New Jersey Legal Description and Well or Unit Information

Description

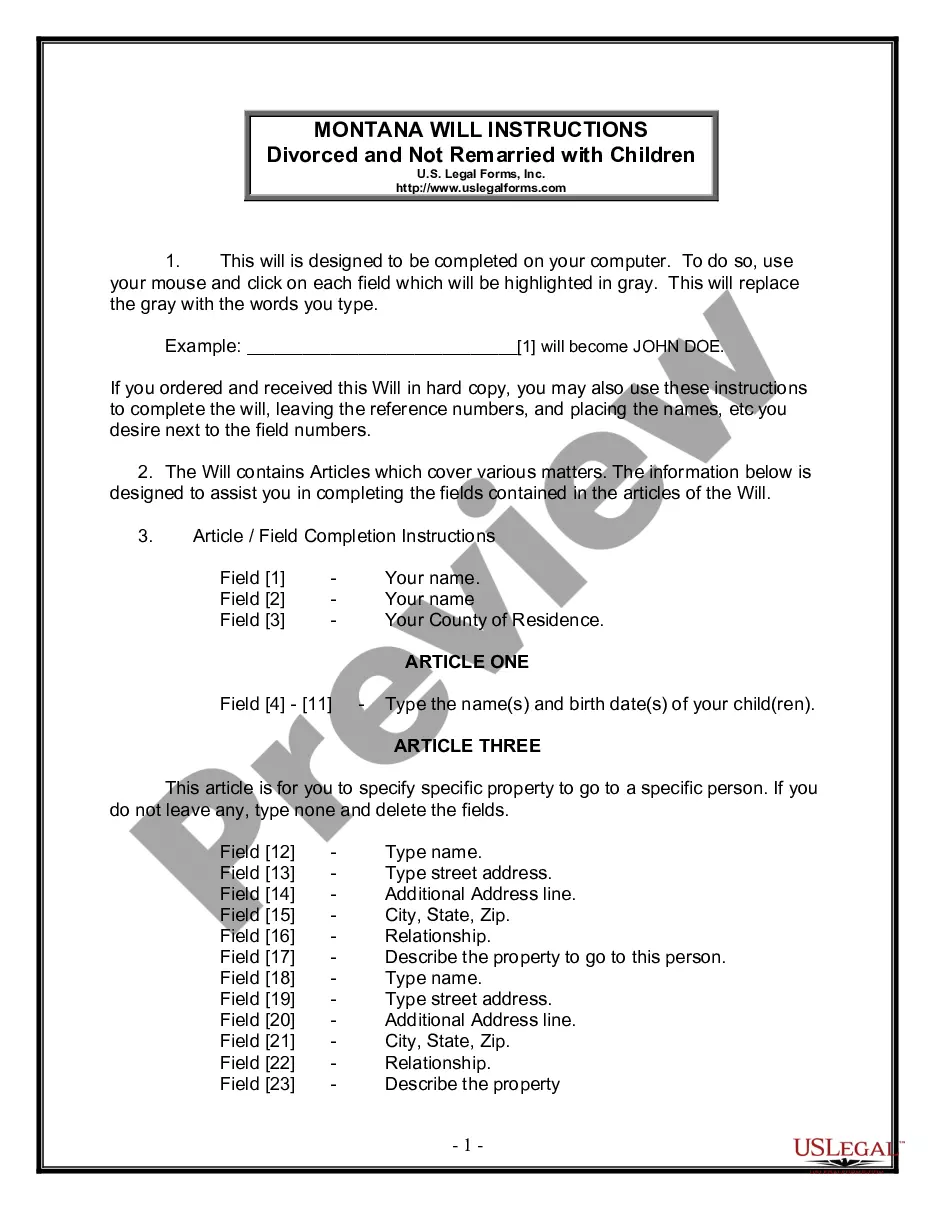

How to fill out Legal Description And Well Or Unit Information?

You can spend several hours on the Internet attempting to find the authorized document template which fits the state and federal needs you need. US Legal Forms offers 1000s of authorized forms which can be analyzed by specialists. You can easily acquire or printing the New Jersey Legal Description and Well or Unit Information from our services.

If you already possess a US Legal Forms accounts, you can log in and click the Acquire switch. After that, you can total, modify, printing, or indicator the New Jersey Legal Description and Well or Unit Information. Every single authorized document template you buy is your own eternally. To get another copy associated with a obtained type, visit the My Forms tab and click the related switch.

Should you use the US Legal Forms internet site for the first time, adhere to the simple recommendations below:

- First, make certain you have chosen the best document template for that area/town of your choosing. Browse the type description to make sure you have selected the correct type. If readily available, take advantage of the Preview switch to search from the document template too.

- If you wish to locate another model in the type, take advantage of the Look for area to discover the template that suits you and needs.

- After you have discovered the template you would like, click on Acquire now to move forward.

- Find the costs prepare you would like, enter your credentials, and register for an account on US Legal Forms.

- Full the deal. You should use your charge card or PayPal accounts to cover the authorized type.

- Find the formatting in the document and acquire it to your gadget.

- Make alterations to your document if required. You can total, modify and indicator and printing New Jersey Legal Description and Well or Unit Information.

Acquire and printing 1000s of document layouts utilizing the US Legal Forms Internet site, which offers the greatest collection of authorized forms. Use skilled and condition-specific layouts to tackle your business or specific requires.

Form popularity

FAQ

Taxable assessed value is that percentage of true value established by each county board of taxation. All 21 counties in New Jersey have chosen 100%. *Qualified Farmland is assessed on its productivity and agricultural use rather than market value for any other purpose.

You will report any income earned on the sale of property as a capital gain. When filing your New Jersey Tax Return, a capital gain is calculated the same way as for federal purposes. Any amount that is taxable for federal purposes is taxable for New Jersey purposes.

The RTF does not apply to sales for less than $100, or those transactions made between husbands and wives or parents and children. Senior citizens, blind or disabled persons and low-and moderate-income housing continue to be exempt from the state portion of the basic fee.

Hear this out loud Pause(e) Class 4A: "Commercial Property" means any other type of income-producing property other than property in classes 1, 2, 3A, 3B, 4B, and 4C; for example, shopping centers, malls, office buildings, restaurants, theaters, etc.

Hear this out loud PauseUnless otherwise agreed upon by the buyer and seller, the mansion tax is typically paid by the buyer at closing.

Eligibility Active wartime service in the United States Armed Forces. Filing of an application for exemption with the local tax assessor. Honorable discharge. Legal or domiciliary New Jersey residence. New Jersey citizenship. Principal or permanent residence in the claimed dwelling. Property ownership.

That cap law provides for several exceptions which allow for year-over-year increases of more than 2% to occur. They include for debt payments, the costs of pension and health benefits for public employees, and for funding responses to large-scale emergencies.

Calculations of property assessments are annually based upon market trends and will be reflected in the following year's assessment. Due to the New Jersey Division of Taxation guidelines for the program, each property will be inspected once every five years.

Hear this out loud PauseThere are exemptions for vacant, commercial, industrial, and multi-unit properties, but for single family homes, in general only those with land that meets the farm assesment requirements are exempted. Properties that are being transferred can also sometimes be exempt with certain restrictions.

Hear this out loud PauseTaxable assessed value is that percentage of true value established by each county board of taxation. All 21 counties in New Jersey have chosen 100%. *Qualified Farmland is assessed on its productivity and agricultural use rather than market value for any other purpose.