New Mexico Commission Agreement - General

Description

How to fill out Commission Agreement - General?

US Legal Forms - one of the largest libraries of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, organized by type, state, or keywords.

You can find the most recent form templates such as the New Mexico Commission Agreement - General in just seconds.

If the form does not meet your needs, use the Search field at the top of the screen to find the one that suits you.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred pricing plan and provide your information to register for an account.

- If you already have a membership, Log In to download the New Mexico Commission Agreement - General from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your city/state. Click on the Review button to check the form's content.

- Review the form details to make sure you have chosen the correct one.

Form popularity

FAQ

Yes, commissions earned in New Mexico are generally subject to gross receipts tax. This tax applies to all businesses that receive payment for services, including those operating under a New Mexico Commission Agreement - General. To remain compliant, it's vital to calculate and report these receipts accurately.

While a CRS number and a tax ID serve similar functions, they are not the same. A CRS number is specifically for businesses operating in New Mexico, while a tax ID can refer to various forms of identification. If you require a CRS number for your business, consider how this intersects with your New Mexico Commission Agreement - General.

In New Mexico, reaching the age of 65 can affect your property taxes through potential exemptions. It’s important to explore these options, as they may provide significant savings. A New Mexico Commission Agreement - General may assist you in understanding the financial implications and benefits available as you age.

Applying for a New Mexico CRS (Combined Reporting System) number is a straightforward process. You can complete the application online through the New Mexico Taxation and Revenue Department’s website. This number is crucial for businesses engaged in collecting gross receipts tax, an important factor to consider when entering into a New Mexico Commission Agreement - General.

Seniors in New Mexico may qualify for a property tax exemption at age 65. This exemption can significantly lessen the financial burden on seniors who own property. To ensure compliance and understand the benefits available to you, refer to your New Mexico Commission Agreement - General.

In New Mexico, certain individuals and properties are eligible for exemptions from property taxes. These typically include low-income seniors, veterans, and individuals with disabilities. To take advantage of these exemptions, reviewing your New Mexico Commission Agreement - General in conjunction with state guidelines is advisable for clarity.

In the United States, including New Mexico, there is no specific age at which seniors stop paying taxes altogether. However, certain tax credits and benefits may be available as you age, potentially reducing your tax burden. If you're considering a New Mexico Commission Agreement - General, it may be beneficial to consult a tax expert who can guide you through your options.

A commission arrangement refers to the structure and terms under which one party pays another for services or sales achieved. It outlines the specifics of commission rates, timelines, and performance criteria. By utilizing the New Mexico Commission Agreement - General, you can establish a clear and effective commission arrangement that protects the interests of both parties involved.

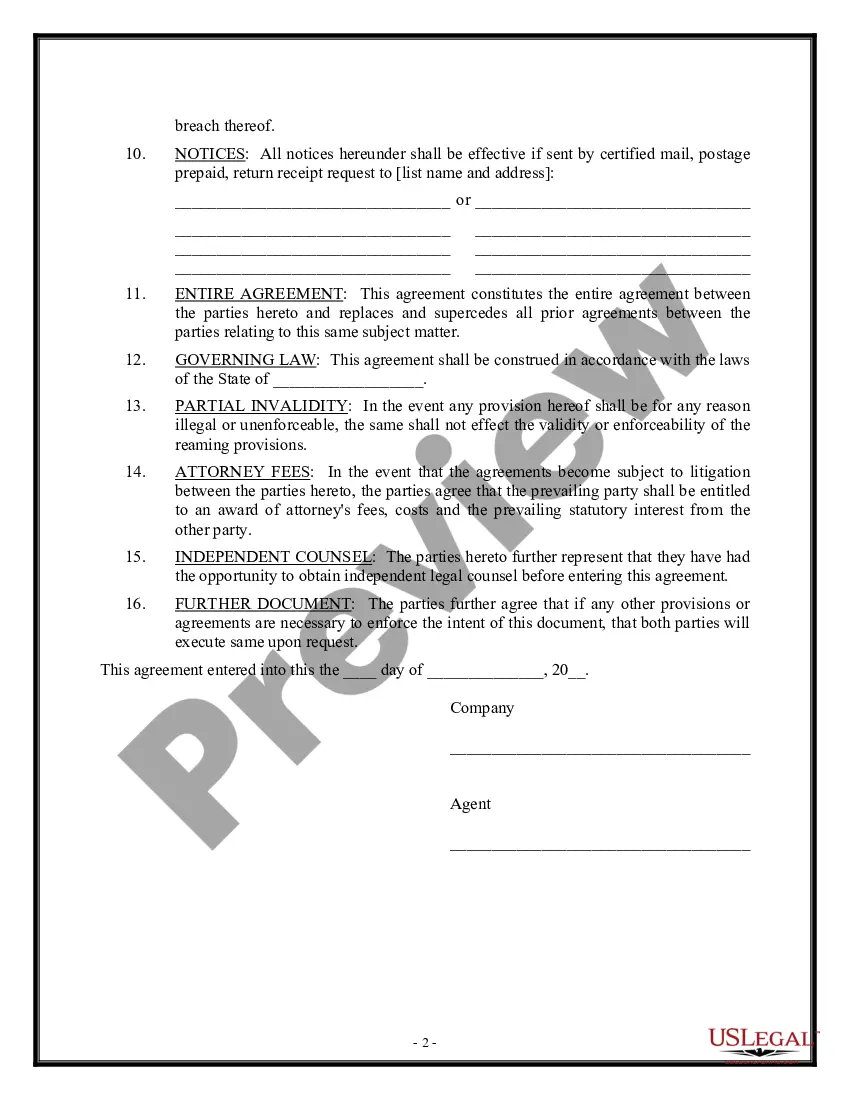

A commission agreement is a legally binding document that clarifies the terms under which a party will receive compensation for services rendered. This type of agreement is fundamental in many sectors, including real estate and sales, where the New Mexico Commission Agreement - General can be applied. By outlining crucial terms, such as commission percentages and payment schedules, both parties can proceed with confidence.

To create a commission agreement, you should begin by outlining the key terms, including the commission rate, payment schedule, and the roles of the parties involved. It’s essential to refer to templates like the New Mexico Commission Agreement - General provided by legal platforms such as uslegalforms to ensure compliance with state laws. Tailoring the agreement to suit your specific needs will help prevent misunderstandings in the future.