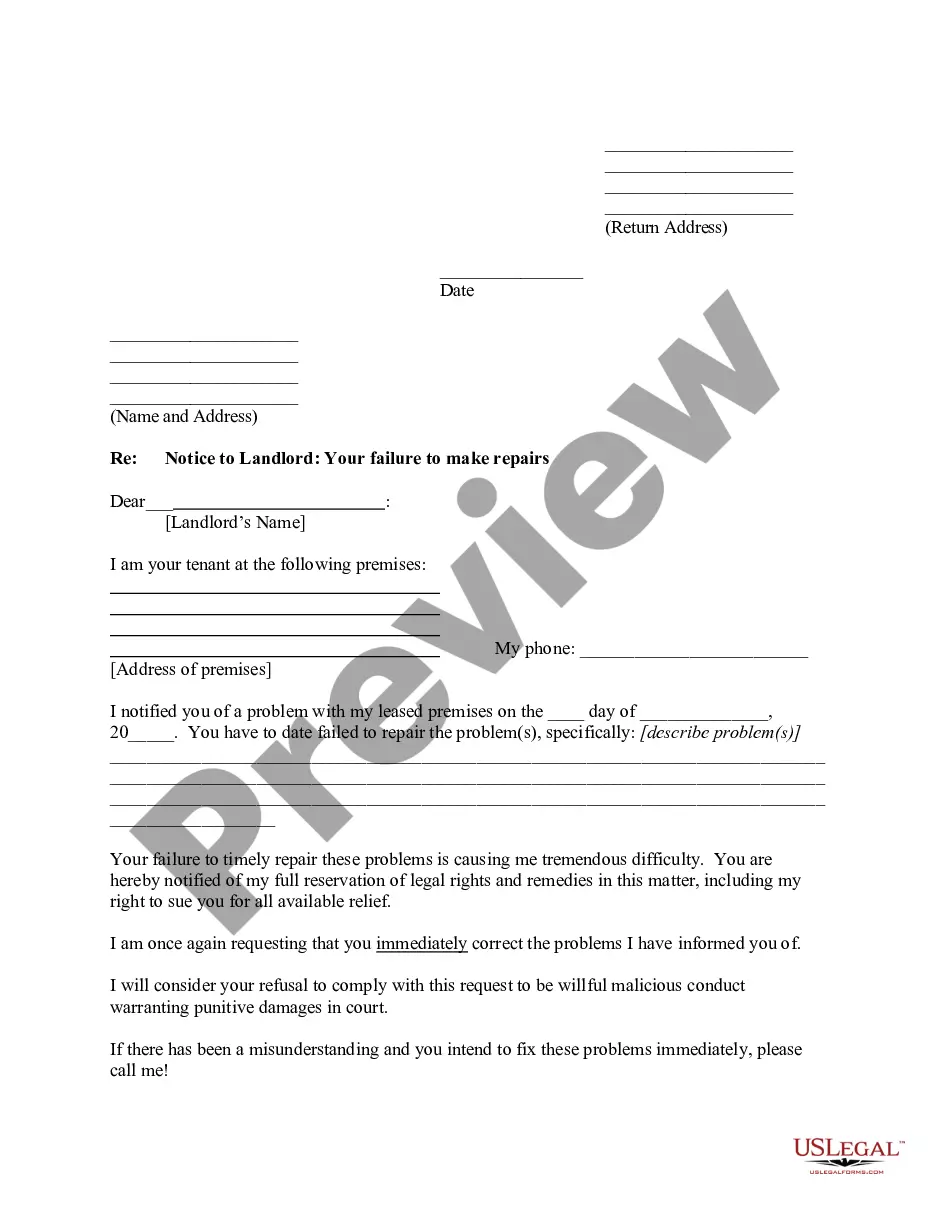

This form is a sample letter in Word format covering the subject matter of the title of the form.

New Mexico Sample Letter for Return of Affidavit

Description

How to fill out Sample Letter For Return Of Affidavit?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a variety of legal form templates that you can download or print. By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can swiftly obtain the latest forms, such as the New Mexico Sample Letter for Return of Affidavit.

If you already have a subscription, Log In and retrieve the New Mexico Sample Letter for Return of Affidavit from the US Legal Forms repository. The Download button will be visible on every form you examine. You can access all previously downloaded forms in the My documents section of your account.

If you wish to use US Legal Forms for the first time, here are straightforward instructions to help you get started: Ensure you have selected the correct form for your city/state. Click the Preview button to review the form's content. Check the form details to confirm that you have chosen the right form. If the form does not meet your requirements, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select the payment plan you prefer and provide your details to register for an account. Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded New Mexico Sample Letter for Return of Affidavit. Every template you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, simply go to the My documents area and click on the form you need.

- Access the New Mexico Sample Letter for Return of Affidavit with US Legal Forms, the largest repository of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

Yes, you can write an affidavit yourself, provided you follow the legal requirements of your state. It is important to ensure that the affidavit is clear, factual, and properly formatted. Utilizing a New Mexico Sample Letter for Return of Affidavit can simplify this process by providing a template to follow, ensuring your document meets all necessary standards. However, if you feel uncertain, consider consulting legal assistance for peace of mind.

Writing an affidavit letter requires a clear structure and specific content. Begin with your personal information, including your name and address, followed by a title that indicates the purpose of the letter, such as 'Affidavit of Your Name.' You should then state the facts you want to affirm, ensuring they are concise and relevant. For a precise example, refer to a New Mexico Sample Letter for Return of Affidavit, which can guide you in crafting your document effectively.

To create an affidavit letter, begin with a title that states it is an affidavit, followed by your personal details and a declaration of facts. Make sure to include a statement that you are signing under oath. For a comprehensive example, check out a New Mexico Sample Letter for Return of Affidavit from US Legal Forms.

An affidavit is legally valid when it is signed in the presence of a notary public or other authorized official. It must contain a statement of truth, clear identification of the affiant, and relevant facts. Utilizing a New Mexico Sample Letter for Return of Affidavit can help ensure you include all necessary elements for validation.

To write a simple affidavit, start by stating your name and address, followed by a clear declaration of the facts you are affirming. Organize your statements logically and keep your language straightforward. For an effective structure, consider a New Mexico Sample Letter for Return of Affidavit as a guide.

Yes, you can create your own affidavit as long as it meets specific legal standards. Ensure that your affidavit is clear, concise, and includes all necessary information. For inspiration, refer to a New Mexico Sample Letter for Return of Affidavit available on platforms like US Legal Forms.

To obtain an affidavit letter, you can either draft one yourself or use a template available online. Websites like US Legal Forms offer customizable affidavit templates tailored to New Mexico laws, ensuring your document meets legal requirements. Using a New Mexico Sample Letter for Return of Affidavit can simplify this process.

A simple example of an affidavit could be a document where an individual states their identity and confirms their residence. This might be used in various legal situations, such as verifying personal details in a court case. For clarity, consider using a New Mexico Sample Letter for Return of Affidavit, which provides a straightforward format.

An affidavit is a written statement confirmed by oath or affirmation, usually used as evidence in court. A common example is a sworn statement declaring facts related to a legal matter, such as a property dispute. For specific guidance, you can refer to a New Mexico Sample Letter for Return of Affidavit to understand the structure and content.

To create an affidavit letter for immigration purposes, start by clearly stating your relationship to the individual involved and the purpose of the affidavit. Include factual statements that support their immigration case, and make sure to sign the document in front of a notary. A New Mexico Sample Letter for Return of Affidavit can be invaluable, as it provides a framework that meets immigration requirements and helps present your case effectively.