This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

New Mexico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

Discovering the right lawful document design can be quite a have difficulties. Naturally, there are a lot of themes available online, but how will you get the lawful develop you need? Take advantage of the US Legal Forms web site. The assistance offers a large number of themes, such as the New Mexico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand, that can be used for company and personal needs. Each of the forms are examined by professionals and fulfill federal and state requirements.

When you are currently signed up, log in in your bank account and click on the Obtain option to get the New Mexico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand. Utilize your bank account to search through the lawful forms you may have purchased in the past. Check out the My Forms tab of your own bank account and get one more backup in the document you need.

When you are a whole new consumer of US Legal Forms, allow me to share straightforward recommendations so that you can comply with:

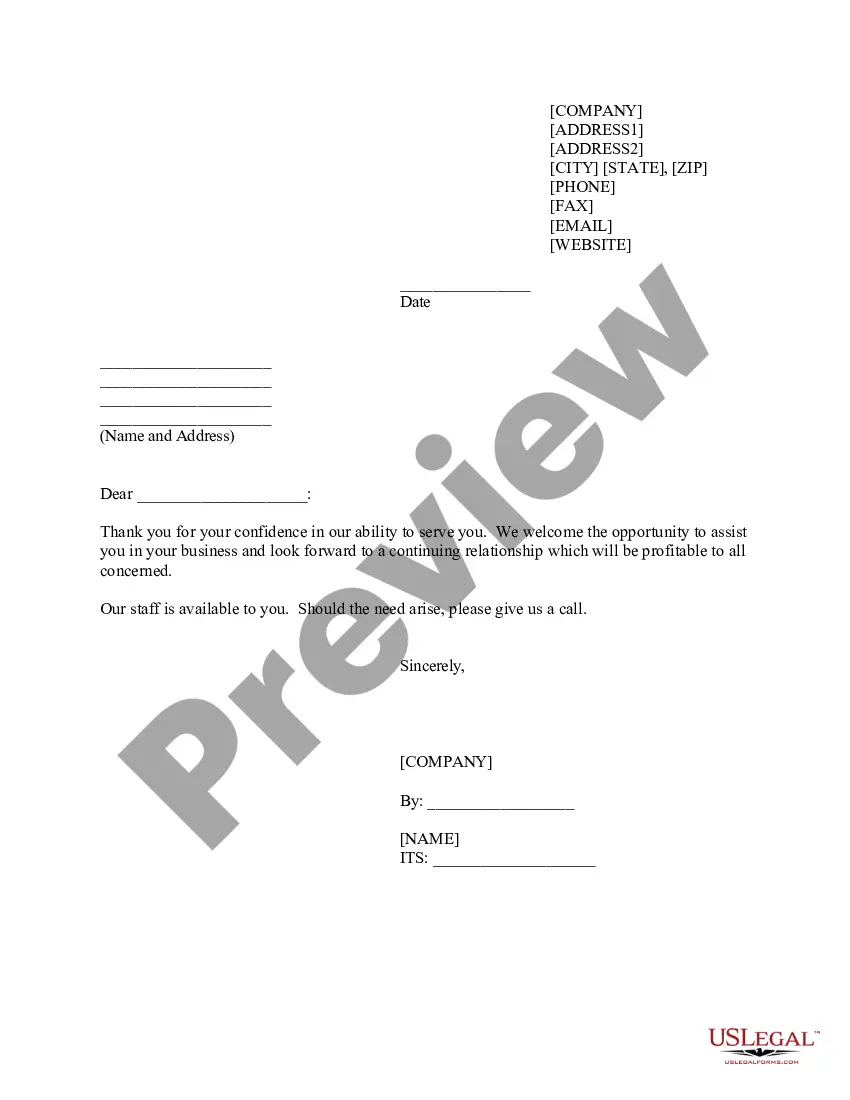

- Very first, make sure you have selected the correct develop for your personal city/area. You can examine the shape utilizing the Review option and read the shape information to make sure this is the right one for you.

- When the develop does not fulfill your preferences, use the Seach discipline to obtain the correct develop.

- When you are positive that the shape is proper, click the Buy now option to get the develop.

- Select the pricing prepare you desire and enter in the required details. Create your bank account and buy your order making use of your PayPal bank account or bank card.

- Pick the data file format and acquire the lawful document design in your device.

- Complete, change and produce and indication the received New Mexico Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

US Legal Forms will be the largest catalogue of lawful forms in which you can see numerous document themes. Take advantage of the company to acquire professionally-manufactured files that comply with express requirements.

Form popularity

FAQ

A bad faith claim arises when one party acts in an unethical or deceptive manner. Unlike a breach of contract claim, a bad faith claim is not a violation of any specific provision of a contract but rather of the spirit of the agreement itself.

In New Mexico, bad faith litigation can result in monetary compensation for the loss suffered by the policyholder and often punitive damages are awarded against the insurance company to punish it.

It is in your best interest to contact an experienced Albuquerque bad faith insurance lawyer promptly if you suspect bad faith. There is a four-year statute of limitations, which begins the moment the insurance company acts unfairly.

The Unfair Insurance Claims Practices Act (UIPA) explicitly creates a private right of action for any person that has suffered damages as a result of an insurer's violation of the UIPA. If your insurer has committed any of the Unfair claims practices listed in See N.M. Stat. Ann. § 59A-16- 20.

Bad faith means an insurer acted unreasonably in denying a claim, such as denying coverage without performing a full and proper investigation or denying a claim for an improper motive.