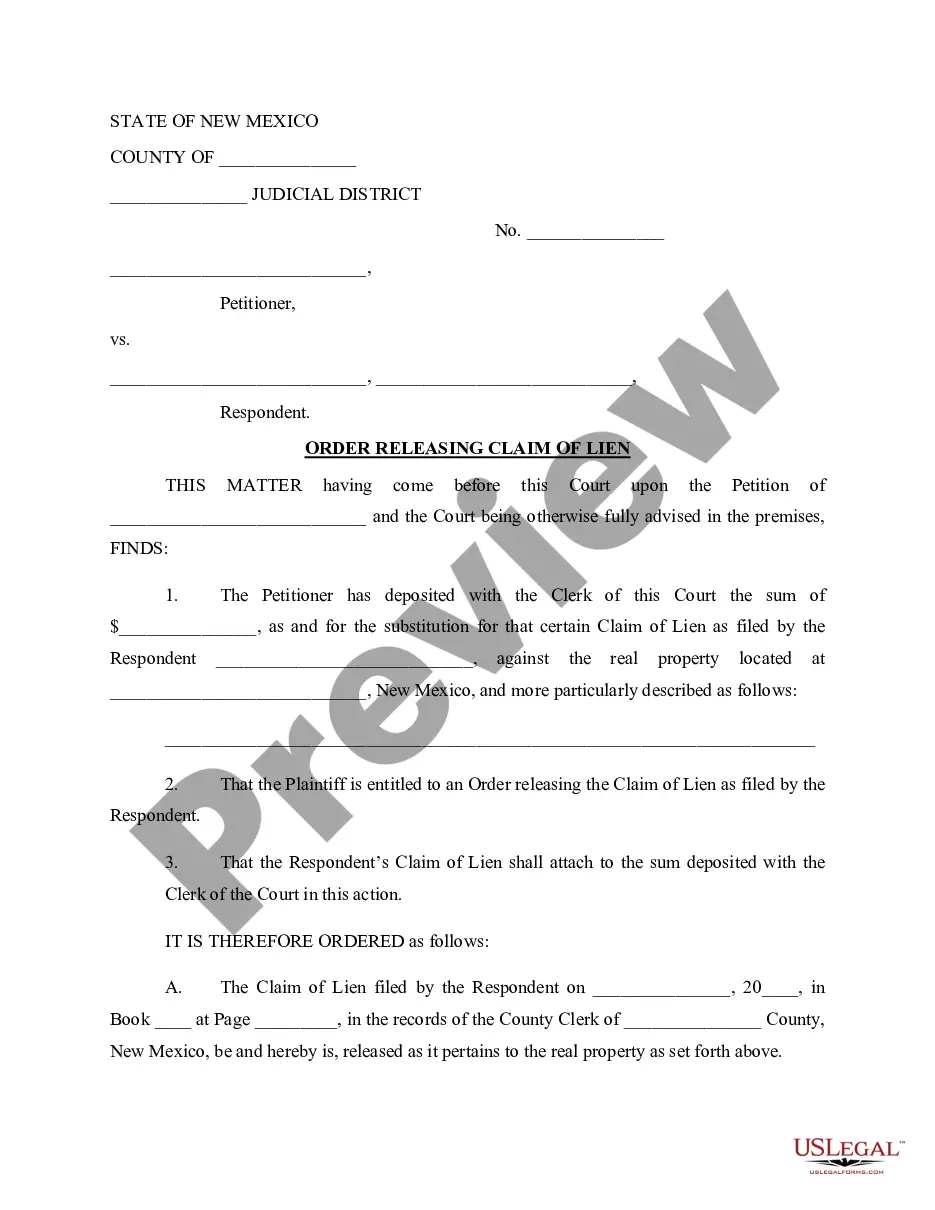

New Mexico Order Releasing Claim of Lien

Description

How to fill out New Mexico Order Releasing Claim Of Lien?

US Legal Forms is actually a special platform to find any legal or tax form for submitting, including New Mexico Order Releasing Claim of Lien. If you’re tired of wasting time looking for perfect samples and paying money on record preparation/attorney charges, then US Legal Forms is exactly what you’re searching for.

To experience all of the service’s advantages, you don't have to download any application but simply choose a subscription plan and sign up an account. If you already have one, just log in and look for an appropriate template, download it, and fill it out. Downloaded files are saved in the My Forms folder.

If you don't have a subscription but need to have New Mexico Order Releasing Claim of Lien, check out the recommendations below:

- Double-check that the form you’re looking at applies in the state you want it in.

- Preview the example and look at its description.

- Simply click Buy Now to reach the sign up webpage.

- Select a pricing plan and proceed registering by providing some info.

- Decide on a payment method to finish the sign up.

- Download the document by selecting the preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you are unsure regarding your New Mexico Order Releasing Claim of Lien sample, speak to a attorney to analyze it before you send or file it. Begin without hassles!

Form popularity

FAQ

A lien is a claim on property to ensure payment of a debt. When you borrow money to purchase a car, the lender files a lien on the vehicle with the state to insure that if the loan defaults, the lender can take the car. When the debt is fully repaid, a release of the lien is provided by the lender.

The lender will also notify the Department of Motor Vehicles (DMV) that the loan has been paid in full. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied. This request can be made through the DMV or directly to the lender.

The main purpose of a lien waiver is to provide protection to the paying party. In exchange for such payment, the lien waiver waives the payee's right to file a lien for the exact value of the payment they have received.

Satisfy the terms of the loan by paying the balance of the loan back to the lender, including any interest incurred. If you don't receive the lien release, submit a request to your lender for proof that the loan has been satisfied.

It basically states that you've paid the subcontractor what is owed, they accept the payment in full, and they waive the right to put a lien on your property. Simply present this form to the subcontractor with your payment and ask them to sign it. Make sure you get their signature!

Lien release/cancellations must be recorded, and not just emailed or faxed between parties. Lien waivers, on the other hand, are just exchanged between the parties. For lien waivers, electronic signatures are perfectly acceptable.

When a person pays off a loan in full, the lien is removed. The asset is no longer pledged to the creditor when the balance is completely paid. When this happens, the creditor acknowledges the release of the lien by signing a Mortgage Release of Lien Certificate.

Subject to some exceptions, a lien for materials, services, or wages may be registered any time up to 45 days from the day the last materials, services, or wages were provided, or since the contract was abandoned. After those 45 days elapse, the lien expires.