering a clear framework for managing your property and making it easier to transfer assets.

Yes, a grantor trust can make distributions to its beneficiaries. The grantor typically retains control over the trust's assets and can decide when and how distributions are made. By utilizing a New Mexico Revocable Trust Agreement - Grantor as Beneficiary, you can outline specific distribution terms that align with your financial and familial goals.

One of the most significant mistakes parents make is not clearly communicating their intentions and terms to their beneficiaries. When setting up a trust fund, vague instructions can lead to conflicts and misunderstandings among heirs. A well-defined New Mexico Revocable Trust Agreement - Grantor as Beneficiary can help prevent these issues by establishing clear guidelines.

Yes, a trust can be a beneficiary of another trust. This situation can create layers of financial structure and can be beneficial for estate planning. However, it's essential to clearly define the terms in your New Mexico Revocable Trust Agreement - Grantor as Beneficiary to avoid confusion and ensure smooth transitions.

Naming a trust as a beneficiary can complicate the distribution of assets. Often, trusts have specific terms that must be followed, which may lead to delays in distributing the assets to beneficiaries. This complexity can sometimes negate the advantages of having a New Mexico Revocable Trust Agreement - Grantor as Beneficiary, making it crucial to consult with a professional when considering this option.

Being a beneficiary can come with several disadvantages, particularly regarding financial responsibility. Beneficiaries may face tax implications on inherited assets, which can affect their overall financial planning. Understanding these factors is crucial, especially when dealing with assets through a New Mexico Revocable Trust Agreement - Grantor as Beneficiary.

To establish a revocable living trust in New Mexico, you start by drafting a trust agreement that outlines your wishes. You will need to transfer assets into the trust, ensuring they are titled correctly. It’s advisable to consult legal experts or platforms like uslegalforms, which provide templates and guidance to assist you in creating a New Mexico Revocable Trust Agreement - Grantor as Beneficiary.

When you name a trust as a beneficiary, the assets will flow into the trust upon your passing. The trustee will then manage these assets according to the trust’s terms, guiding distributions to the beneficiaries. Properly setting this up can be critical, especially if you wish to leverage the benefits of a New Mexico Revocable Trust Agreement - Grantor as Beneficiary.

When you name a trust as the beneficiary of your IRA, the IRS will treat the trust as the account owner for tax purposes. This means that the distribution rules applicable to the trust will come into play, which could potentially stretch distributions over the trust's lifetime. Understanding how this interacts with your estate planning goals is essential, especially in the context of a New Mexico Revocable Trust Agreement - Grantor as Beneficiary.